- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A039030

EO Technics And Two Other KRX Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The South Korean market has shown robust performance, rising 2.2% in the last week and achieving an 11% increase over the past year, with earnings projected to grow by 30% annually. In such a thriving environment, stocks like EO Technics that combine high insider ownership with significant growth potential are particularly noteworthy for investors seeking opportunities aligned with strong market trends and solid internal confidence.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 27.9% | 48.1% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.6% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| Vuno (KOSDAQ:A338220) | 19.5% | 105% |

| HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Underneath we present a selection of stocks filtered out by our screen.

EO Technics (KOSDAQ:A039030)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EO Technics Co., Ltd. is a global manufacturer and supplier of laser processing equipment, with a market capitalization of approximately ₩2.39 billion.

Operations: The company's revenue is derived from the manufacture and supply of laser processing equipment across international markets.

Insider Ownership: 30.7%

Earnings Growth Forecast: 47% p.a.

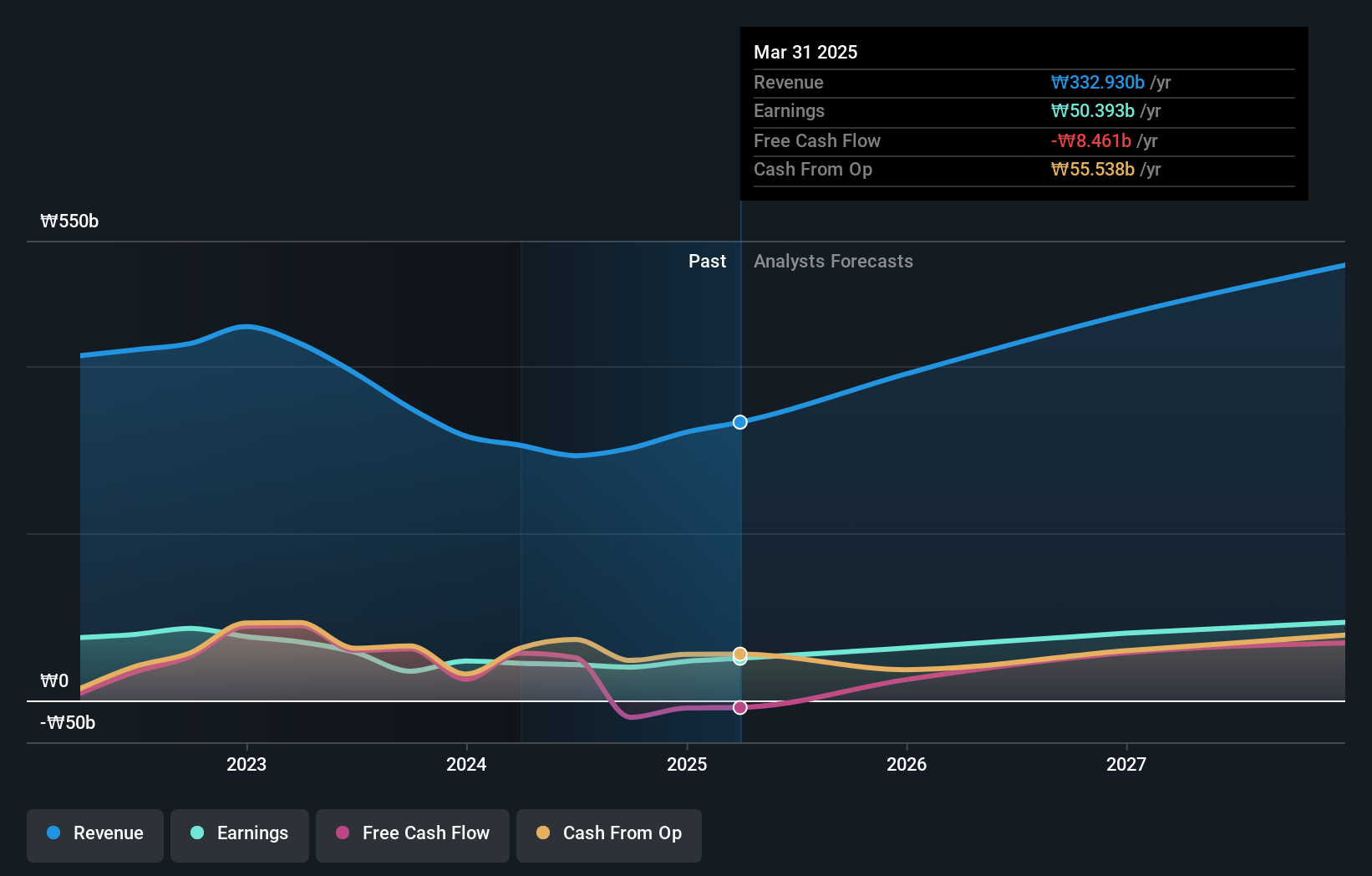

EO Technics, a South Korean company, showcases robust growth prospects with expected earnings and revenue increases outpacing the market at 47% and 19.9% per year respectively. However, it grapples with challenges such as highly volatile share prices and declining profit margins—falling from 16.4% to 11%. Despite these hurdles, the firm benefits from high insider ownership but lacks recent insider trading data to confirm ongoing confidence among insiders.

- Take a closer look at EO Technics' potential here in our earnings growth report.

- Our valuation report unveils the possibility EO Technics' shares may be trading at a premium.

ST PharmLtd (KOSDAQ:A237690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ST Pharm Co., Ltd. specializes in custom manufacturing services for active pharmaceutical ingredients and intermediates, operating both domestically in South Korea and internationally, with a market capitalization of approximately ₩1.79 billion.

Operations: The company generates revenue primarily through its Raw Drug Manufacturing segment, which brought in ₩251.86 billion, and its Clinical Trial Site Consignment Research Institute, contributing ₩34.40 billion.

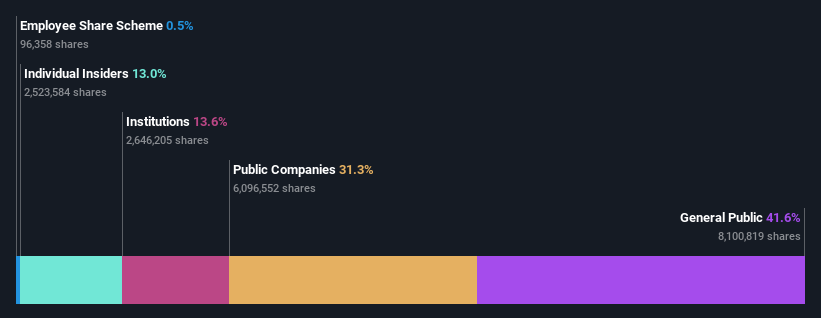

Insider Ownership: 13%

Earnings Growth Forecast: 34.2% p.a.

ST PharmLtd, trading at a significant discount to its fair value, is poised for robust growth with earnings expected to expand by 34.16% annually. Although the company's revenue growth of 16.5% per year lags behind some peers, it still outpaces the broader South Korean market. Challenges include share dilution over the past year and large one-off items impacting earnings quality. Recent activities include a special shareholders meeting addressing governance enhancements and leadership appointments, signaling active management engagement.

- Navigate through the intricacies of ST PharmLtd with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility ST PharmLtd's shares may be trading at a discount.

Doosan (KOSE:A000150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across various regions including South Korea, the United States, Asia, the Middle East, and Europe with a market capitalization of approximately ₩3.40 billion.

Operations: The company's revenue is derived from three primary segments: heavy industry, machinery manufacturing, and apartment construction.

Insider Ownership: 38.9%

Earnings Growth Forecast: 72.9% p.a.

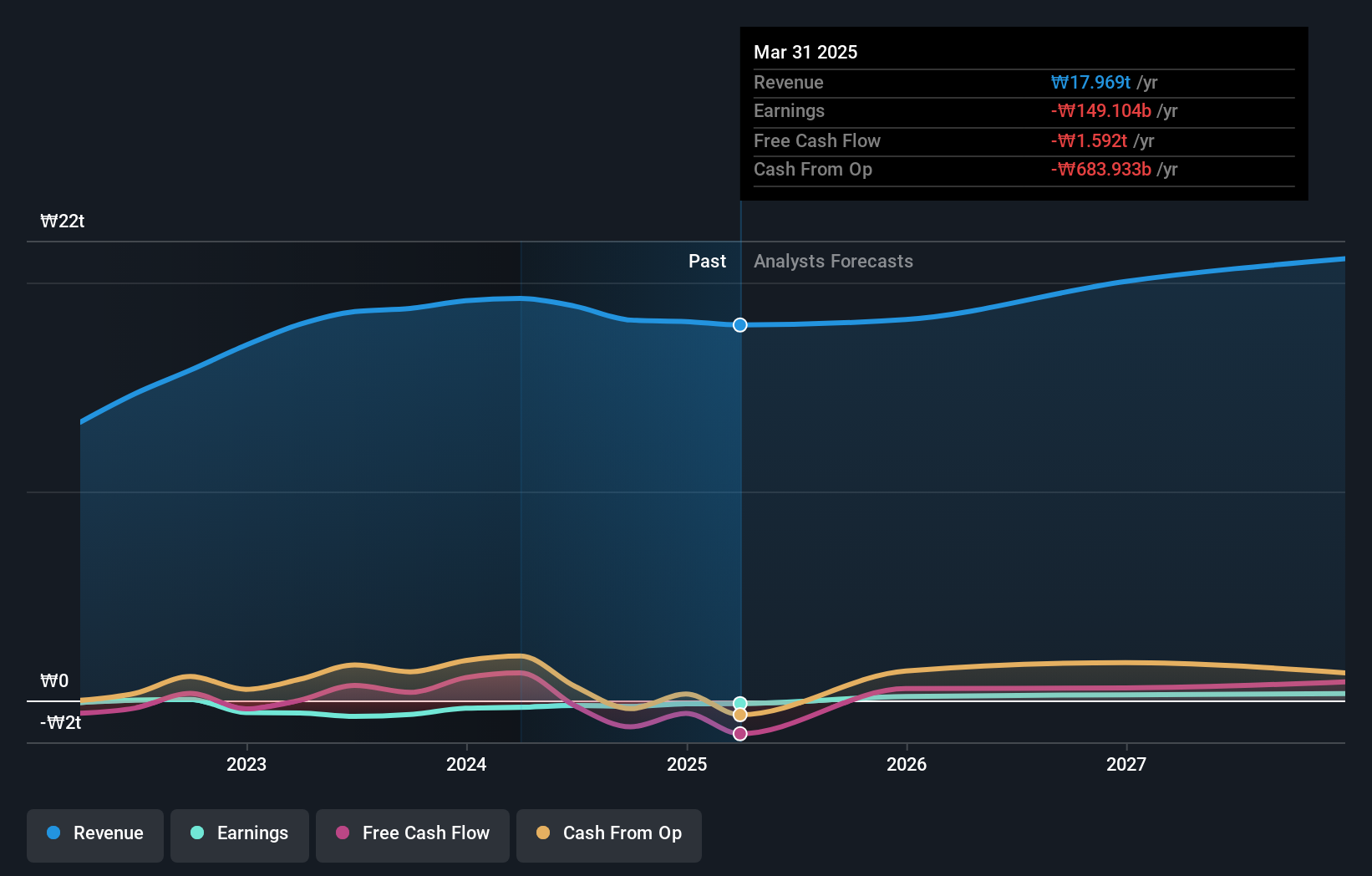

Doosan Corporation, currently trading at 57.3% below its estimated fair value, is on a path to profitability within the next three years, with expected earnings growth of 72.89% annually. Despite its revenue growth forecast of 3.6% per year trailing the South Korean market average of 10.7%, the company has demonstrated a strong turnaround in Q1 2024, reporting a net income of ₩4.98 billion against a net loss in the previous year and achieving substantial year-over-year sales increase to ₩180.97 billion from ₩169.05 billion.

- Click here to discover the nuances of Doosan with our detailed analytical future growth report.

- Our expertly prepared valuation report Doosan implies its share price may be lower than expected.

Turning Ideas Into Actions

- Delve into our full catalog of 84 Fast Growing KRX Companies With High Insider Ownership here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if EO Technics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A039030

EO Technics

Manufactures and supplies laser processing equipment worldwide.

Flawless balance sheet with high growth potential.