- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A064290

Does INTEKPLUS (KOSDAQ:064290) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, INTEKPLUS Co., Ltd. (KOSDAQ:064290) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

What Is INTEKPLUS's Debt?

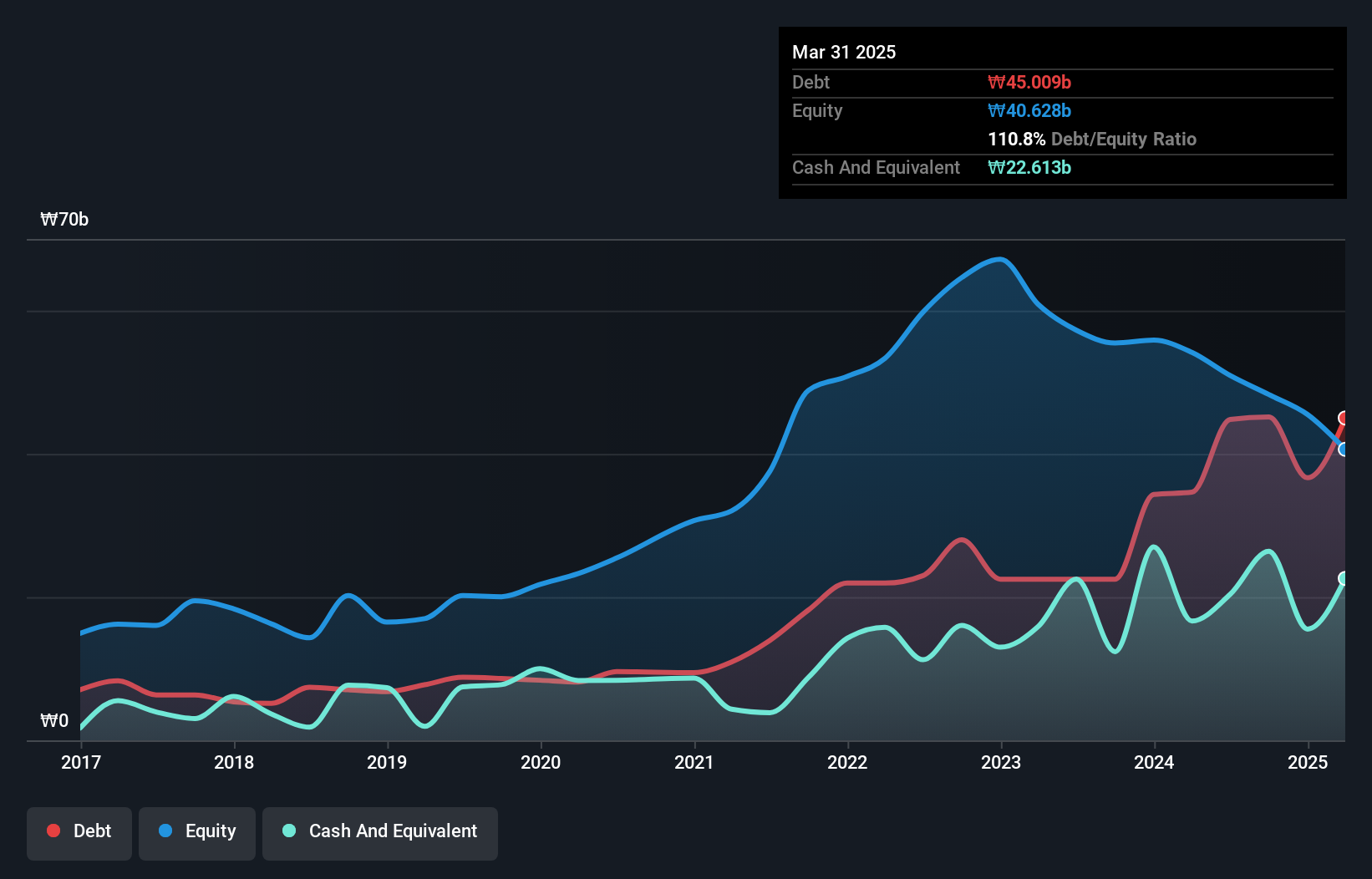

You can click the graphic below for the historical numbers, but it shows that as of March 2025 INTEKPLUS had ₩45.0b of debt, an increase on ₩34.6b, over one year. However, because it has a cash reserve of ₩22.6b, its net debt is less, at about ₩22.4b.

A Look At INTEKPLUS' Liabilities

The latest balance sheet data shows that INTEKPLUS had liabilities of ₩81.1b due within a year, and liabilities of ₩8.39b falling due after that. On the other hand, it had cash of ₩22.6b and ₩26.5b worth of receivables due within a year. So its liabilities total ₩40.4b more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since INTEKPLUS has a market capitalization of ₩118.0b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is INTEKPLUS's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

See our latest analysis for INTEKPLUS

Over 12 months, INTEKPLUS made a loss at the EBIT level, and saw its revenue drop to ₩79b, which is a fall of 4.4%. We would much prefer see growth.

Caveat Emptor

Over the last twelve months INTEKPLUS produced an earnings before interest and tax (EBIT) loss. Indeed, it lost a very considerable ₩18b at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. For example, we would not want to see a repeat of last year's loss of ₩15b. So to be blunt we do think it is risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for INTEKPLUS you should be aware of, and 2 of them don't sit too well with us.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A064290

INTEKPLUS

Develops and supplies semiconductor packages and visual inspection equipment.

Exceptional growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026