- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A052420

The Strong Earnings Posted By Osung Advanced Materials (KOSDAQ:052420) Are A Good Indication Of The Strength Of The Business

Even though Osung Advanced Materials Co., Ltd.'s (KOSDAQ:052420) recent earnings release was robust, the market didn't seem to notice. Investors are probably missing some underlying factors which are encouraging for the future of the company.

See our latest analysis for Osung Advanced Materials

Zooming In On Osung Advanced Materials' Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

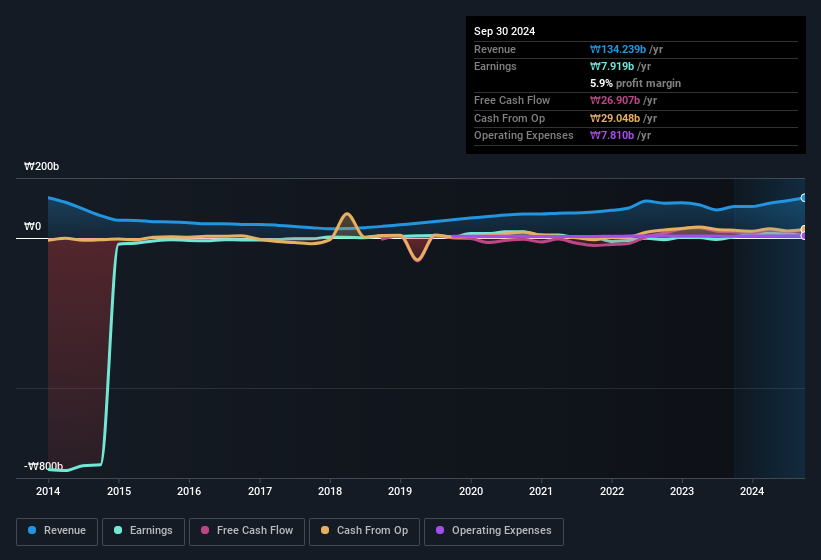

Over the twelve months to September 2024, Osung Advanced Materials recorded an accrual ratio of -0.10. That implies it has good cash conversion, and implies that its free cash flow solidly exceeded its profit last year. To wit, it produced free cash flow of ₩27b during the period, dwarfing its reported profit of ₩7.92b. Osung Advanced Materials' free cash flow improved over the last year, which is generally good to see. However, that's not the end of the story. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Osung Advanced Materials.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, Osung Advanced Materials increased the number of shares on issue by 5.1% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Osung Advanced Materials' EPS by clicking here.

A Look At The Impact Of Osung Advanced Materials' Dilution On Its Earnings Per Share (EPS)

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. On the bright side, in the last twelve months it grew profit by 88%. On the other hand, earnings per share are only up 135% over the same period. Therefore, the dilution is having a noteworthy influence on shareholder returns.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if Osung Advanced Materials can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

How Do Unusual Items Influence Profit?

Osung Advanced Materials' profit was reduced by unusual items worth ₩7.1b in the last twelve months, and this helped it produce high cash conversion, as reflected by its unusual items. In a scenario where those unusual items included non-cash charges, we'd expect to see a strong accrual ratio, which is exactly what has happened in this case. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. If Osung Advanced Materials doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Osung Advanced Materials' Profit Performance

Summing up, Osung Advanced Materials' accrual ratio and its unusual items suggest that its statutory earnings were temporarily depressed (and could bounce back), while the dilution is a negative for shareholders. Based on these factors, we think Osung Advanced Materials' earnings potential is at least as good as it seems, and maybe even better! With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For example, we've discovered 4 warning signs that you should run your eye over to get a better picture of Osung Advanced Materials.

Our examination of Osung Advanced Materials has focussed on certain factors that can make its earnings look better than they are. And it has passed with flying colours. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A052420

Osung Advanced Materials

Engages in the manufacture of plastics products in South Korea.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success