- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A067310

Revenues Not Telling The Story For HANA Micron Inc. (KOSDAQ:067310) After Shares Rise 39%

HANA Micron Inc. (KOSDAQ:067310) shares have continued their recent momentum with a 39% gain in the last month alone. The annual gain comes to 171% following the latest surge, making investors sit up and take notice.

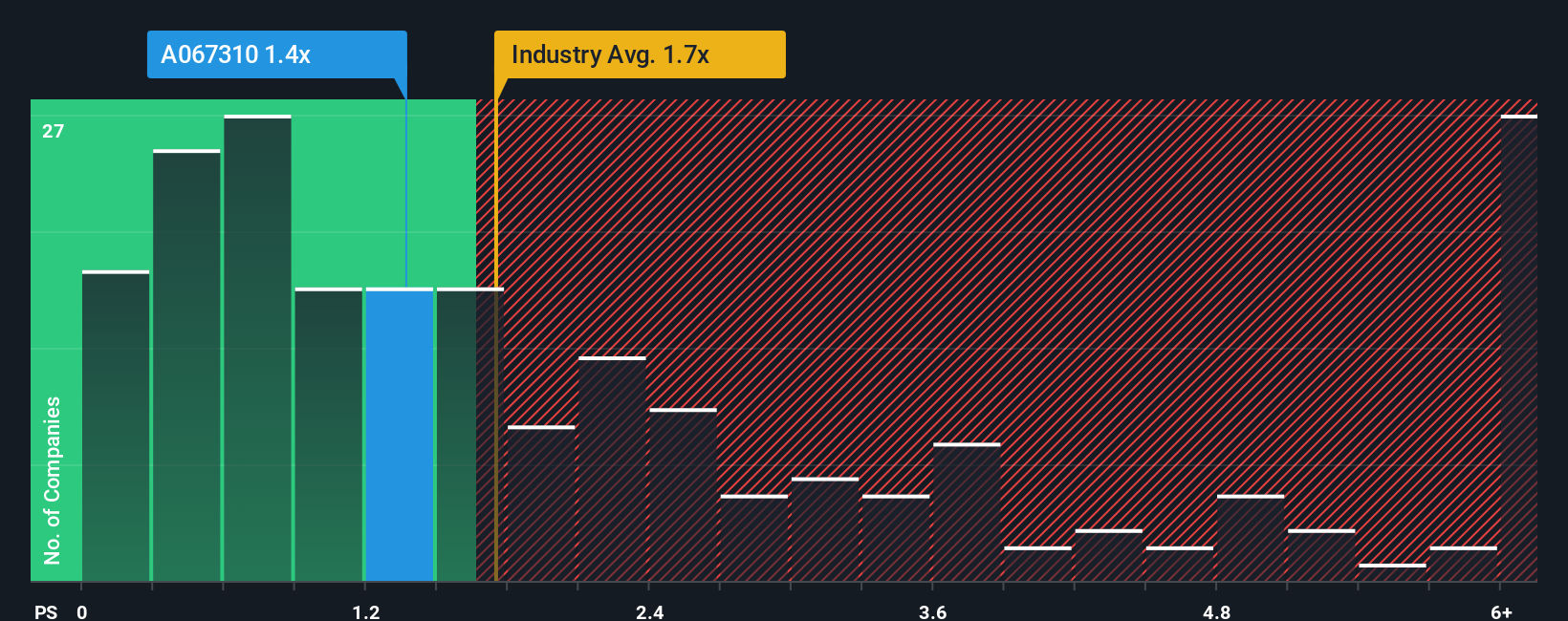

Although its price has surged higher, you could still be forgiven for feeling indifferent about HANA Micron's P/S ratio of 1.4x, since the median price-to-sales (or "P/S") ratio for the Semiconductor industry in Korea is also close to 1.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for HANA Micron

How HANA Micron Has Been Performing

HANA Micron could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on HANA Micron.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, HANA Micron would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 30%. The latest three year period has also seen an excellent 62% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 23% over the next year. That's shaping up to be materially lower than the 37% growth forecast for the broader industry.

With this information, we find it interesting that HANA Micron is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On HANA Micron's P/S

HANA Micron's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that HANA Micron's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

We don't want to rain on the parade too much, but we did also find 3 warning signs for HANA Micron (1 is significant!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if HANA Micron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A067310

HANA Micron

Provides semiconductor back-end process packaging solutions in South Korea.

High growth potential and good value.

Market Insights

Community Narratives