- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A093640

Is Korea Robot ManufacturingLtd (KOSDAQ:093640) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Korea Robot Manufacturing Co.,Ltd. (KOSDAQ:093640) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Korea Robot ManufacturingLtd

What Is Korea Robot ManufacturingLtd's Debt?

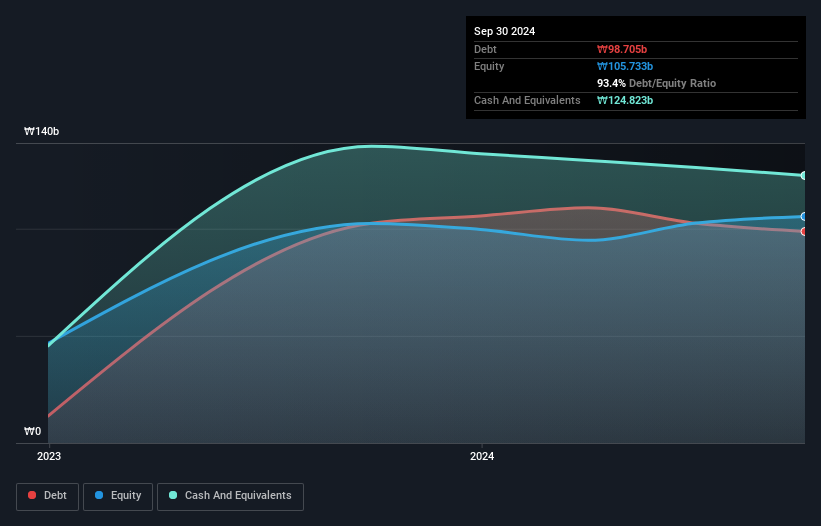

The chart below, which you can click on for greater detail, shows that Korea Robot ManufacturingLtd had ₩98.7b in debt in September 2024; about the same as the year before. But it also has ₩124.8b in cash to offset that, meaning it has ₩26.1b net cash.

A Look At Korea Robot ManufacturingLtd's Liabilities

According to the last reported balance sheet, Korea Robot ManufacturingLtd had liabilities of ₩81.1b due within 12 months, and liabilities of ₩24.5b due beyond 12 months. Offsetting this, it had ₩124.8b in cash and ₩2.65b in receivables that were due within 12 months. So it can boast ₩21.9b more liquid assets than total liabilities.

This surplus suggests that Korea Robot ManufacturingLtd has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Korea Robot ManufacturingLtd boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is Korea Robot ManufacturingLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Korea Robot ManufacturingLtd's revenue was pretty flat, and it made a negative EBIT. While that's not too bad, we'd prefer see growth.

So How Risky Is Korea Robot ManufacturingLtd?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Korea Robot ManufacturingLtd lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of ₩17b and booked a ₩19b accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of ₩26.1b. That kitty means the company can keep spending for growth for at least two years, at current rates. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 1 warning sign for Korea Robot ManufacturingLtd that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Korea Robot ManufacturingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A093640

Korea Robot ManufacturingLtd

Designs and develops semiconductor solutions.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives