- Taiwan

- /

- Renewable Energy

- /

- TWSE:6869

Top Growth Companies With Insider Ownership In October 2024

Reviewed by Simply Wall St

As global markets navigate the challenges of rising U.S. Treasury yields and tepid economic growth, investors are keenly observing how these factors influence stock performance. While large-cap and growth stocks have shown resilience, particularly in tech-heavy indices like the Nasdaq Composite, identifying promising investment opportunities requires a focus on companies with robust fundamentals and strategic insider ownership. In this context, examining growth companies with high insider ownership can provide valuable insights into potential long-term value amidst current market dynamics.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Pharmanutra (BIT:PHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pharmanutra S.p.A. is a pharmaceutical and nutraceutical company that focuses on the research, design, development, and marketing of nutritional supplements and medical devices across Italy, Europe, the Middle East, South America, the Far East, and internationally with a market cap of €541.89 million.

Operations: The company's revenue segments consist of €5.11 million from Akern, €65.51 million from Italy, and €36.03 million from international markets outside Italy.

Insider Ownership: 10.7%

Earnings Growth Forecast: 20.7% p.a.

Pharmanutra demonstrates potential as a growth company with high insider ownership. Insiders have increased their holdings recently, although not in large volumes, indicating confidence in the company's future. Analysts forecast significant earnings growth of 20.68% annually over the next three years, outpacing both revenue and market averages. Recent financials show strong performance with first-half 2024 sales at €56.07 million and net income rising to €8.9 million, supporting optimistic projections for the stock's appreciation by 44.2%.

- Click to explore a detailed breakdown of our findings in Pharmanutra's earnings growth report.

- Our expertly prepared valuation report Pharmanutra implies its share price may be too high.

S&S Tech (KOSDAQ:A101490)

Simply Wall St Growth Rating: ★★★★★☆

Overview: S&S Tech Corporation manufactures and sells blank masks globally, with a market cap of ₩471.10 billion.

Operations: The company's revenue is primarily derived from S&S Tech Co., Ltd. at ₩154.55 billion, followed by S&S Investment Co., Ltd. at ₩6.41 billion, and S&S Lab Co., Ltd. at ₩1.72 billion.

Insider Ownership: 22.6%

Earnings Growth Forecast: 36.8% p.a.

S&S Tech shows promise with its substantial earnings growth, forecasted at 36.78% annually over the next three years, surpassing market averages. Recent financials highlight strong performance, with second-quarter net income rising to KRW 7.91 billion from KRW 5.78 billion a year ago. The company announced a share repurchase program worth up to KRW 10 billion to enhance shareholder value and stabilize stock price, reflecting management's commitment despite low insider trading activity recently.

- Unlock comprehensive insights into our analysis of S&S Tech stock in this growth report.

- Upon reviewing our latest valuation report, S&S Tech's share price might be too optimistic.

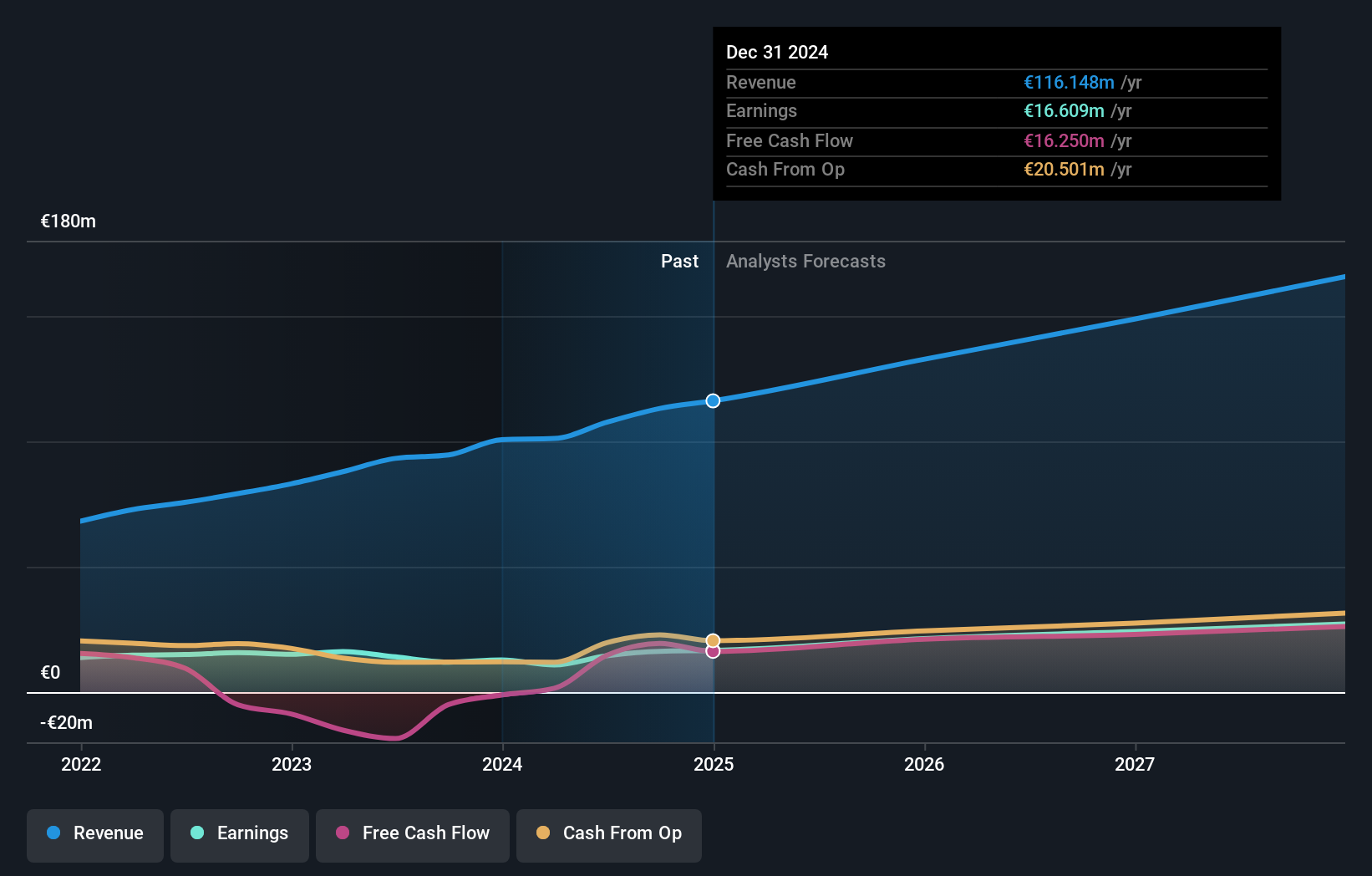

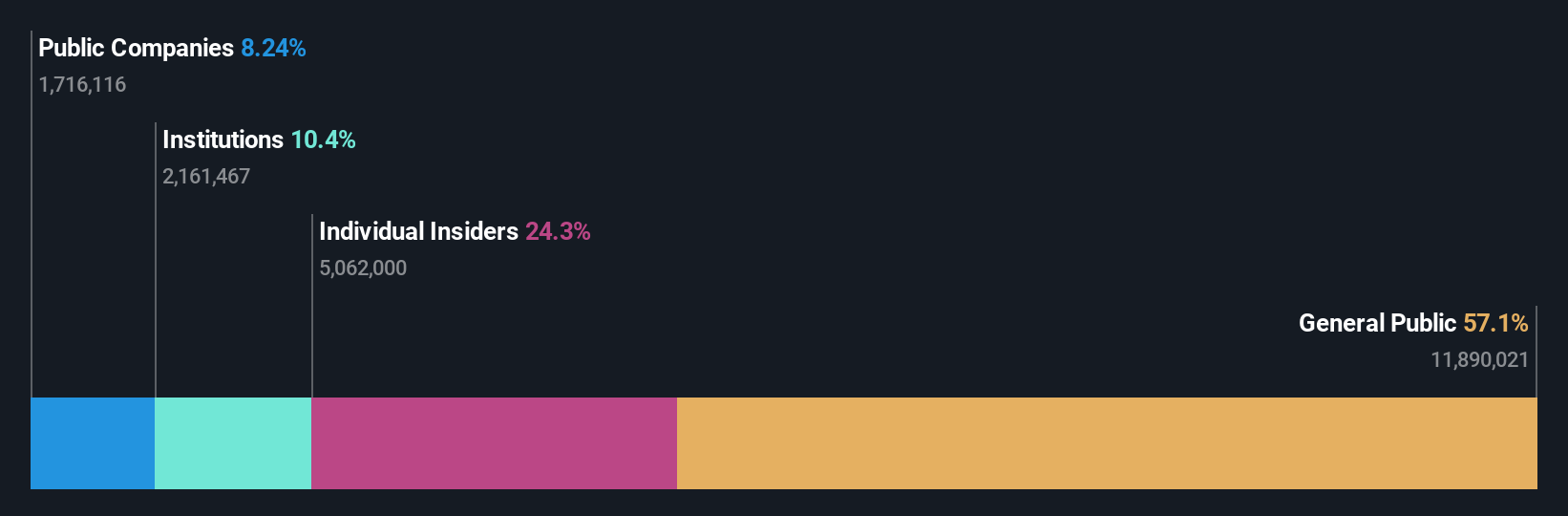

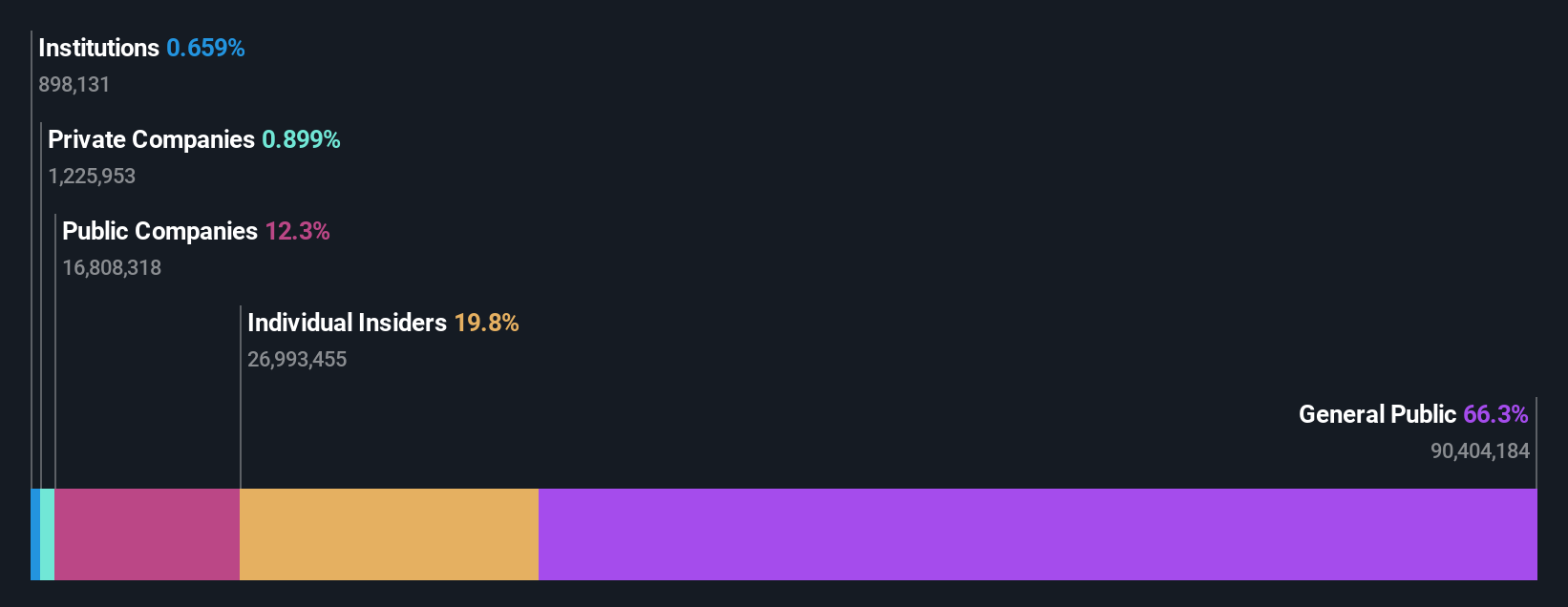

J&V Energy Technology (TWSE:6869)

Simply Wall St Growth Rating: ★★★★★☆

Overview: J&V Energy Technology Co., Ltd. and its subsidiaries focus on the development, investment, maintenance, and management of renewable energy plants in Taiwan, with a market cap of NT$28.47 billion.

Operations: The company's revenue segments include Solar Engineering (NT$786.77 million), Sale of Electricity (NT$751.61 million), Energy Storage Engineering (NT$3.12 billion), and Trading of Energy Equipment (NT$201.58 million).

Insider Ownership: 30.2%

Earnings Growth Forecast: 35.2% p.a.

J&V Energy Technology is poised for significant growth, with earnings expected to rise 35.2% annually, outpacing the TW market. However, recent financials show a decline, with Q2 sales at TWD 1.01 billion and net income at TWD 133.98 million, both down from the previous year. Revenue growth is forecasted at a robust 46.7% per year despite past shareholder dilution and volatile share prices, indicating potential but requiring cautious consideration of risks involved.

- Dive into the specifics of J&V Energy Technology here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that J&V Energy Technology is trading beyond its estimated value.

Where To Now?

- Explore the 1513 names from our Fast Growing Companies With High Insider Ownership screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6869

J&V Energy Technology

Engages in the development, investment, maintenance, and management of renewable energy plants in Taiwan.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives