- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A084370

KRX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen 2.2%, driven by gains of 4.0% in the Industrials sector. In the last 12 months, the market has been flat, but earnings are forecast to grow by 29% annually. In this environment, identifying growth companies with high insider ownership can be crucial as it often signals confidence from those who know the business best and potentially aligns their interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 97.6% |

| Park Systems (KOSDAQ:A140860) | 33% | 35.7% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| Devsisters (KOSDAQ:A194480) | 26.2% | 63% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

Let's explore several standout options from the results in the screener.

HANA Micron (KOSDAQ:A067310)

Simply Wall St Growth Rating: ★★★★★★

Overview: HANA Micron Inc. provides semiconductor back-end process packaging solutions in South Korea and has a market cap of ₩690.31 billion.

Operations: HANA Micron generates revenue from semiconductor manufacturing (₩1.41 billion) and semiconductor material (₩217.79 million).

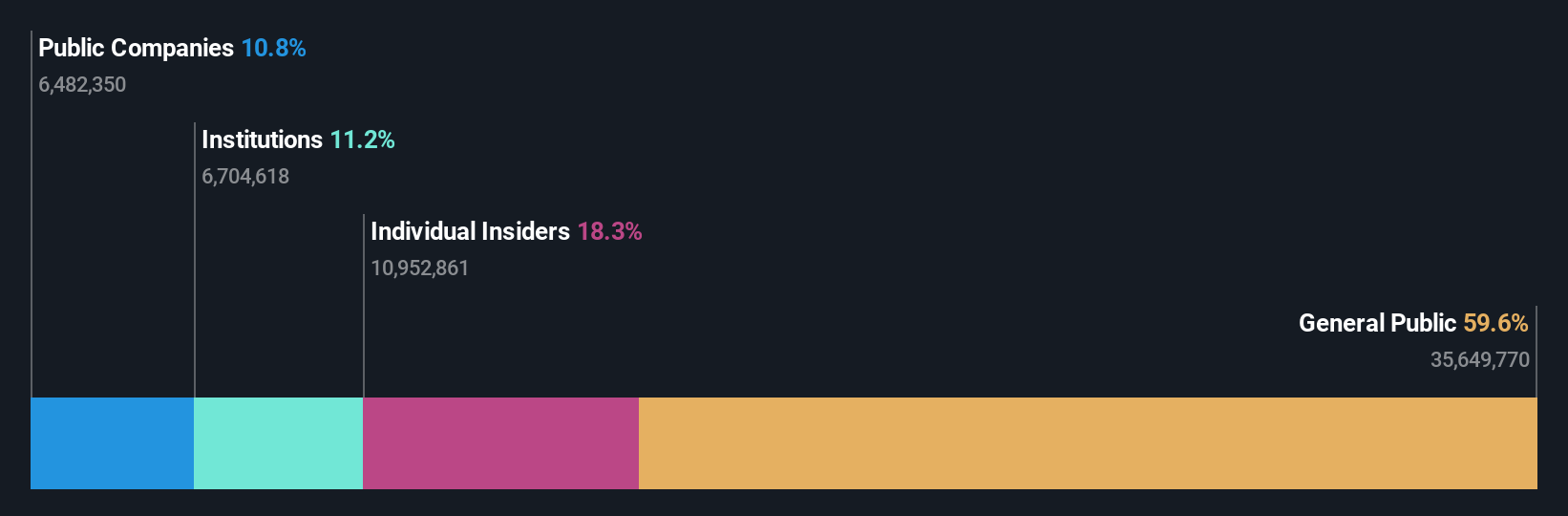

Insider Ownership: 18.3%

Revenue Growth Forecast: 24.8% p.a.

HANA Micron, with substantial insider ownership, presents a mixed outlook. Despite a recent follow-on equity offering raising KRW 82.4 billion and sales growth of 15% year-over-year to KRW 285.94 billion in Q2 2024, the company reported a net loss of KRW 11.34 million for the quarter. However, forecasts suggest annual revenue growth of 24.8% and profitability within three years, indicating potential long-term value amidst current financial challenges.

- Take a closer look at HANA Micron's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, HANA Micron's share price might be too pessimistic.

Eugene TechnologyLtd (KOSDAQ:A084370)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eugene Technology Co., Ltd. manufactures and sells semiconductor equipment and parts in South Korea and internationally, with a market cap of ₩841.53 billion.

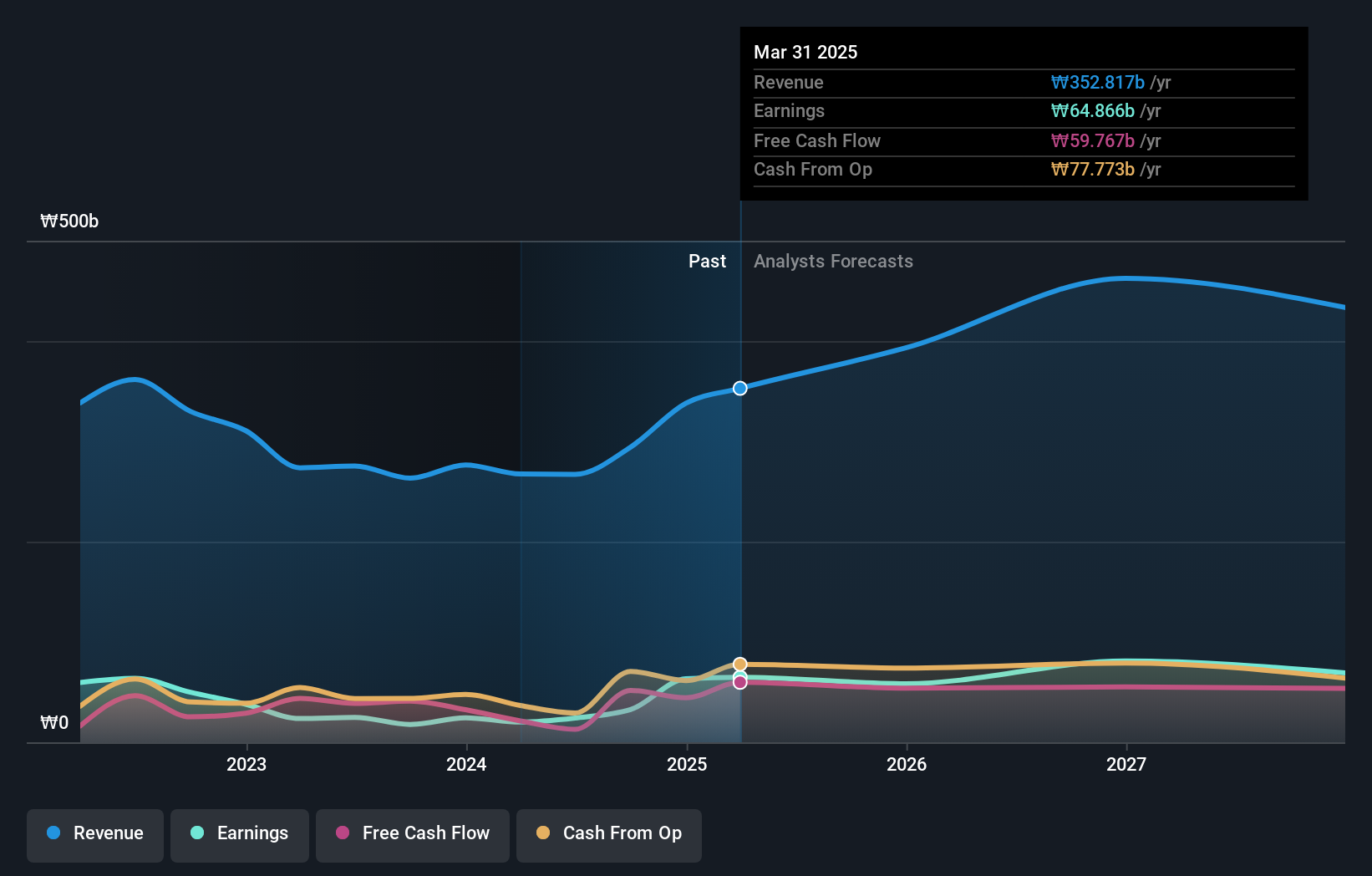

Operations: The company's revenue segments include ₩256.56 billion from semiconductor equipment and ₩10.49 billion from industrial gas for semiconductors.

Insider Ownership: 37.5%

Revenue Growth Forecast: 21.2% p.a.

Eugene Technology Ltd. demonstrates strong growth potential with high insider ownership. The company's earnings are forecast to grow 40% annually, outpacing the Korean market's 29.1%. Revenue is expected to increase by 21.2% per year, also surpassing market expectations of 10.3%. Despite a volatile share price and a forecasted low return on equity (16.1%) in three years, analysts predict a significant stock price rise of 52.5%. Recent Q2 results showed net income growth from KRW 8 billion to KRW 12 billion year-over-year, reflecting robust financial performance amidst broader market dynamics.

- Click to explore a detailed breakdown of our findings in Eugene TechnologyLtd's earnings growth report.

- Our comprehensive valuation report raises the possibility that Eugene TechnologyLtd is priced higher than what may be justified by its financials.

Devsisters (KOSDAQ:A194480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Devsisters Corporation develops mobile games in South Korea and internationally, with a market cap of ₩405.43 billion.

Operations: Devsisters generates revenue from computer graphics amounting to ₩186.57 million.

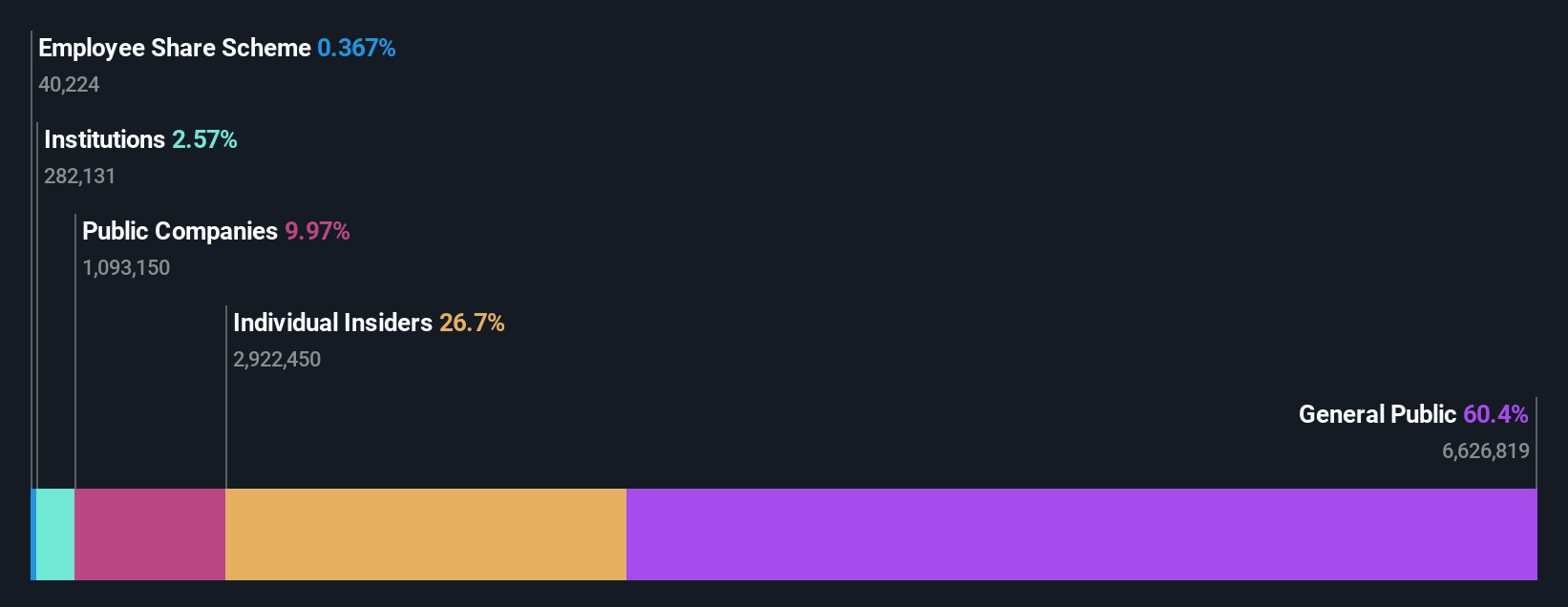

Insider Ownership: 26.2%

Revenue Growth Forecast: 29.1% p.a.

Devsisters showcases significant growth potential with high insider ownership. The company’s earnings are forecast to grow 63.02% annually, and revenue is expected to increase by 29.1% per year, surpassing the Korean market's 10.3%. Despite a highly volatile share price, Devsisters trades at 79.7% below its estimated fair value. Recent Q2 results reported sales of KRW 51.82 billion and net income of KRW 6.27 billion, reflecting a strong turnaround from the previous year's losses.

- Click here and access our complete growth analysis report to understand the dynamics of Devsisters.

- The valuation report we've compiled suggests that Devsisters' current price could be quite moderate.

Next Steps

- Discover the full array of 78 Fast Growing KRX Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Eugene TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A084370

Eugene TechnologyLtd

Engages in the manufacture and sale of semiconductor equipment and parts in South Korea and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success