- South Korea

- /

- Auto Components

- /

- KOSE:A004490

Undiscovered Gems in South Korea to Watch This September 2024

Reviewed by Simply Wall St

The South Korean market is up 2.2% over the last week, although it has remained flat over the past year. With earnings expected to grow by 29% per annum in the coming years, identifying promising stocks that can capitalize on this growth becomes crucial for investors seeking potential opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

YC (KOSDAQ:A232140)

Simply Wall St Value Rating: ★★★★★★

Overview: YC Corporation develops, manufactures, and sells inspection equipment for semiconductor memories in South Korea and internationally, with a market cap of ₩1.07 trillion.

Operations: YC Corporation generates revenue primarily from its Semiconductor Division (₩161.99 billion), followed by Electrical and Electronic Accessories (₩42.12 billion) and Wholesale/Retail (₩4.71 billion).

YC, a small-cap semiconductor firm in South Korea, has seen its debt to equity ratio improve significantly from 43.6% to 18% over the past five years. Despite recording negative earnings growth of -7.1% last year, it still outpaced the industry average of -11.2%. The company's earnings are forecasted to grow by nearly 50% annually. However, its share price has been highly volatile in recent months, reflecting market uncertainty.

- Take a closer look at YC's potential here in our health report.

Gain insights into YC's historical performance by reviewing our past performance report.

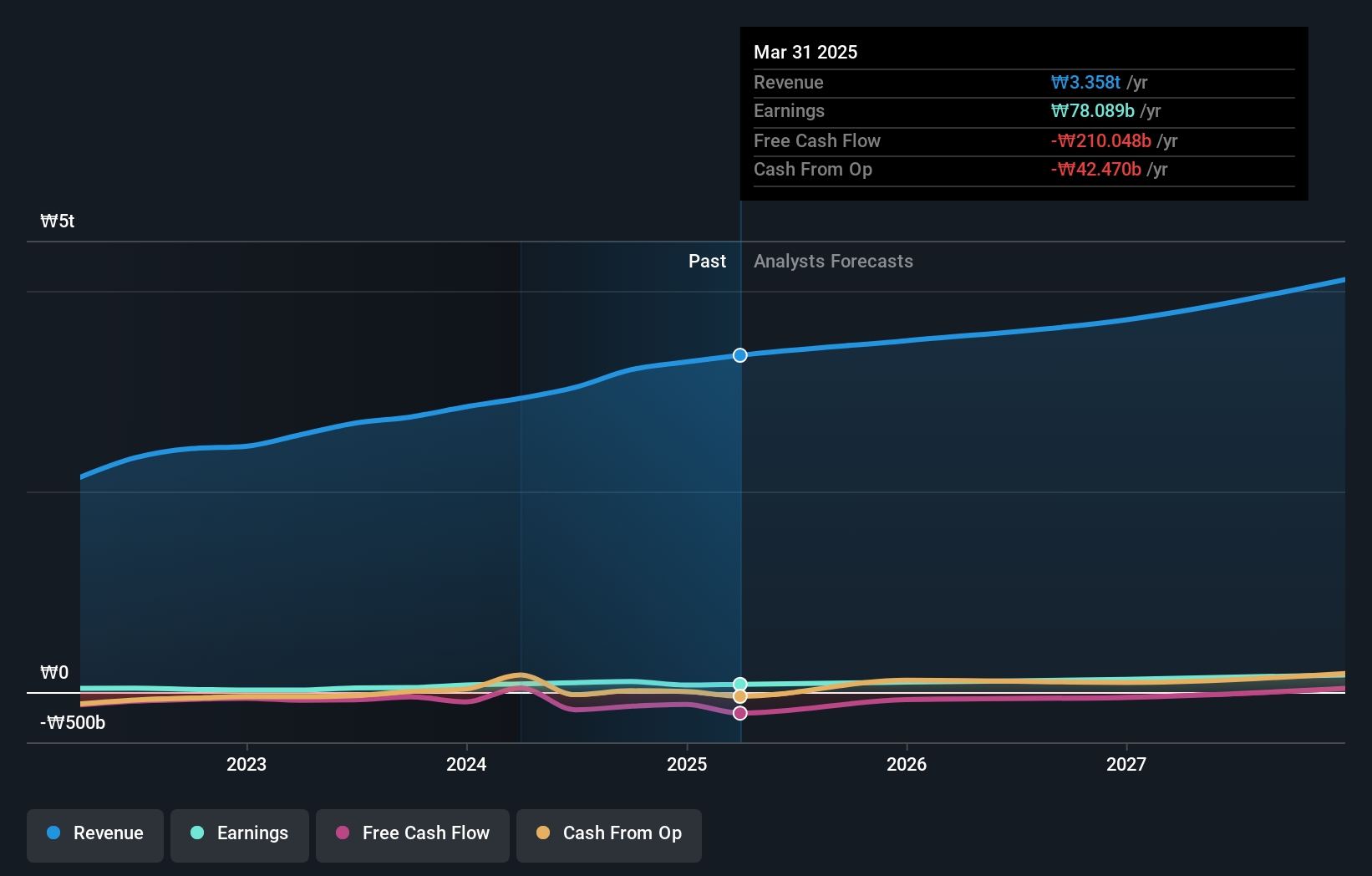

Taihan Cable & Solution (KOSE:A001440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taihan Cable & Solution Co., Ltd. manufactures, processes, and sells electric wires, cables, and related products worldwide with a market cap of ₩2.09 trillion.

Operations: Revenue from wire sales amounted to ₩3.42 billion, with inter-division sales adjustments of -₩0.38 billion.

Taihan Cable & Solution has seen impressive earnings growth of 127% over the past year, outpacing the Electrical industry’s 25.5%. For Q2 2024, net income reached KRW 24.88 million, a significant rise from KRW 12.82 million in the same period last year. Despite a dip in sales to KRW 8.82 million from KRW 9.75 million, basic earnings per share increased to KRW 134 from KRW 104 a year ago. The company’s debt-to-equity ratio improved dramatically over five years, falling from 203.6% to just over 30%.

- Click to explore a detailed breakdown of our findings in Taihan Cable & Solution's health report.

Gain insights into Taihan Cable & Solution's past trends and performance with our Past report.

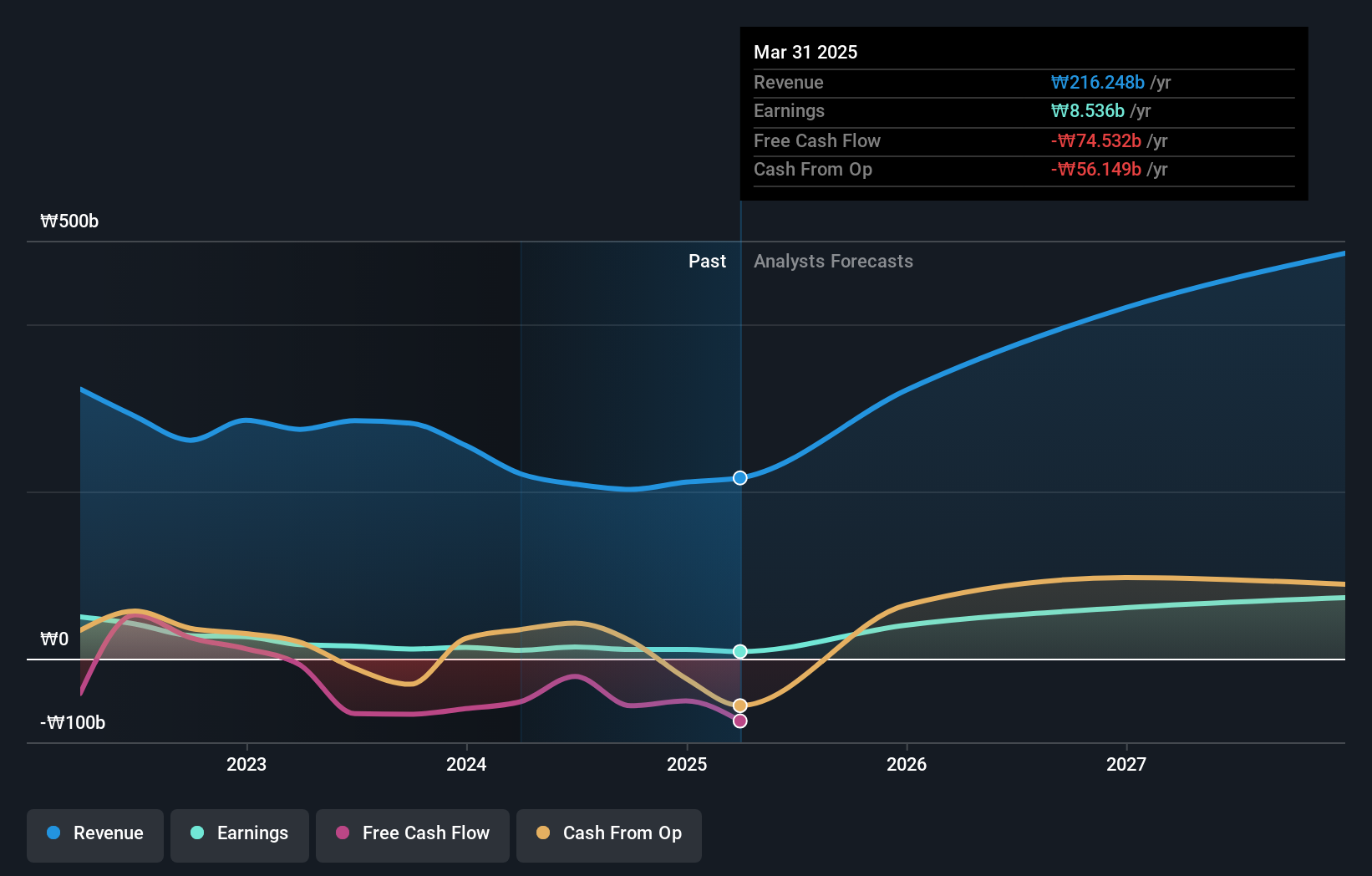

Sebang Global Battery (KOSE:A004490)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sebang Global Battery Co., Ltd. manufactures and sells lead acid batteries in South Korea and internationally, with a market cap of ₩1.17 trillion.

Operations: Sebang Global Battery generates revenue primarily from the sale of lead acid batteries both domestically and internationally. The company's net profit margin is 5.23%.

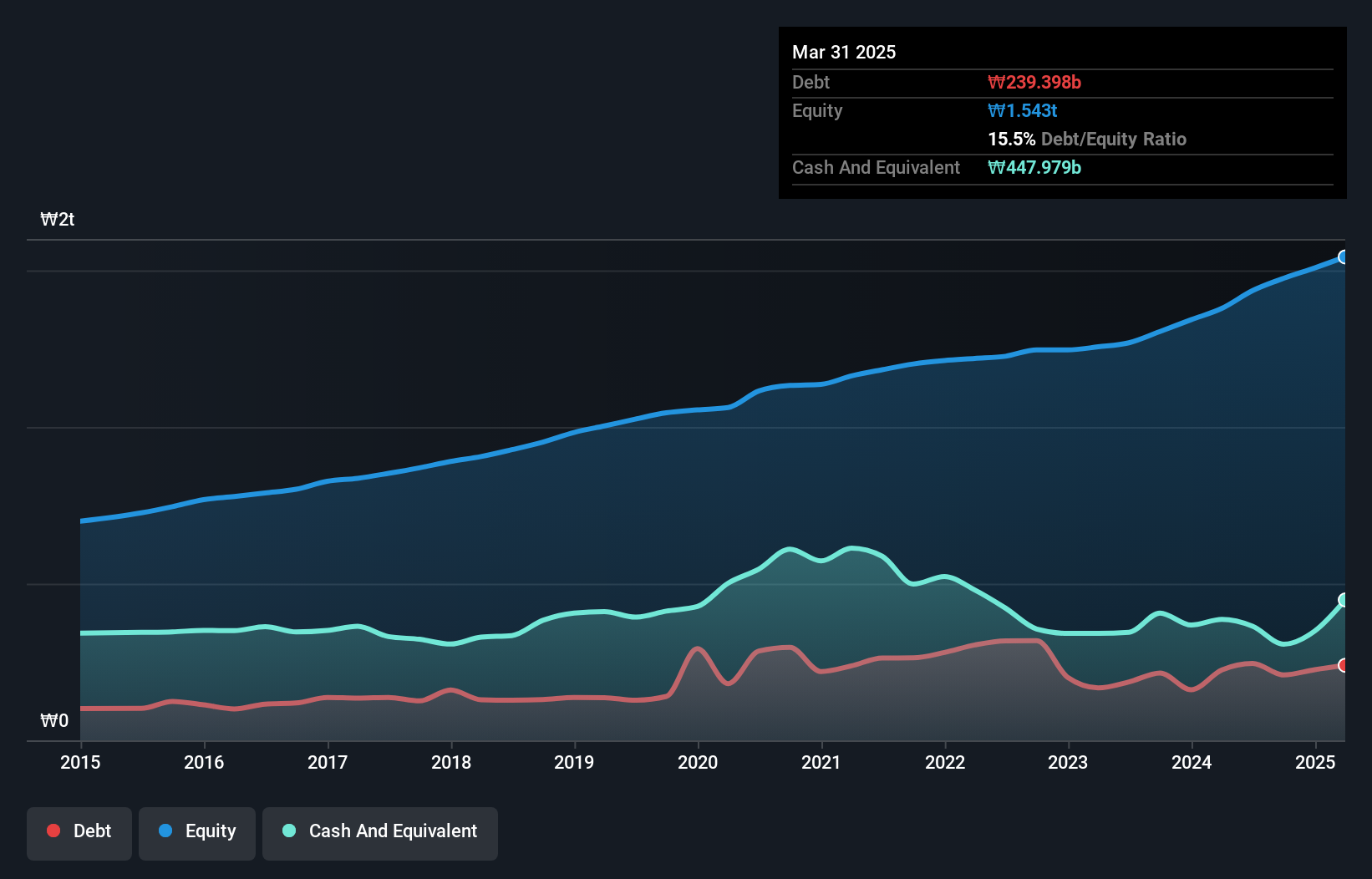

Sebang Global Battery, a lesser-known small-cap stock in South Korea, has shown impressive earnings growth of 190.8% over the past year, far outpacing the Auto Components industry average of 20.8%. The company's debt to equity ratio has risen from 12.5% to 17.1% over five years, yet it holds more cash than its total debt, ensuring financial stability. Additionally, Sebang trades at a significant discount of 40.2% below its estimated fair value, indicating potential upside for investors seeking undervalued opportunities in the market.

Summing It All Up

- Click here to access our complete index of 151 KRX Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A004490

Sebang Global Battery

Manufactures and sells lead acid batteries in South Korea and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026