- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A084370

Top KRX Growth Companies With High Insider Ownership August 2024

Reviewed by Simply Wall St

The South Korean market has climbed 4.1% in the last 7 days and is up 5.1% over the last 12 months, with earnings forecast to grow by 28% annually. In this favorable environment, growth companies with high insider ownership can be particularly compelling as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 72.9% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 89.7% |

| Global Tax Free (KOSDAQ:A204620) | 21.4% | 90.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 29.6% | 58.7% |

| Park Systems (KOSDAQ:A140860) | 33% | 37.5% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 20.2% | 97.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Here we highlight a subset of our preferred stocks from the screener.

HANA Micron (KOSDAQ:A067310)

Simply Wall St Growth Rating: ★★★★★★

Overview: HANA Micron Inc. provides semiconductor back-end process packaging solutions in South Korea and has a market cap of ₩774.46 billion.

Operations: HANA Micron generates revenue from semiconductor manufacturing (₩1.27 billion) and semiconductor material (₩221.85 million).

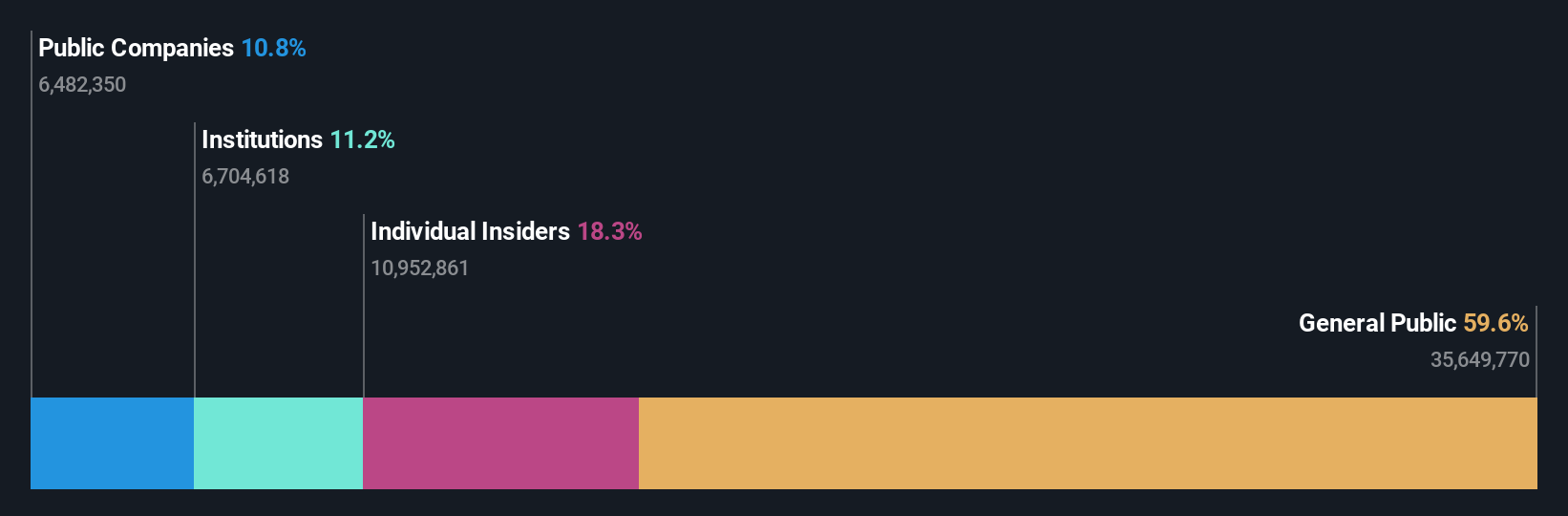

Insider Ownership: 20.2%

Earnings Growth Forecast: 97.4% p.a.

HANA Micron, a South Korean growth company with high insider ownership, recently completed a KRW 82.4 billion follow-on equity offering. Analysts forecast the company's revenue to grow at 26.3% annually, significantly outpacing the market average of 10.7%. The stock is trading below analyst price targets with an expected rise of 71.5%. HANA Micron's earnings are projected to grow by 97.38% per year and achieve profitability within three years, making it a compelling investment opportunity despite recent shareholder dilution.

- Delve into the full analysis future growth report here for a deeper understanding of HANA Micron.

- Our valuation report unveils the possibility HANA Micron's shares may be trading at a discount.

Eugene TechnologyLtd (KOSDAQ:A084370)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Eugene Technology Co., Ltd. manufactures and sells semiconductor equipment and parts in South Korea and internationally, with a market cap of ₩1.13 trillion.

Operations: The company's revenue segments include ₩257.39 billion from semiconductor equipment and ₩10.01 billion from industrial gas for semiconductors.

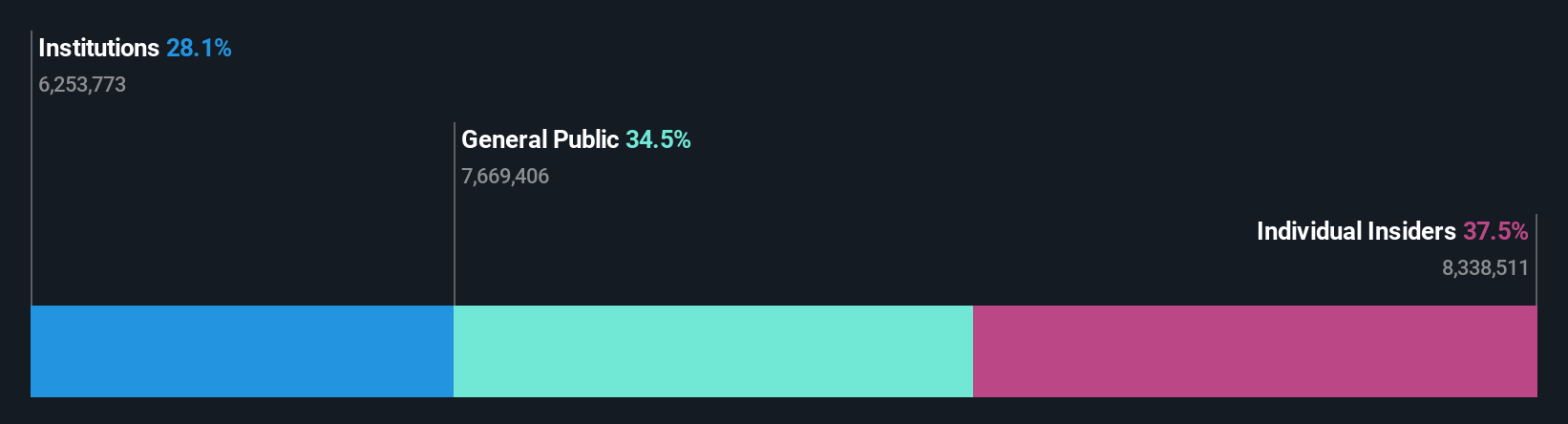

Insider Ownership: 37.5%

Earnings Growth Forecast: 43.4% p.a.

Eugene Technology Ltd., a South Korean company with high insider ownership, is forecast to grow its revenue by 19.7% annually, outpacing the market average of 10.7%. Earnings are expected to increase significantly at 43.4% per year over the next three years, though its Return on Equity is projected to be relatively low at 16.4%. The stock has experienced high volatility in recent months but shows strong growth potential despite this instability.

- Get an in-depth perspective on Eugene TechnologyLtd's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Eugene TechnologyLtd's current price could be inflated.

Devsisters (KOSDAQ:A194480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Devsisters Corporation develops mobile games in South Korea and internationally, with a market cap of approximately ₩448.78 billion.

Operations: The company generates revenue primarily from computer graphics, amounting to ₩170.33 billion.

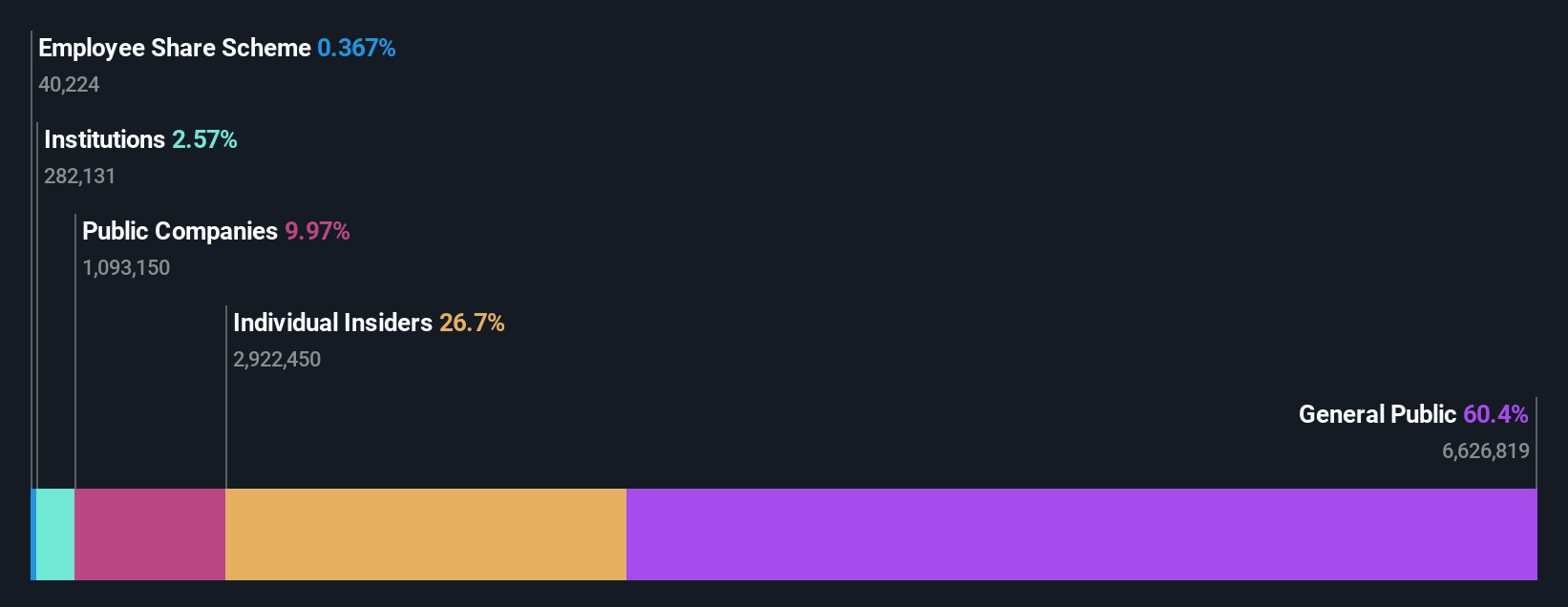

Insider Ownership: 26.3%

Earnings Growth Forecast: 65.9% p.a.

Devsisters, a South Korean company with high insider ownership, is trading at 77.1% below its estimated fair value and is expected to become profitable within the next three years. Revenue growth is forecasted at 26.1% annually, significantly outpacing the market average of 10.7%. Earnings are projected to grow by 65.92% per year, and Return on Equity is anticipated to reach 29.9% in three years despite recent share price volatility.

- Dive into the specifics of Devsisters here with our thorough growth forecast report.

- Our valuation report here indicates Devsisters may be overvalued.

Seize The Opportunity

- Navigate through the entire inventory of 88 Fast Growing KRX Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Eugene TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A084370

Eugene TechnologyLtd

Engages in the manufacture and sale of semiconductor equipment and parts in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.