- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A078150

It's Down 31% But HB Technology CO.,LTD. (KOSDAQ:078150) Could Be Riskier Than It Looks

HB Technology CO.,LTD. (KOSDAQ:078150) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 24% share price drop.

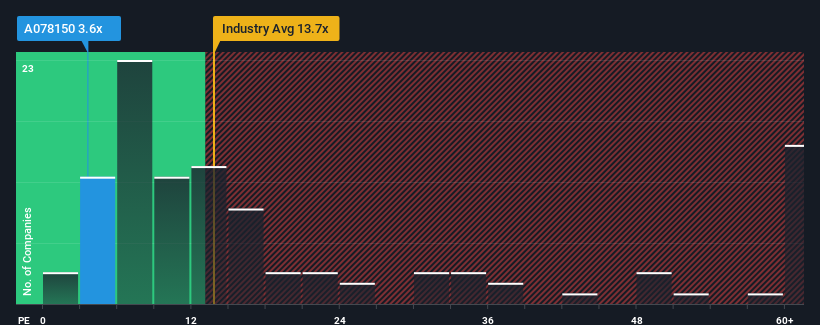

In spite of the heavy fall in price, HB TechnologyLTD's price-to-earnings (or "P/E") ratio of 3.6x might still make it look like a strong buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 11x and even P/E's above 21x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

While the market has experienced earnings growth lately, HB TechnologyLTD's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for HB TechnologyLTD

Does Growth Match The Low P/E?

In order to justify its P/E ratio, HB TechnologyLTD would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 13%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 131% over the next year. That's shaping up to be materially higher than the 27% growth forecast for the broader market.

With this information, we find it odd that HB TechnologyLTD is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From HB TechnologyLTD's P/E?

HB TechnologyLTD's P/E looks about as weak as its stock price lately. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of HB TechnologyLTD's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for HB TechnologyLTD that you should be aware of.

If these risks are making you reconsider your opinion on HB TechnologyLTD, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if HB TechnologyLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A078150

HB TechnologyLTD

Engages in the manufacture and sale of inspection display equipment in South Korea and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives