- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A039030

Subdued Growth No Barrier To EO Technics Co., Ltd. (KOSDAQ:039030) With Shares Advancing 27%

Despite an already strong run, EO Technics Co., Ltd. (KOSDAQ:039030) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 203% following the latest surge, making investors sit up and take notice.

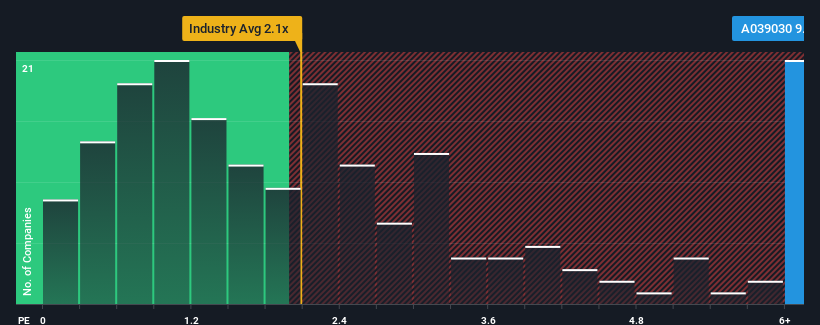

Following the firm bounce in price, you could be forgiven for thinking EO Technics is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.9x, considering almost half the companies in Korea's Semiconductor industry have P/S ratios below 2.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for EO Technics

How Has EO Technics Performed Recently?

With revenue that's retreating more than the industry's average of late, EO Technics has been very sluggish. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think EO Technics' future stacks up against the industry? In that case, our free report is a great place to start.How Is EO Technics' Revenue Growth Trending?

In order to justify its P/S ratio, EO Technics would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 2.7% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 27% per annum as estimated by the five analysts watching the company. With the industry predicted to deliver 32% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that EO Technics' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

The strong share price surge has lead to EO Technics' P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've concluded that EO Technics currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

You should always think about risks. Case in point, we've spotted 3 warning signs for EO Technics you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if EO Technics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A039030

EO Technics

Manufactures and supplies laser processing equipment worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives