- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A066980

Investors Give Hansung Cleantech Co., Ltd. (KOSDAQ:066980) Shares A 25% Hiding

The Hansung Cleantech Co., Ltd. (KOSDAQ:066980) share price has fared very poorly over the last month, falling by a substantial 25%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 65% loss during that time.

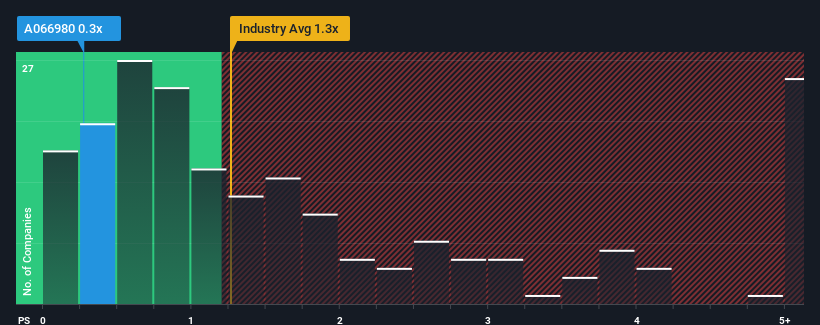

After such a large drop in price, it would be understandable if you think Hansung Cleantech is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in Korea's Semiconductor industry have P/S ratios above 1.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Hansung Cleantech

What Does Hansung Cleantech's Recent Performance Look Like?

For example, consider that Hansung Cleantech's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Hansung Cleantech, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Hansung Cleantech's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 39% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 136% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that to the industry, which is predicted to deliver 31% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we find it odd that Hansung Cleantech is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

The Final Word

The southerly movements of Hansung Cleantech's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Hansung Cleantech currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. While recent

Having said that, be aware Hansung Cleantech is showing 3 warning signs in our investment analysis, and 2 of those are a bit unpleasant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hansung Cleantech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A066980

Good value with adequate balance sheet.

Market Insights

Community Narratives