- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A217190

Are Genesem Inc.'s (KOSDAQ:217190) Mixed Financials Driving The Negative Sentiment?

Genesem (KOSDAQ:217190) has had a rough month with its share price down 11%. It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Long-term fundamentals are usually what drive market outcomes, so it's worth paying close attention. In this article, we decided to focus on Genesem's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for Genesem

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Genesem is:

1.6% = ₩299m ÷ ₩19b (Based on the trailing twelve months to June 2020).

The 'return' refers to a company's earnings over the last year. So, this means that for every ₩1 of its shareholder's investments, the company generates a profit of ₩0.02.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Genesem's Earnings Growth And 1.6% ROE

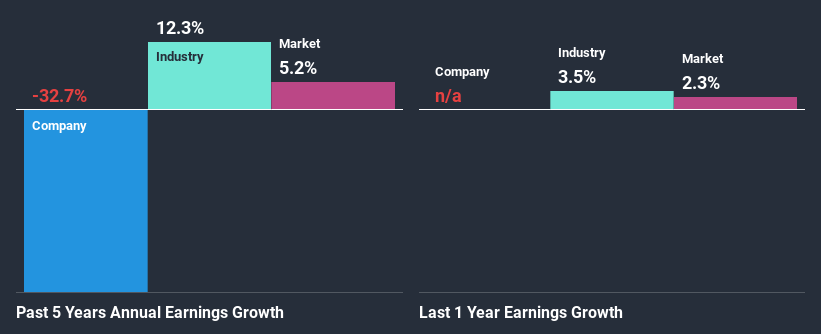

As you can see, Genesem's ROE looks pretty weak. Not just that, even compared to the industry average of 8.2%, the company's ROE is entirely unremarkable. For this reason, Genesem's five year net income decline of 33% is not surprising given its lower ROE. However, there could also be other factors causing the earnings to decline. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

That being said, we compared Genesem's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 12% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Genesem's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Genesem Making Efficient Use Of Its Profits?

Summary

On the whole, we feel that the performance shown by Genesem can be open to many interpretations. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. You can see the 3 risks we have identified for Genesem by visiting our risks dashboard for free on our platform here.

If you’re looking to trade Genesem, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A217190

Genesem

Develops, manufactures, and supplies automated equipment for the semiconductor back-end process in South Korea and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.