- South Korea

- /

- Personal Products

- /

- KOSDAQ:A018290

Discovering 3 Undiscovered Gems In South Korea

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen by 1.4%, although it has seen a decline of 3.9% over the past 12 months. In this fluctuating environment, identifying stocks with strong growth potential and solid fundamentals can be particularly rewarding; here are three such undiscovered gems in South Korea poised for attention.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

VT (KOSDAQ:A018290)

Simply Wall St Value Rating: ★★★★★★

Overview: VT Co., Ltd. produces and exports laminating machines and films worldwide, with a market cap of ₩1.27 billion.

Operations: VT Co., Ltd. generates revenue primarily from its Cosmetic segment (₩256.27 billion), followed by Entertainment (₩93.74 billion) and Laminating (₩33.86 billion).

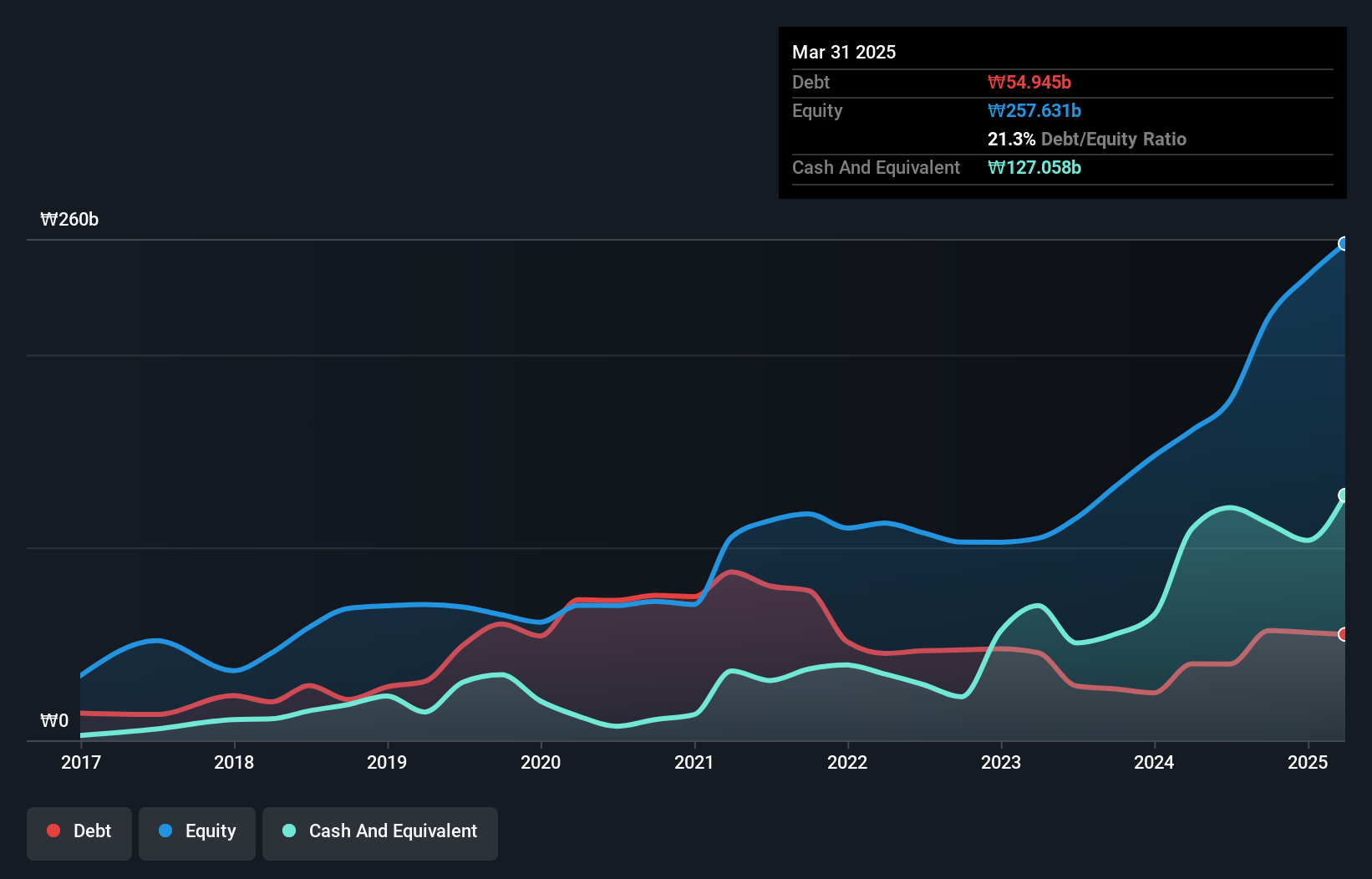

VT Co., Ltd. is showing promising signs with its recent earnings report. For Q2 2024, sales reached ₩113.35 billion, up from ₩74.69 billion last year, while net income surged to ₩15.40 billion from ₩5.09 billion a year ago, reflecting strong growth momentum. The company’s debt to equity ratio has improved significantly over the past five years from 71% to 22%. Furthermore, VT's EBIT covers interest payments by an impressive 175 times and earnings grew by a staggering 563% in the past year alone.

- Get an in-depth perspective on VT's performance by reading our health report here.

Evaluate VT's historical performance by accessing our past performance report.

Cheryong ElectricLtd (KOSDAQ:A033100)

Simply Wall St Value Rating: ★★★★★★

Overview: Cheryong Electric Co., Ltd. manufactures and sells power electric equipment in South Korea and has a market cap of ₩905.92 billion.

Operations: Cheryong Electric Co., Ltd. generates revenue from the sale of power electric equipment in South Korea, with a market cap of ₩905.92 billion. The company's net profit margin is notable at 12.5%.

Cheryong Electric Ltd. has shown remarkable performance with earnings growth of 134% over the past year, far outpacing the Electrical industry’s 18.5%. The company is debt-free, a significant improvement from five years ago when its debt to equity ratio was 2.3%. Currently trading at 80.9% below estimated fair value, Cheryong offers substantial upside potential. Despite recent share price volatility, it remains profitable and boasts high-quality earnings with positive free cash flow.

YC (KOSDAQ:A232140)

Simply Wall St Value Rating: ★★★★★★

Overview: YC Corporation develops, manufactures, and sells inspection equipment for semiconductor memories in South Korea and internationally, with a market cap of ₩1.07 billion.

Operations: YC Corporation generates revenue primarily from its Semiconductor Division (₩161.99 billion), followed by Electrical and Electronic Accessories (₩42.12 billion) and Wholesale/Retail (₩4.71 billion).

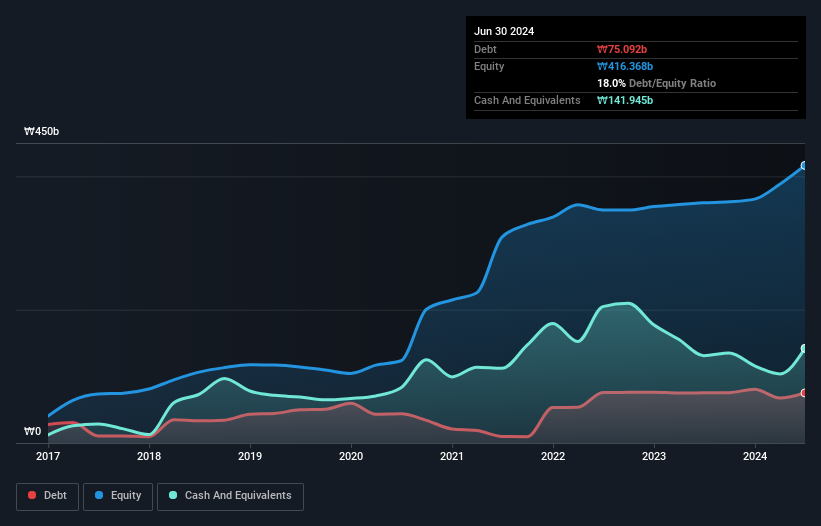

YC, a promising player in South Korea's tech sector, has seen its debt-to-equity ratio improve from 43.6% to 18% over five years. Despite a -7.1% earnings growth last year, it outperformed the semiconductor industry average of -10%. The company repurchased shares recently, signaling confidence in its future prospects. With earnings projected to grow at nearly 50% annually and high-quality past earnings, YC stands out as an intriguing investment opportunity in the tech space.

Key Takeaways

- Gain an insight into the universe of 187 KRX Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A018290

Outstanding track record with flawless balance sheet.