- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A084370

3 Growth Stocks With High Insider Ownership And 22% Revenue Growth

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of inflation and interest rate expectations, U.S. stock indexes are climbing toward record highs, with growth stocks leading the charge over value shares. In this environment, identifying growth companies with high insider ownership can be particularly appealing as they often demonstrate strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 118.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

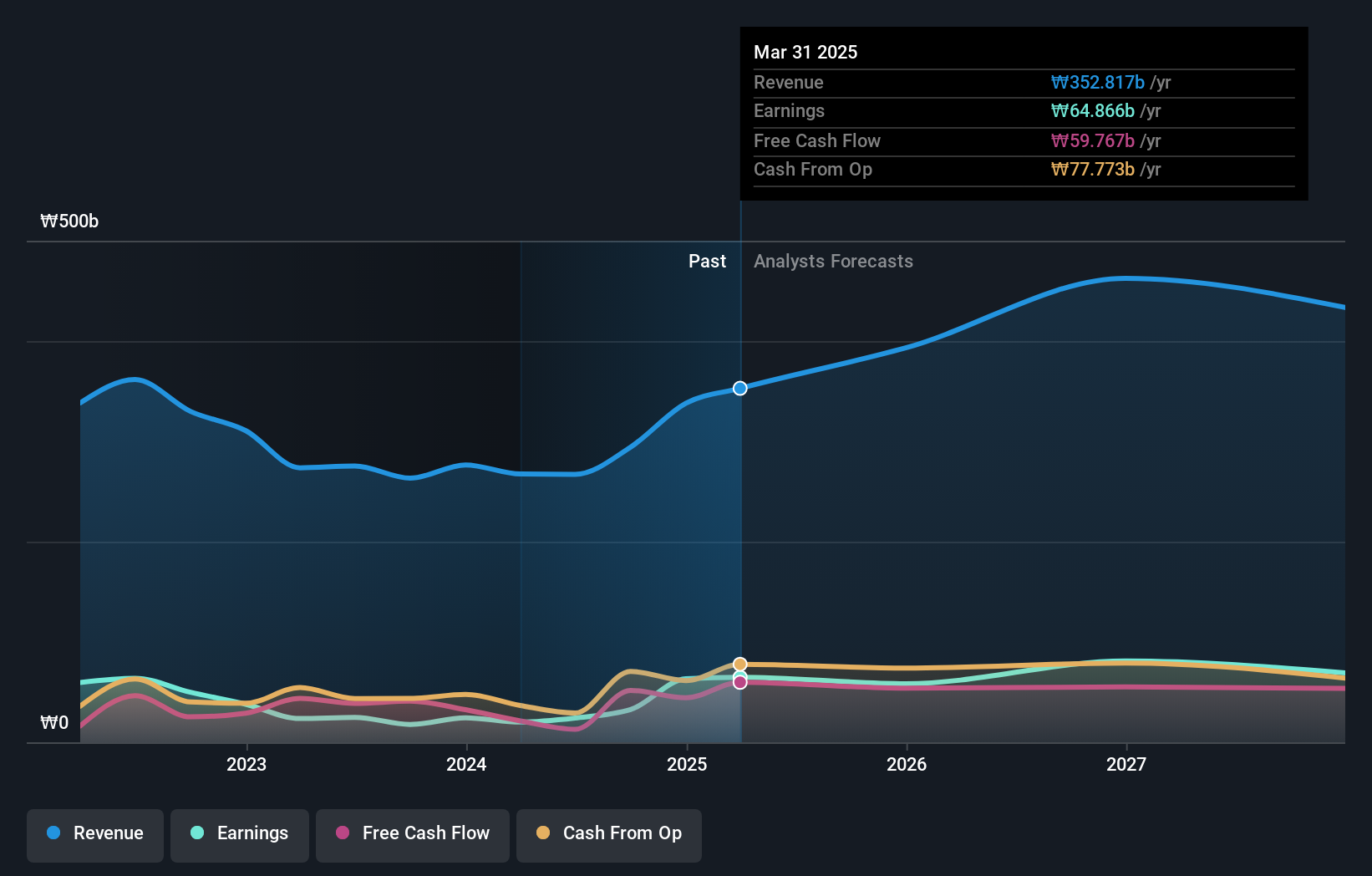

EO Technics (KOSDAQ:A039030)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EO Technics Co., Ltd. manufactures and supplies laser processing equipment globally, with a market cap of ₩1.82 trillion.

Operations: The Semiconductor Machine Division generates ₩301.92 billion in revenue.

Insider Ownership: 30.7%

Revenue Growth Forecast: 22.6% p.a.

EO Technics is positioned for substantial growth, with earnings projected to increase 46.9% annually, outpacing the KR market's 26% growth rate. Revenue is expected to rise by 22.6% per year, surpassing the market average of 9%. Despite these strong forecasts, the company's return on equity is anticipated to be relatively low at 12.6% in three years. Recent share price volatility and lack of insider trading activity may warrant cautious consideration by investors.

- Click here and access our complete growth analysis report to understand the dynamics of EO Technics.

- Our valuation report here indicates EO Technics may be overvalued.

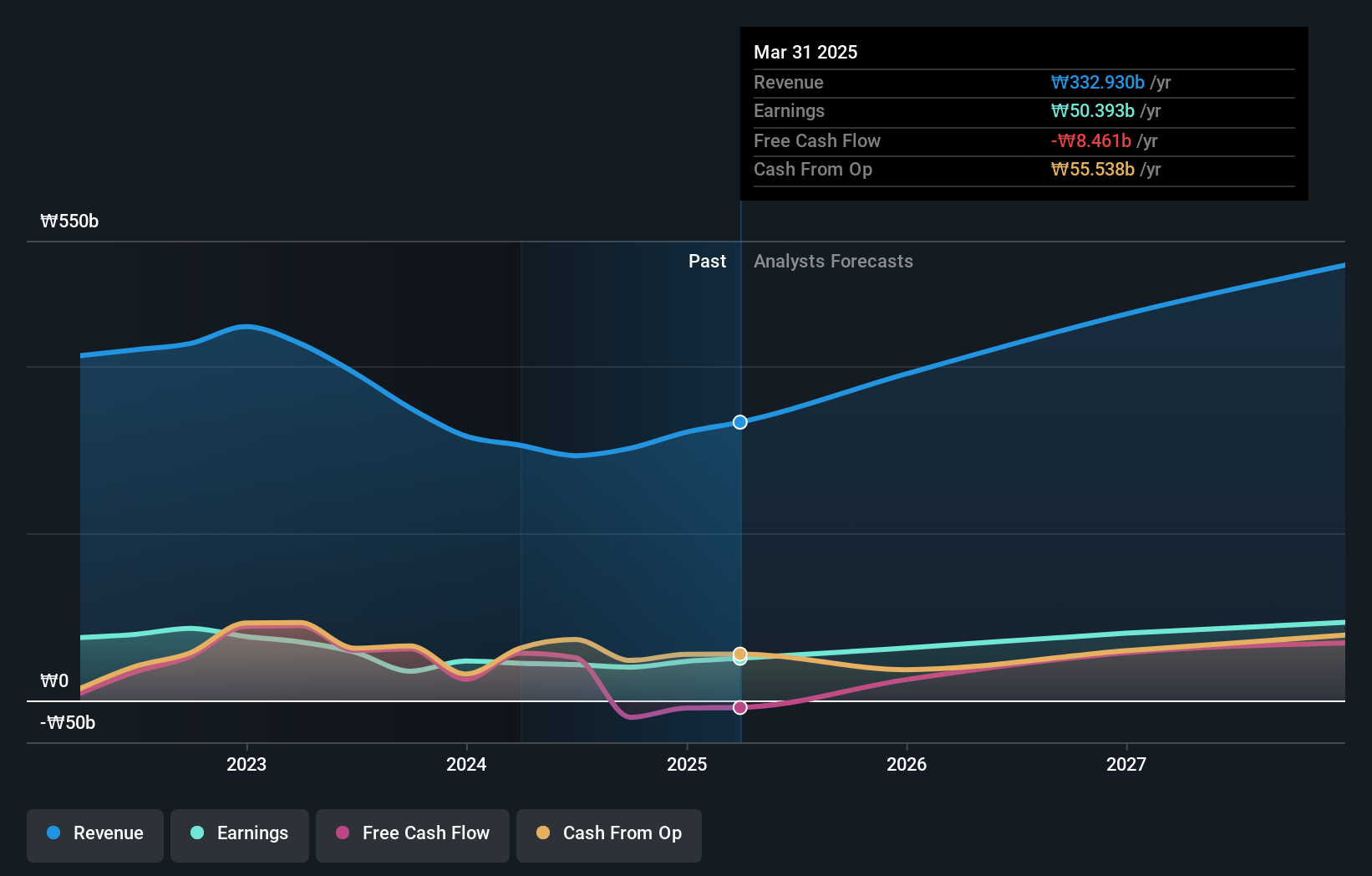

Eugene TechnologyLtd (KOSDAQ:A084370)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eugene Technology Co., Ltd. manufactures and sells semiconductor equipment and parts in South Korea and internationally, with a market cap of ₩1.02 trillion.

Operations: The company's revenue is primarily derived from its semiconductor equipment segment, which accounts for ₩282.49 billion, and industrial gases for semiconductors, contributing ₩11.72 billion.

Insider Ownership: 37.6%

Revenue Growth Forecast: 20.4% p.a.

Eugene Technology Ltd. is poised for significant growth, with earnings expected to rise 35.1% annually, surpassing the KR market's 26%. Revenue growth is projected at 20.4% per year, outstripping the market average of 9%. Despite these robust forecasts, return on equity remains modest at a forecasted 15.6% in three years. Recent announcements include a dividend increase to KRW 230 per share but lack recent insider trading activity may require investor attention.

- Navigate through the intricacies of Eugene TechnologyLtd with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Eugene TechnologyLtd's share price might be too optimistic.

Suzhou TZTEK Technology (SHSE:688003)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou TZTEK Technology Co., Ltd specializes in the design, development, assembly, and debugging of industrial vision equipment in China with a market cap of CN¥9.96 billion.

Operations: Revenue segments for Suzhou TZTEK Technology Co., Ltd include the design, development, assembly, and debugging of industrial vision equipment in China.

Insider Ownership: 15.3%

Revenue Growth Forecast: 22.3% p.a.

Suzhou TZTEK Technology's earnings are projected to grow 35.42% annually, outpacing the CN market's 25% growth, with revenue expected to rise 22.3% per year. Despite this strong growth outlook, its return on equity is forecasted at a modest 14.5%. The company's recent share buyback completed with the repurchase of 1,213,000 shares for CNY 30.03 million but showed no insider trading activity in the past three months.

- Take a closer look at Suzhou TZTEK Technology's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Suzhou TZTEK Technology is trading beyond its estimated value.

Summing It All Up

- Click here to access our complete index of 1455 Fast Growing Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Eugene TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A084370

Eugene TechnologyLtd

Engages in the manufacture and sale of semiconductor equipment and parts in South Korea and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives