- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A101490

Undiscovered Gems with Promising Potential In February 2025

Reviewed by Simply Wall St

As global markets navigate through a complex landscape of tariff uncertainties and mixed economic signals, small-cap stocks have been notably impacted, with indices like the Russell 2000 experiencing fluctuations amid broader market sentiment. Despite these challenges, opportunities arise for discerning investors to identify promising small-cap companies that exhibit resilience and potential for growth in such dynamic environments. In this context, a good stock is often characterized by strong fundamentals and adaptability to changing market conditions—qualities that can position it well amidst economic shifts and policy developments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

S&S Tech (KOSDAQ:A101490)

Simply Wall St Value Rating: ★★★★★★

Overview: S&S Tech Corporation specializes in the manufacturing and sale of blank masks globally, with a market capitalization of approximately ₩642.96 billion.

Operations: S&S Tech generates revenue primarily from S&S Tech Co., Ltd., contributing ₩158.48 billion, and S&S Investment Co., Ltd., with ₩10.65 billion.

S&S Tech, a nimble player in the semiconductor space, showcases impressive financial health with earnings growth of 23.6% over the past year, outpacing the industry’s 7.4%. The company has reduced its debt-to-equity ratio from 34.7% to 5.8% over five years and holds more cash than total debt, indicating robust financial management. Recent activities include repurchasing 201,680 shares for KRW 4.73 billion as part of their buyback plan announced in August 2024. Net income for Q3 reached KRW 8,207 million compared to KRW 6,287 million a year ago, reflecting solid profitability improvements despite minor sales fluctuations.

- Take a closer look at S&S Tech's potential here in our health report.

Evaluate S&S Tech's historical performance by accessing our past performance report.

Shenzhen Qingyi Photomask (SHSE:688138)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Qingyi Photomask Limited specializes in the research, design, production, and sales of high precision masks in China with a market cap of CN¥7.20 billion.

Operations: Shenzhen Qingyi Photomask generates revenue primarily through the production and sales of high precision masks. The company's cost structure is significantly influenced by its research and design activities, impacting its overall profitability. Notably, it has experienced fluctuations in net profit margin over recent periods.

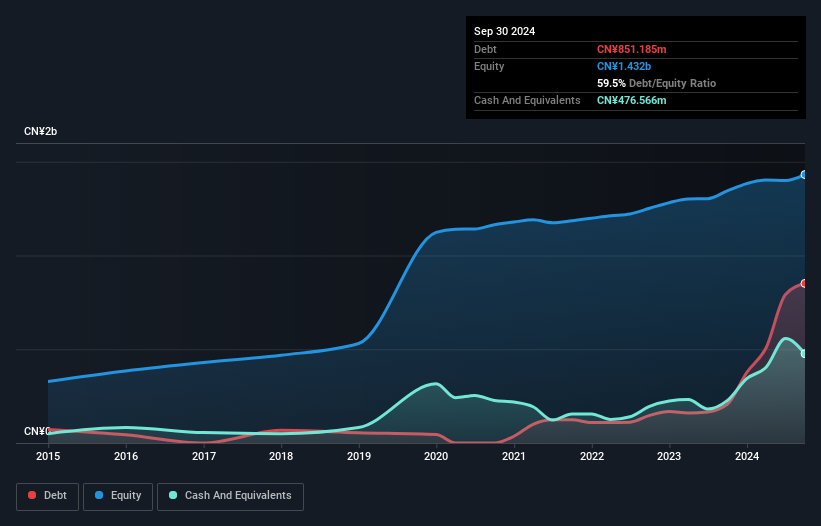

Shenzhen Qingyi Photomask, a nimble player in the electronics sector, has shown impressive earnings growth of 28% over the past year, outpacing its industry peers. Despite a debt to equity ratio rising from 4.9% to 59.5% over five years, their net debt to equity remains satisfactory at 26%. Interest coverage is robust with EBIT covering interest payments by 15.6 times. The company repurchased shares worth CNY 30 million recently, reflecting confidence in its valuation; however, high non-cash earnings and share price volatility could be concerns for some investors looking at this promising yet complex entity.

Sichuan Huiyu Pharmaceutical (SHSE:688553)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Huiyu Pharmaceutical Co., Ltd. engages in the research, development, production, and sale of anti-tumor and injection drugs both in China and internationally, with a market capitalization of CN¥6.47 billion.

Operations: Huiyu Pharmaceutical generates revenue primarily from its medicine segment, amounting to CN¥1.12 billion. The company focuses on anti-tumor and injection drugs, contributing significantly to its financial performance.

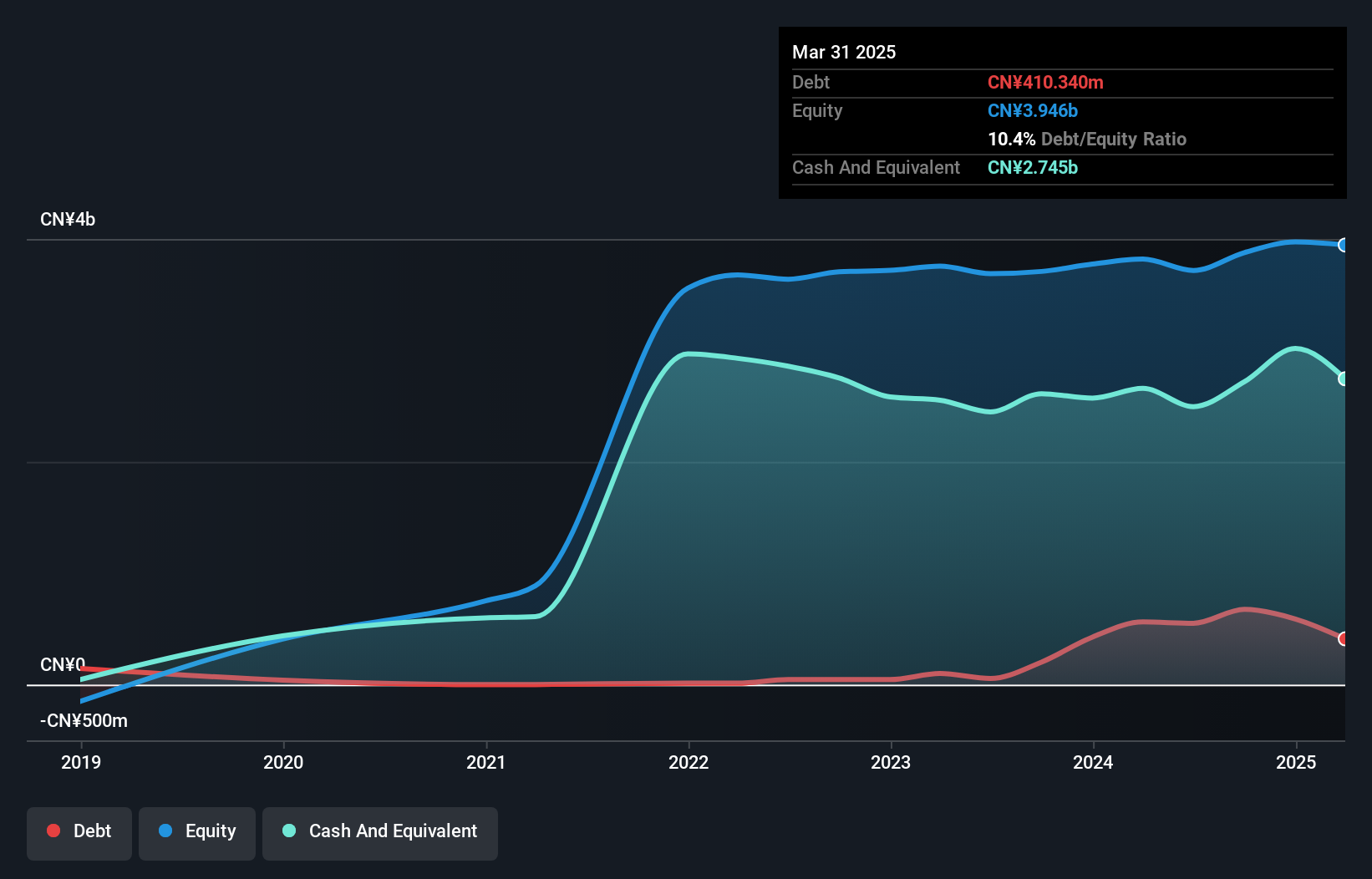

Huiyu Pharmaceutical, a Shanghai-listed player in oncology and immune therapies, has shown impressive earnings growth of 171% over the past year, outpacing the industry average. Despite a notable one-off gain of CN¥179M impacting recent results, the company maintains a healthy financial footing with more cash than total debt and reduced its debt-to-equity ratio from 25% to 17% over five years. Its P/E ratio of 23x suggests good value compared to the broader CN market at 36x. A strategic distribution deal with Hupan Pharmaceutical further underscores its robust R&D and global reach in critical healthcare solutions.

Next Steps

- Investigate our full lineup of 4705 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A101490

Flawless balance sheet with solid track record.

Market Insights

Community Narratives