- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A066980

Hansung Cleantech Co., Ltd.'s (KOSDAQ:066980) Shares Leap 26% Yet They're Still Not Telling The Full Story

Hansung Cleantech Co., Ltd. (KOSDAQ:066980) shares have had a really impressive month, gaining 26% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.0% in the last twelve months.

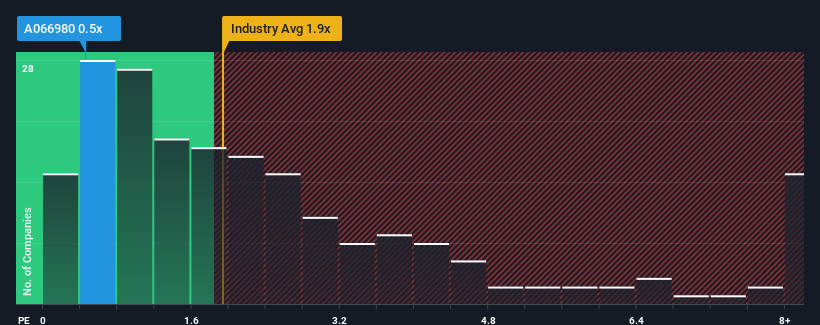

Although its price has surged higher, Hansung Cleantech's price-to-sales (or "P/S") ratio of 0.5x might still make it look like a buy right now compared to the Semiconductor industry in Korea, where around half of the companies have P/S ratios above 1.9x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Hansung Cleantech

How Has Hansung Cleantech Performed Recently?

It looks like revenue growth has deserted Hansung Cleantech recently, which is not something to boast about. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hansung Cleantech will help you shine a light on its historical performance.How Is Hansung Cleantech's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Hansung Cleantech's is when the company's growth is on track to lag the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were nothing to write home about. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

This is in contrast to the rest of the industry, which is expected to grow by 75% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Hansung Cleantech's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Hansung Cleantech's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Hansung Cleantech's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We're very surprised to see Hansung Cleantech currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Hansung Cleantech that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hansung Cleantech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A066980

Good value with adequate balance sheet.

Market Insights

Community Narratives