- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A146320

Insiders were the biggest winners as BCnC Co., Ltd.'s (KOSDAQ:146320) market cap grew by ₩17b last week

Key Insights

- Insiders appear to have a vested interest in BCnC's growth, as seen by their sizeable ownership

- Dong-seok Kim owns 58% of the company

- Using data from company's past performance alongside ownership research, one can better assess the future performance of a company

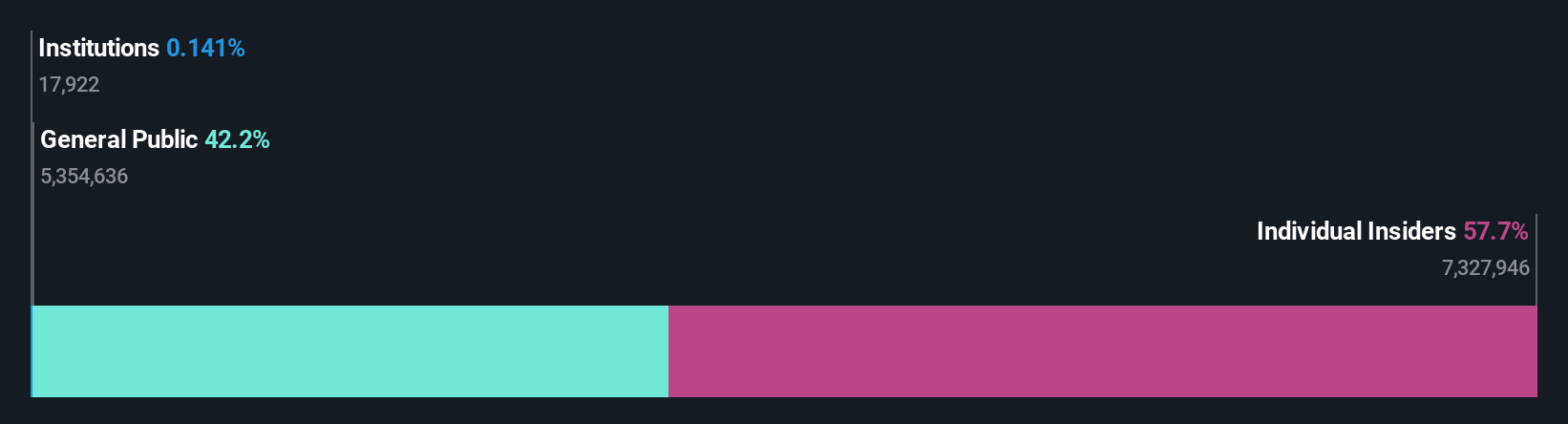

Every investor in BCnC Co., Ltd. (KOSDAQ:146320) should be aware of the most powerful shareholder groups. The group holding the most number of shares in the company, around 58% to be precise, is individual insiders. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

As a result, insiders scored the highest last week as the company hit ₩163b market cap following a 12% gain in the stock.

Let's take a closer look to see what the different types of shareholders can tell us about BCnC.

View our latest analysis for BCnC

What Does The Lack Of Institutional Ownership Tell Us About BCnC?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

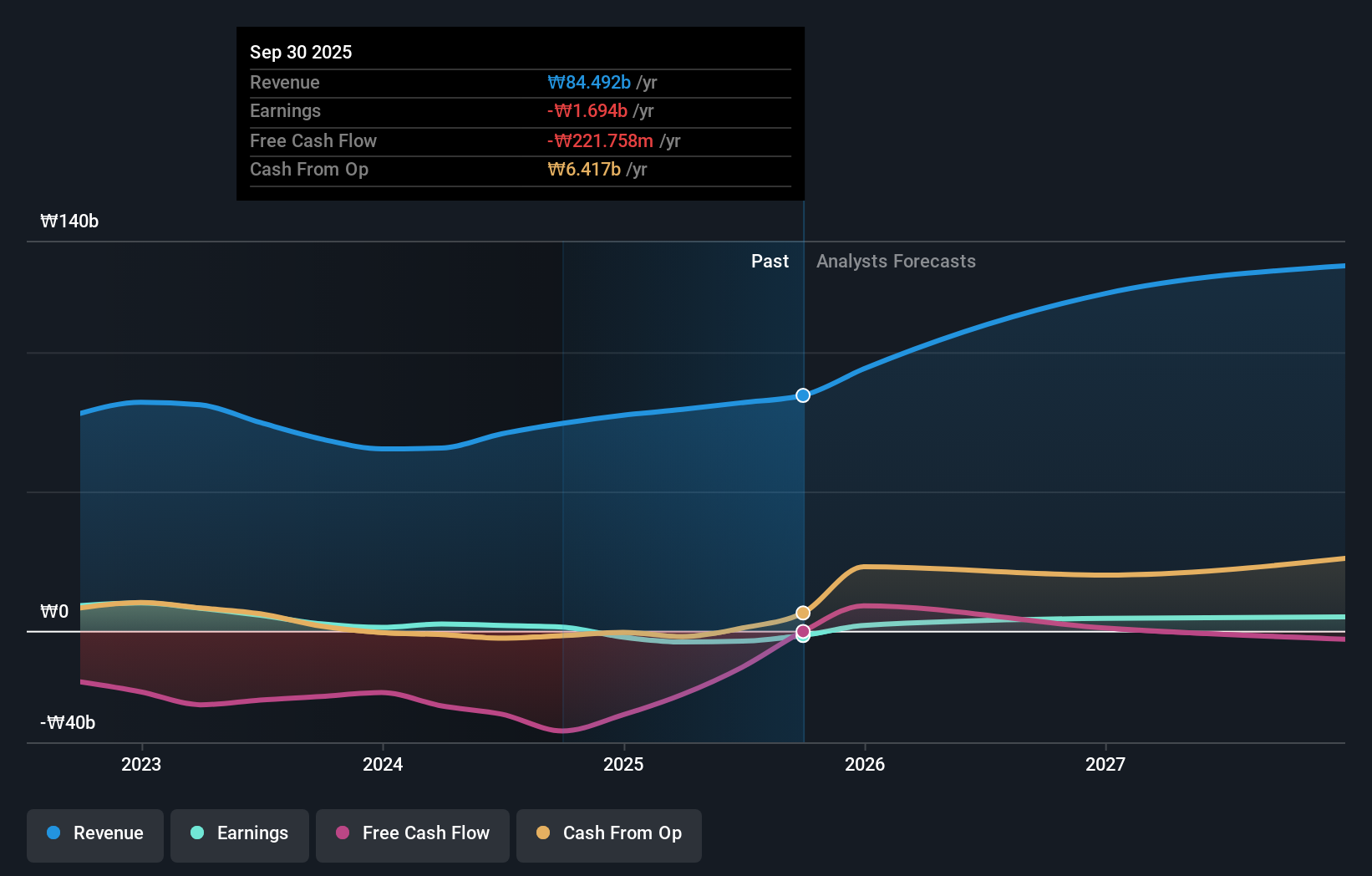

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of BCnC, for yourself, below.

We note that hedge funds don't have a meaningful investment in BCnC. Dong-seok Kim is currently the company's largest shareholder with 58% of shares outstanding. With such a huge stake in the ownership, we infer that they have significant control of the future of the company. Meanwhile, the second and third largest shareholders, hold 0.1% and 0.05%, of the shares outstanding, respectively.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Insider Ownership Of BCnC

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that insiders own more than half of BCnC Co., Ltd.. This gives them effective control of the company. Given it has a market cap of ₩163b, that means they have ₩94b worth of shares. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public-- including retail investors -- own 42% stake in the company, and hence can't easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for BCnC (1 makes us a bit uncomfortable) that you should be aware of.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if BCnC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A146320

BCnC

Manufactures and sells semiconductor parts in South Korea and internationally.

Reasonable growth potential with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026