- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A036540

Is SFA Semicon's (KOSDAQ:036540) 144% Share Price Increase Well Justified?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. For instance, the price of SFA Semicon Co., Ltd. (KOSDAQ:036540) stock is up an impressive 144% over the last five years. It's also good to see the share price up 13% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 20% in 90 days).

See our latest analysis for SFA Semicon

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

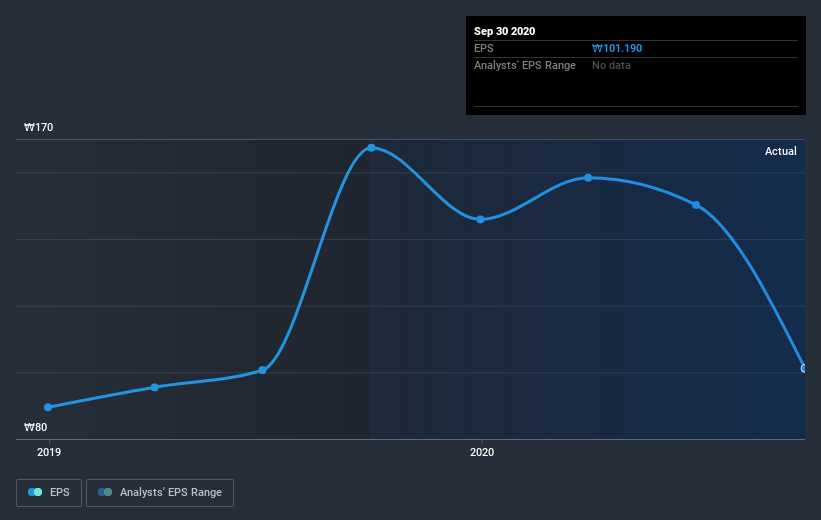

During the last half decade, SFA Semicon became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. Indeed, the SFA Semicon share price has gained 141% in three years. Meanwhile, EPS is up 25% per year. Notably, the EPS growth has been slower than the annualised share price gain of 34% over three years. So it's fair to assume the market has a higher opinion of the business than it did three years ago.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into SFA Semicon's key metrics by checking this interactive graph of SFA Semicon's earnings, revenue and cash flow.

A Different Perspective

SFA Semicon provided a TSR of 34% over the year. That's fairly close to the broader market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 20%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that SFA Semicon is showing 3 warning signs in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade SFA Semicon, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A036540

Excellent balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives