- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A039030

The three-year decline in earnings might be taking its toll on EO Technics (KOSDAQ:039030) shareholders as stock falls 3.6% over the past week

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you buy shares in a really great company, you can more than double your money. For instance the EO Technics Co., Ltd. (KOSDAQ:039030) share price is 166% higher than it was three years ago. How nice for those who held the stock! It's also good to see the share price up 77% over the last quarter.

Although EO Technics has shed ₩97b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years of share price growth, EO Technics actually saw its earnings per share (EPS) drop 12% per year.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The modest 0.2% dividend yield is unlikely to be propping up the share price. You can only imagine how long term shareholders feel about the declining revenue trend (slipping at 14% per year). What's clear is that historic earnings and revenue aren't matching up with the share price action, very well. So you might have to dig deeper to get a grasp of the situation

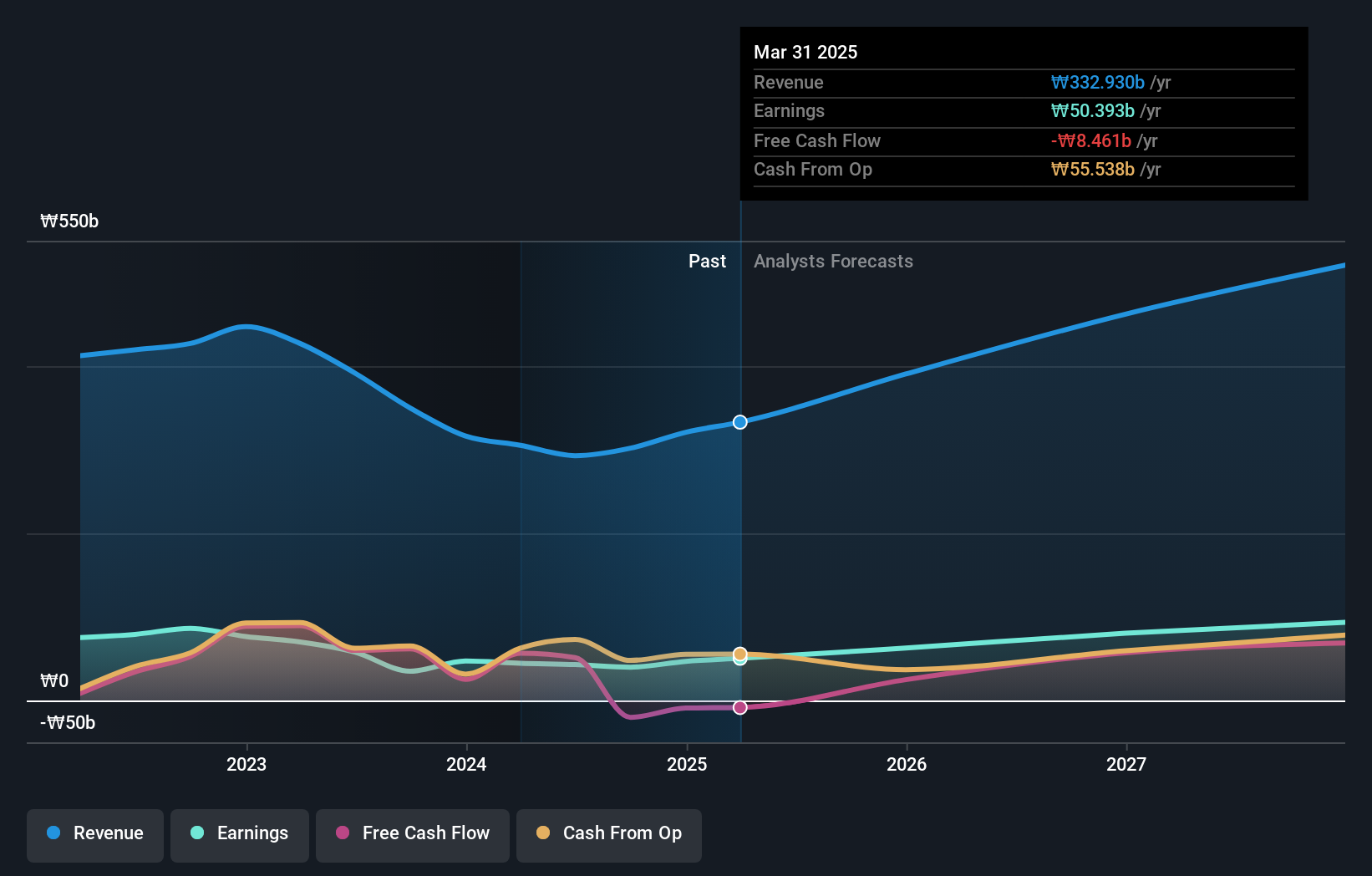

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that EO Technics has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on EO Technics

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for EO Technics the TSR over the last 3 years was 172%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

EO Technics provided a TSR of 9.1% over the last twelve months. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 14% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Before forming an opinion on EO Technics you might want to consider these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if EO Technics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A039030

EO Technics

Manufactures and supplies laser processing equipment worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives