- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A066980

Further Upside For Hansung Cleantech Co., Ltd. (KOSDAQ:066980) Shares Could Introduce Price Risks After 39% Bounce

Hansung Cleantech Co., Ltd. (KOSDAQ:066980) shares have had a really impressive month, gaining 39% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

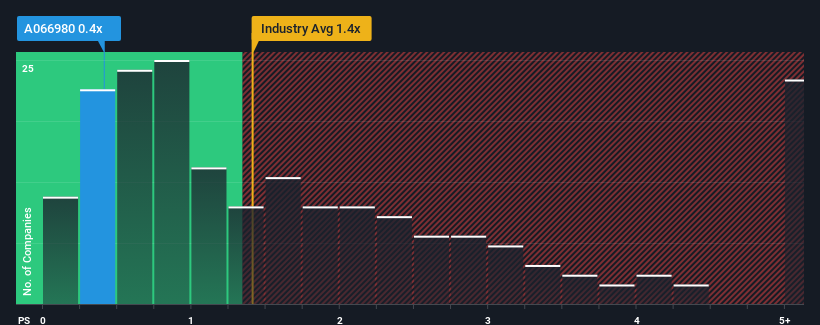

Even after such a large jump in price, it would still be understandable if you think Hansung Cleantech is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in Korea's Semiconductor industry have P/S ratios above 1.4x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Hansung Cleantech

How Hansung Cleantech Has Been Performing

As an illustration, revenue has deteriorated at Hansung Cleantech over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hansung Cleantech will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Hansung Cleantech's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

When compared to the industry's one-year growth forecast of 65%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that Hansung Cleantech's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Despite Hansung Cleantech's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see Hansung Cleantech currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

It is also worth noting that we have found 5 warning signs for Hansung Cleantech (2 are a bit concerning!) that you need to take into consideration.

If you're unsure about the strength of Hansung Cleantech's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hansung Cleantech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A066980

Good value with adequate balance sheet.

Market Insights

Community Narratives