- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A095340

ISC Co., Ltd.'s (KOSDAQ:095340) 32% Price Boost Is Out Of Tune With Revenues

ISC Co., Ltd. (KOSDAQ:095340) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. The annual gain comes to 187% following the latest surge, making investors sit up and take notice.

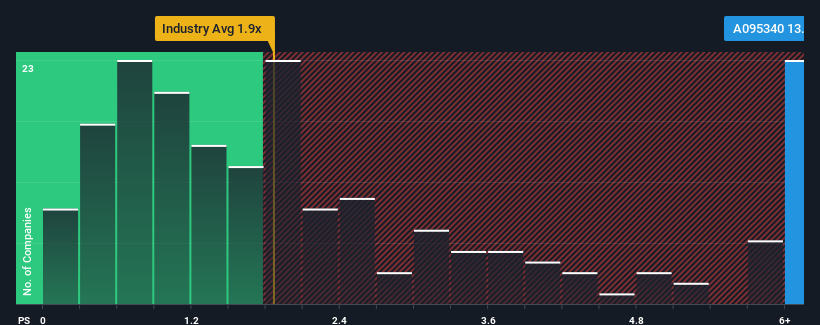

Following the firm bounce in price, given around half the companies in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider ISC as a stock to avoid entirely with its 13.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for ISC

How ISC Has Been Performing

Recent times have been more advantageous for ISC as its revenue hasn't fallen as much as the rest of the industry. It seems that many are expecting the comparatively superior revenue performance to persist, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price, especially if revenue continues to dissolve.

Keen to find out how analysts think ISC's future stacks up against the industry? In that case, our free report is a great place to start.How Is ISC's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as ISC's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 29% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 34% per annum as estimated by the six analysts watching the company. With the industry predicted to deliver 35% growth per annum, the company is positioned for a comparable revenue result.

With this information, we find it interesting that ISC is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On ISC's P/S

Shares in ISC have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that ISC currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

You should always think about risks. Case in point, we've spotted 3 warning signs for ISC you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A095340

ISC

Develops, manufactures, and sells semiconductor test sockets worldwide.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives