Stock Analysis

- South Korea

- /

- Electrical

- /

- KOSE:A298040

KRX Growth Companies With High Insider Ownership To Watch In July 2024

Reviewed by Simply Wall St

The South Korea stock market has recently demonstrated resilience, with the KOSPI index advancing in consecutive sessions and now positioned just above the 2,800-point plateau. Amidst this upward trajectory and cautious global sentiment ahead of significant U.S. economic data, investors might consider focusing on growth companies with high insider ownership as these entities often reflect a deep commitment by those most familiar with the company's potential and challenges.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| Vuno (KOSDAQ:A338220) | 19.5% | 118.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Here's a peek at a few of the choices from the screener.

JUSUNG ENGINEERINGLtd (KOSDAQ:A036930)

Simply Wall St Growth Rating: ★★★★★☆

Overview: JUSUNG ENGINEERING Co., Ltd. is a global manufacturer and seller of semiconductor, display, solar, and lighting equipment based in South Korea, with a market capitalization of approximately ₩1.82 trillion.

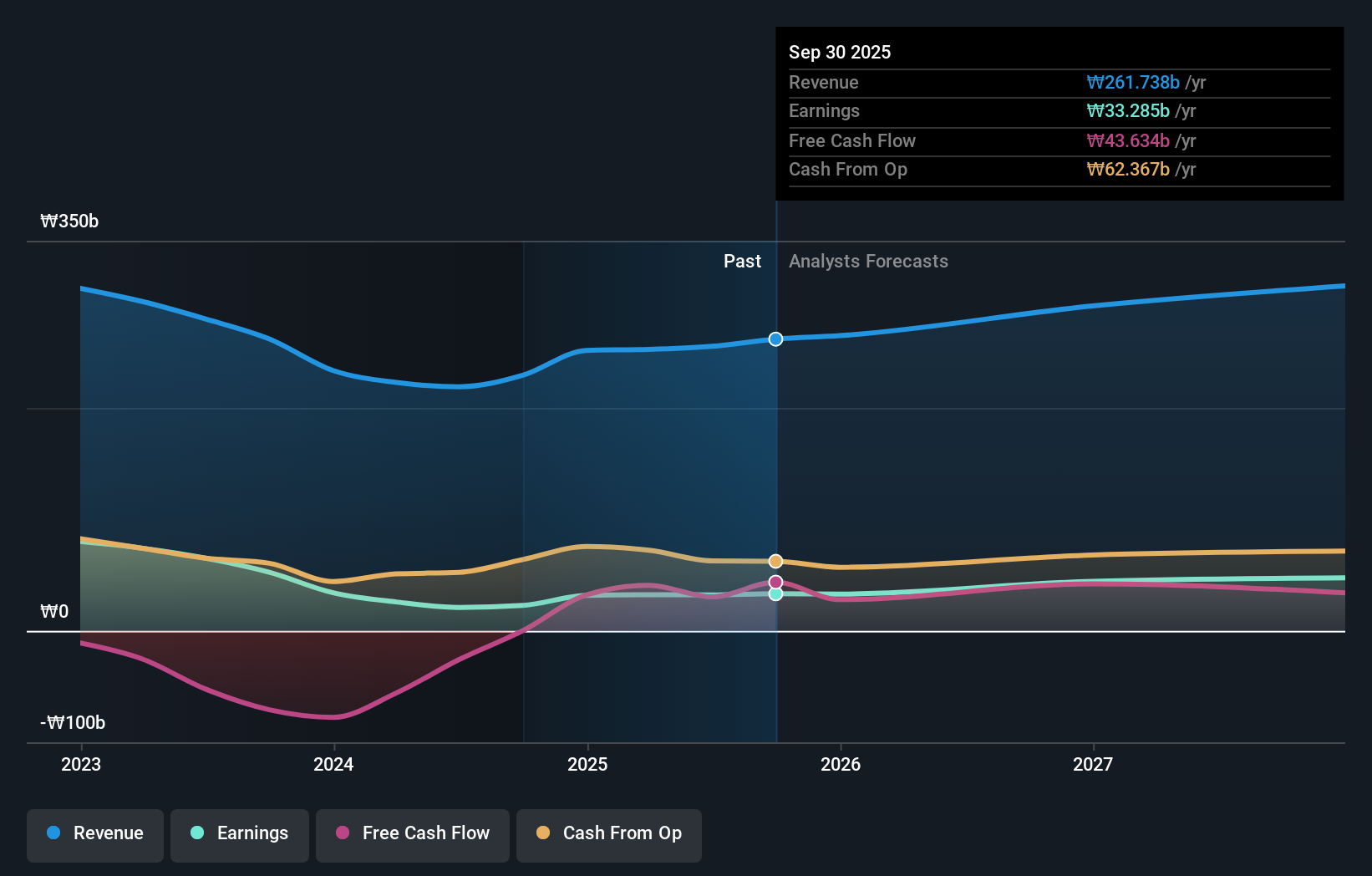

Operations: The company generates revenue primarily from its semiconductor equipment and services segment, which posted earnings of ₩272.61 billion.

Insider Ownership: 36.8%

Earnings Growth Forecast: 37.9% p.a.

JUSUNG ENGINEERING Ltd., a South Korean company, exhibits strong growth prospects with its earnings expected to increase by 37.91% annually. Despite a decline in profit margins from 23% to 14.6%, revenue is also projected to rise significantly at 24.7% per year, outpacing the domestic market's growth. Analyst consensus suggests a potential stock price increase of 22%. However, the firm's return on equity is anticipated to remain low at 17.2%, and financial results have been affected by large one-off items.

- Click to explore a detailed breakdown of our findings in JUSUNG ENGINEERINGLtd's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of JUSUNG ENGINEERINGLtd shares in the market.

Hana Materials (KOSDAQ:A166090)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hana Materials Inc. is a South Korean company that manufactures and sells silicon electrodes and rings, with a market capitalization of approximately ₩1.30 billion.

Operations: The company's primary revenue streams are derived from the manufacture and sale of silicon electrodes and rings.

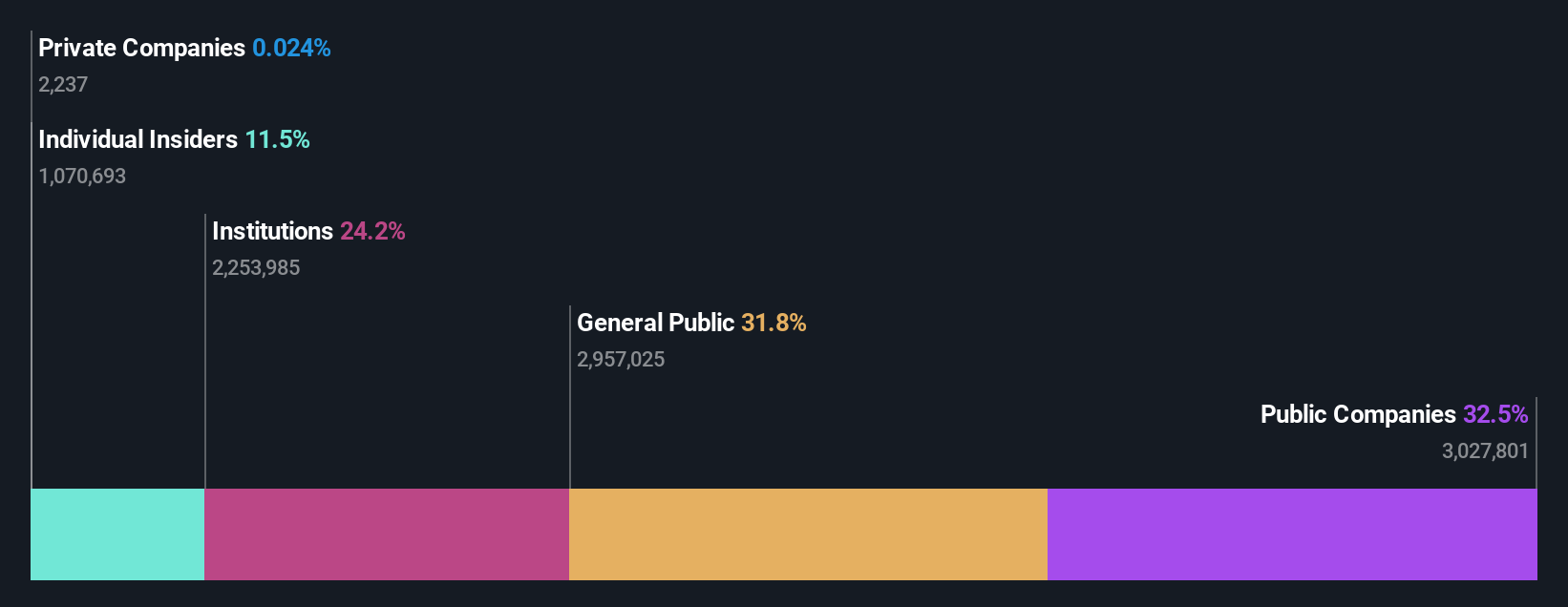

Insider Ownership: 12.5%

Earnings Growth Forecast: 40.7% p.a.

Hana Materials, a South Korean company, is poised for notable growth with earnings forecasted to surge by 40.75% annually. This growth outstrips the broader Korean market's expectations of 29.2%. Additionally, revenue is expected to expand by 20.5% each year, again exceeding market projections of 10.7%. However, there are challenges: profit margins have declined from last year's 25.1% to current 11.6%, and the forecasted return on equity in three years is relatively low at 16.3%.

- Delve into the full analysis future growth report here for a deeper understanding of Hana Materials.

- Our valuation report unveils the possibility Hana Materials' shares may be trading at a premium.

Hyosung Heavy Industries (KOSE:A298040)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hyosung Heavy Industries Corporation specializes in manufacturing and selling heavy electrical equipment both domestically in South Korea and internationally, with a market capitalization of approximately ₩2.97 trillion.

Operations: The company generates its revenue from the production and sale of heavy electrical equipment across domestic and international markets.

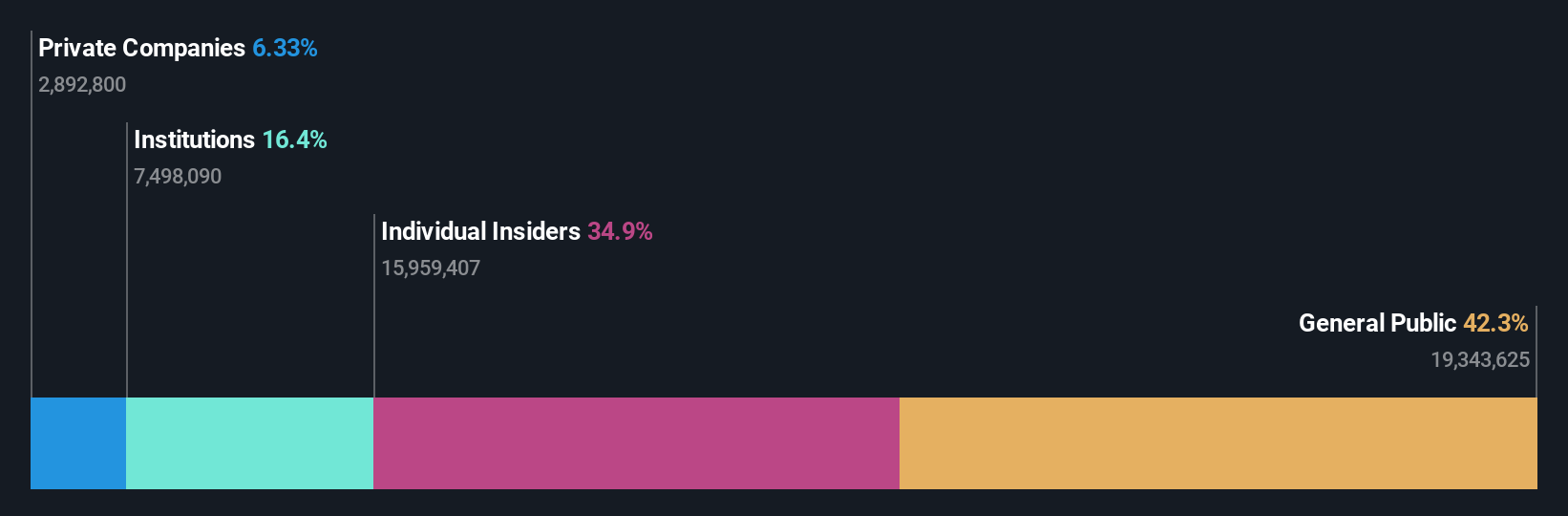

Insider Ownership: 17.9%

Earnings Growth Forecast: 32.3% p.a.

Hyosung Heavy Industries has demonstrated robust earnings growth, up by a very large margin last year, with expectations to grow earnings by 32.26% annually over the next three years—outpacing the South Korean market forecast of 29.2%. Revenue is also expected to rise faster than the market at 12% annually. Despite trading at a significant discount to its estimated fair value, it faces challenges such as high debt levels and low forecasted return on equity at 19.8%. The stock's price has been highly volatile recently.

- Dive into the specifics of Hyosung Heavy Industries here with our thorough growth forecast report.

- Our valuation report unveils the possibility Hyosung Heavy Industries' shares may be trading at a discount.

Next Steps

- Delve into our full catalog of 87 Fast Growing KRX Companies With High Insider Ownership here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Hyosung Heavy Industries is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A298040

Hyosung Heavy Industries

Manufactures and sells heavy electrical equipment in South Korea and internationally.

Undervalued with solid track record.