- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A041520

Does e-LITECOM (KOSDAQ:041520) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies e-LITECOM CO., Ltd. (KOSDAQ:041520) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for e-LITECOM

What Is e-LITECOM's Net Debt?

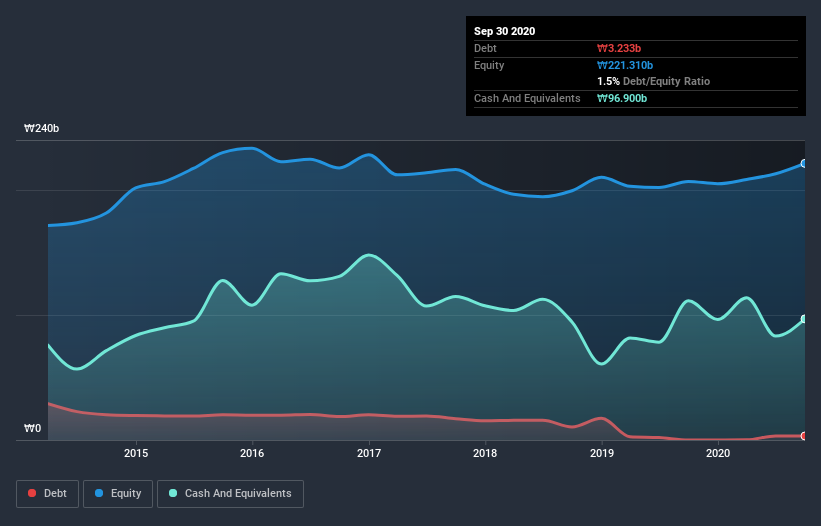

As you can see below, at the end of September 2020, e-LITECOM had ₩3.23b of debt, up from none a year ago. Click the image for more detail. However, its balance sheet shows it holds ₩96.9b in cash, so it actually has ₩93.7b net cash.

How Strong Is e-LITECOM's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that e-LITECOM had liabilities of ₩57.9b due within 12 months and liabilities of ₩13.4b due beyond that. On the other hand, it had cash of ₩96.9b and ₩77.7b worth of receivables due within a year. So it actually has ₩103.3b more liquid assets than total liabilities.

This excess liquidity is a great indication that e-LITECOM's balance sheet is almost as strong as Fort Knox. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Simply put, the fact that e-LITECOM has more cash than debt is arguably a good indication that it can manage its debt safely.

Better yet, e-LITECOM grew its EBIT by 176% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since e-LITECOM will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While e-LITECOM has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last two years, e-LITECOM actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that e-LITECOM has net cash of ₩93.7b, as well as more liquid assets than liabilities. And it impressed us with free cash flow of ₩15b, being 310% of its EBIT. The bottom line is that e-LITECOM's use of debt is absolutely fine. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for e-LITECOM (1 is a bit unpleasant!) that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade e-LITECOM, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ELCLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A041520

ELCLtd

Engages in the manufacture, development, and sale of semiconductor components worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026