- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A218410

Earnings Tell The Story For RFHIC Corporation (KOSDAQ:218410) As Its Stock Soars 28%

RFHIC Corporation (KOSDAQ:218410) shares have continued their recent momentum with a 28% gain in the last month alone. The annual gain comes to 182% following the latest surge, making investors sit up and take notice.

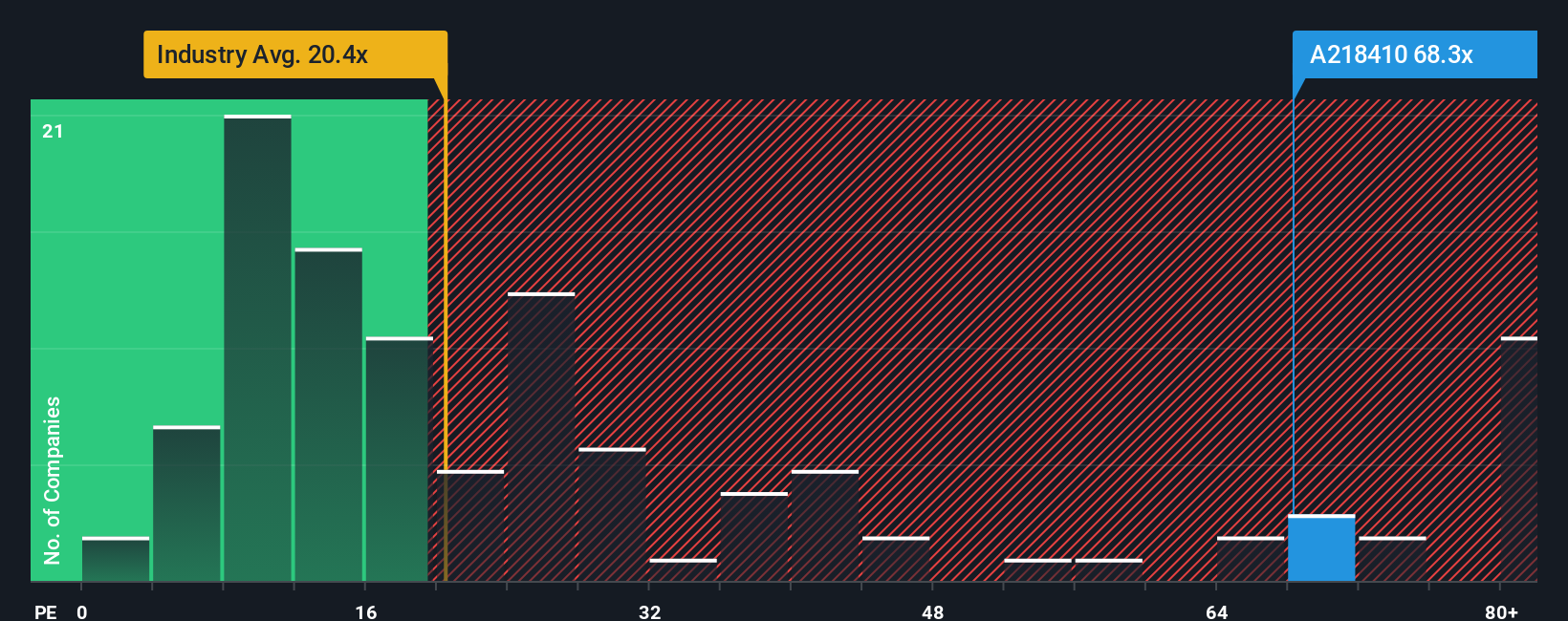

After such a large jump in price, given close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 15x, you may consider RFHIC as a stock to avoid entirely with its 68.3x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

RFHIC has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for RFHIC

How Is RFHIC's Growth Trending?

RFHIC's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 71%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 272% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 46% each year as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 18% per annum growth forecast for the broader market.

With this information, we can see why RFHIC is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From RFHIC's P/E?

RFHIC's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that RFHIC maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for RFHIC that we have uncovered.

You might be able to find a better investment than RFHIC. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A218410

RFHIC

Designs and manufactures radio frequency (RF) and microwave components for wireless infrastructure, commercial and military radar, and RF energy applications in South Korea and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives