- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A171090

Revenues Tell The Story For SUNIC SYSTEM Co., Ltd. (KOSDAQ:171090) As Its Stock Soars 34%

SUNIC SYSTEM Co., Ltd. (KOSDAQ:171090) shareholders are no doubt pleased to see that the share price has bounced 34% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 83% in the last year.

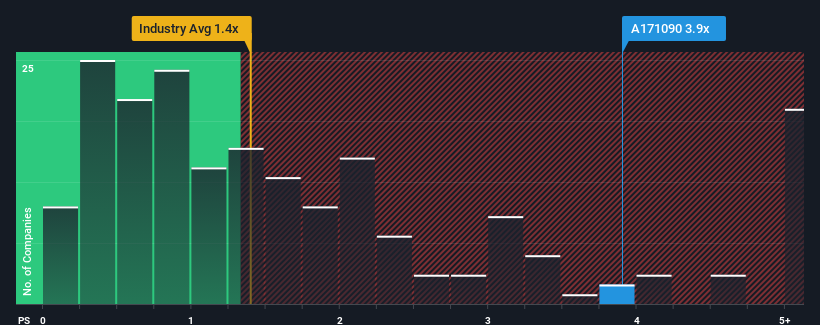

After such a large jump in price, you could be forgiven for thinking SUNIC SYSTEM is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.9x, considering almost half the companies in Korea's Semiconductor industry have P/S ratios below 1.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for SUNIC SYSTEM

What Does SUNIC SYSTEM's Recent Performance Look Like?

Recent times have been advantageous for SUNIC SYSTEM as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think SUNIC SYSTEM's future stacks up against the industry? In that case, our free report is a great place to start.How Is SUNIC SYSTEM's Revenue Growth Trending?

SUNIC SYSTEM's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 48% gain to the company's top line. The latest three year period has also seen an excellent 59% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 79% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 69% growth forecast for the broader industry.

In light of this, it's understandable that SUNIC SYSTEM's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From SUNIC SYSTEM's P/S?

SUNIC SYSTEM's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into SUNIC SYSTEM shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with SUNIC SYSTEM, and understanding should be part of your investment process.

If you're unsure about the strength of SUNIC SYSTEM's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A171090

SUNIC SYSTEM

Manufactures and sells OLED deposition equipment and semiconductor vacuum equipment in Korea.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026