- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A052860

Three Days Left To Buy I&C Technology Co., Ltd. (KOSDAQ:052860) Before The Ex-Dividend Date

Readers hoping to buy I&C Technology Co., Ltd. (KOSDAQ:052860) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Investors can purchase shares before the 29th of December in order to be eligible for this dividend, which will be paid on the 22nd of April.

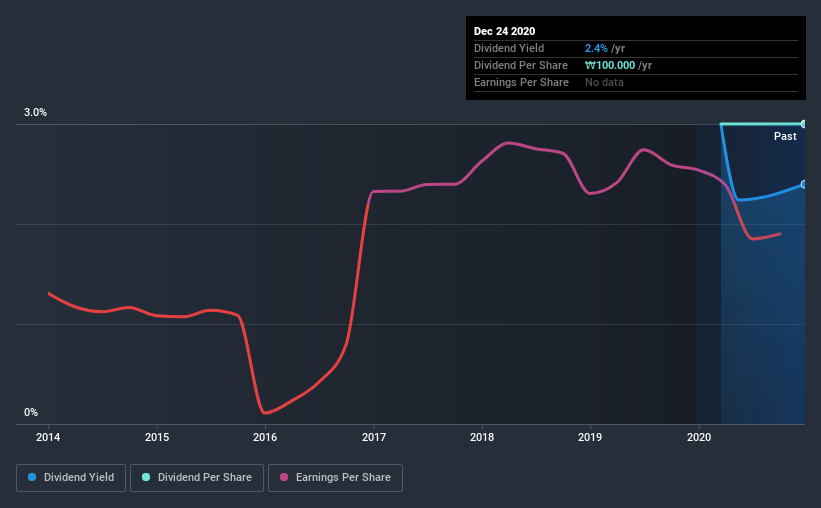

I&C Technology's next dividend payment will be ₩100.00 per share. Last year, in total, the company distributed ₩100.00 to shareholders. Based on the last year's worth of payments, I&C Technology has a trailing yield of 2.4% on the current stock price of ₩4170. If you buy this business for its dividend, you should have an idea of whether I&C Technology's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

View our latest analysis for I&C Technology

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. I&C Technology reported a loss last year, so it's not great to see that it has continued paying a dividend. Given that the company reported a loss last year, we now need to see if it generated enough free cash flow to fund the dividend. If I&C Technology didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term.

Click here to see how much of its profit I&C Technology paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. I&C Technology reported a loss last year, but at least the general trend suggests its income has been improving over the past five years. Even so, an unprofitable company whose business does not quickly recover is usually not a good candidate for dividend investors.

Given that I&C Technology has only been paying a dividend for a year, there's not much of a past history to draw insight from.

Remember, you can always get a snapshot of I&C Technology's financial health, by checking our visualisation of its financial health, here.

The Bottom Line

From a dividend perspective, should investors buy or avoid I&C Technology? We're a bit uncomfortable with it paying a dividend while being loss-making, especially given that the dividend was not well covered by free cash flow. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

With that in mind though, if the poor dividend characteristics of I&C Technology don't faze you, it's worth being mindful of the risks involved with this business. For example - I&C Technology has 3 warning signs we think you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading I&C Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A052860

I&C Technology

Develops semiconductor chips for Wi-Fi, PLC, and LTE in South Korea.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success