- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A078350

Earnings Not Telling The Story For Hanyang Digitech Co., Ltd. (KOSDAQ:078350) After Shares Rise 33%

Hanyang Digitech Co., Ltd. (KOSDAQ:078350) shareholders have had their patience rewarded with a 33% share price jump in the last month. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

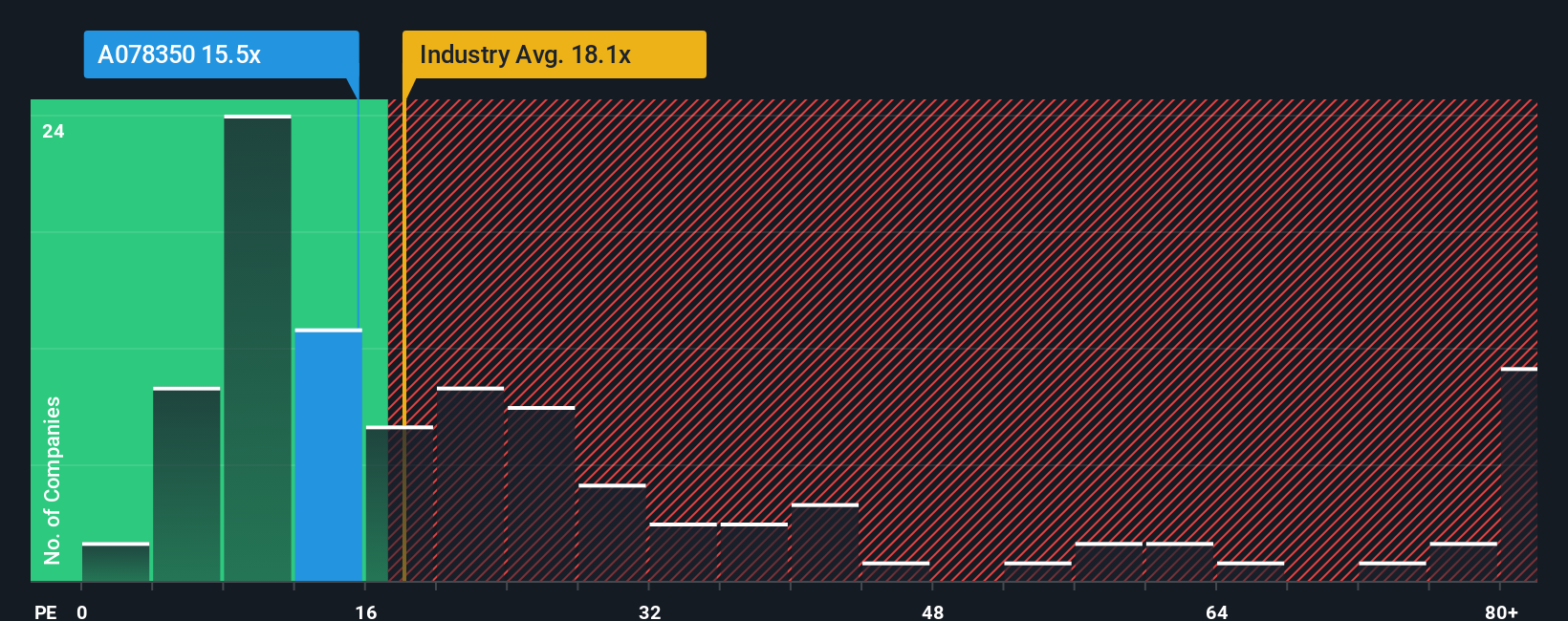

Although its price has surged higher, there still wouldn't be many who think Hanyang Digitech's price-to-earnings (or "P/E") ratio of 15.5x is worth a mention when the median P/E in Korea is similar at about 15x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

As an illustration, earnings have deteriorated at Hanyang Digitech over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Hanyang Digitech

Is There Some Growth For Hanyang Digitech?

There's an inherent assumption that a company should be matching the market for P/E ratios like Hanyang Digitech's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 41%. This means it has also seen a slide in earnings over the longer-term as EPS is down 64% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 32% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Hanyang Digitech is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

Hanyang Digitech's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Hanyang Digitech currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Hanyang Digitech that you should be aware of.

If these risks are making you reconsider your opinion on Hanyang Digitech, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hanyang Digitech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A078350

Hanyang Digitech

Engages in the development, manufacture, and sale of semiconductor memory modules and VoIP terminals in South Korea and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives