- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A078350

Hanyang Digitech Co., Ltd.'s (KOSDAQ:078350) 29% Cheaper Price Remains In Tune With Earnings

To the annoyance of some shareholders, Hanyang Digitech Co., Ltd. (KOSDAQ:078350) shares are down a considerable 29% in the last month, which continues a horrid run for the company. Longer-term, the stock has been solid despite a difficult 30 days, gaining 22% in the last year.

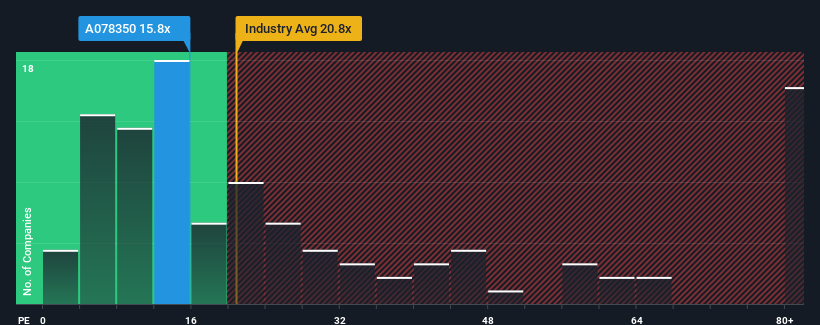

Although its price has dipped substantially, Hanyang Digitech's price-to-earnings (or "P/E") ratio of 15.8x might still make it look like a sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 12x and even P/E's below 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

As an illustration, earnings have deteriorated at Hanyang Digitech over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Hanyang Digitech

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Hanyang Digitech's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 47%. Even so, admirably EPS has lifted 229% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Comparing that to the market, which is only predicted to deliver 33% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's understandable that Hanyang Digitech's P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Hanyang Digitech's P/E hasn't come down all the way after its stock plunged. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hanyang Digitech maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Hanyang Digitech has 2 warning signs we think you should be aware of.

Of course, you might also be able to find a better stock than Hanyang Digitech. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hanyang Digitech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A078350

Hanyang Digitech

Engages in the development, manufacture, and sale of semiconductor memory modules and VoIP terminals in South Korea and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026