Stock Analysis

- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A041590

What Type Of Returns Would Gemvaxzio's(KOSDAQ:041590) Shareholders Have Earned If They Purchased Their SharesFive Years Ago?

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. Anyone who held Gemvaxzio Co., Ltd. (KOSDAQ:041590) for five years would be nursing their metaphorical wounds since the share price dropped 88% in that time. And it's not just long term holders hurting, because the stock is down 27% in the last year.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Gemvaxzio

Gemvaxzio wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last five years Gemvaxzio saw its revenue shrink by 19% per year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 13% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

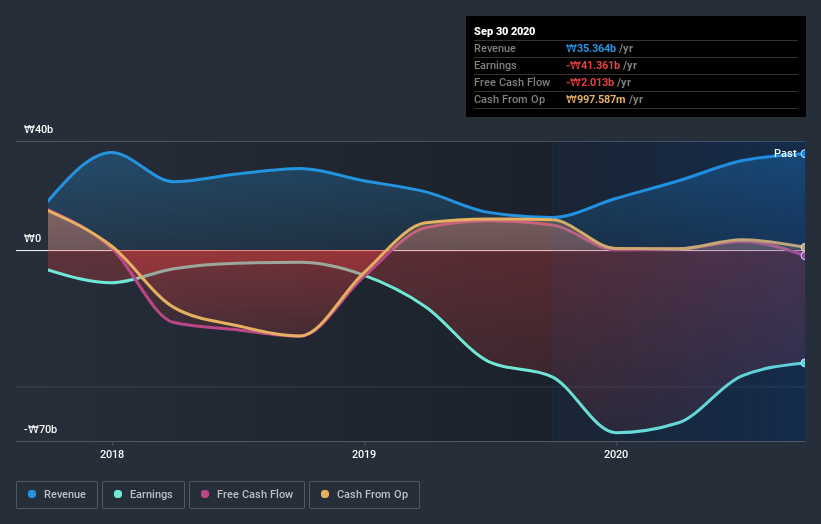

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Gemvaxzio stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Gemvaxzio had a tough year, with a total loss of 27%, against a market gain of about 53%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 13% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Gemvaxzio (1 makes us a bit uncomfortable) that you should be aware of.

But note: Gemvaxzio may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Gemvaxzio, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Flask is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A041590

Flask

Flask Co., Ltd. builds blockchain technology-based platforms and games.

Worrying balance sheet with weak fundamentals.