- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A031980

Discovering Hidden Gems in South Korea This August 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen 1.9%, and over the past year, it has climbed 3.8%, with earnings forecast to grow by 28% annually. In this favorable environment, identifying stocks with strong growth potential and solid fundamentals can lead to uncovering hidden gems in South Korea's vibrant market this August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Ratings | NA | 1.74% | 0.87% | ★★★★★★ |

| Samyang | 47.03% | 6.61% | 22.07% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 2.58% | 14.14% | ★★★★★★ |

| ASIA Holdings | 34.13% | 8.28% | 15.67% | ★★★★★★ |

| Kyung Dong Navien | 26.97% | 11.54% | 19.49% | ★★★★★★ |

| SELVAS Healthcare | 13.58% | 10.16% | 77.14% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| Hansae Yes24 Holdings | 97.82% | 2.74% | 18.89% | ★★★★★☆ |

| KG Chemical | 43.62% | 33.46% | 8.39% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.38% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

PSK HOLDINGS (KOSDAQ:A031980)

Simply Wall St Value Rating: ★★★★★☆

Overview: PSK HOLDINGS Inc. manufactures and sells semiconductor manufacturing and flat panel display equipment worldwide, with a market cap of ₩1.16 billion.

Operations: PSK HOLDINGS generates revenue primarily from its semiconductor manufacturing equipment segment, which reported ₩117.90 billion.

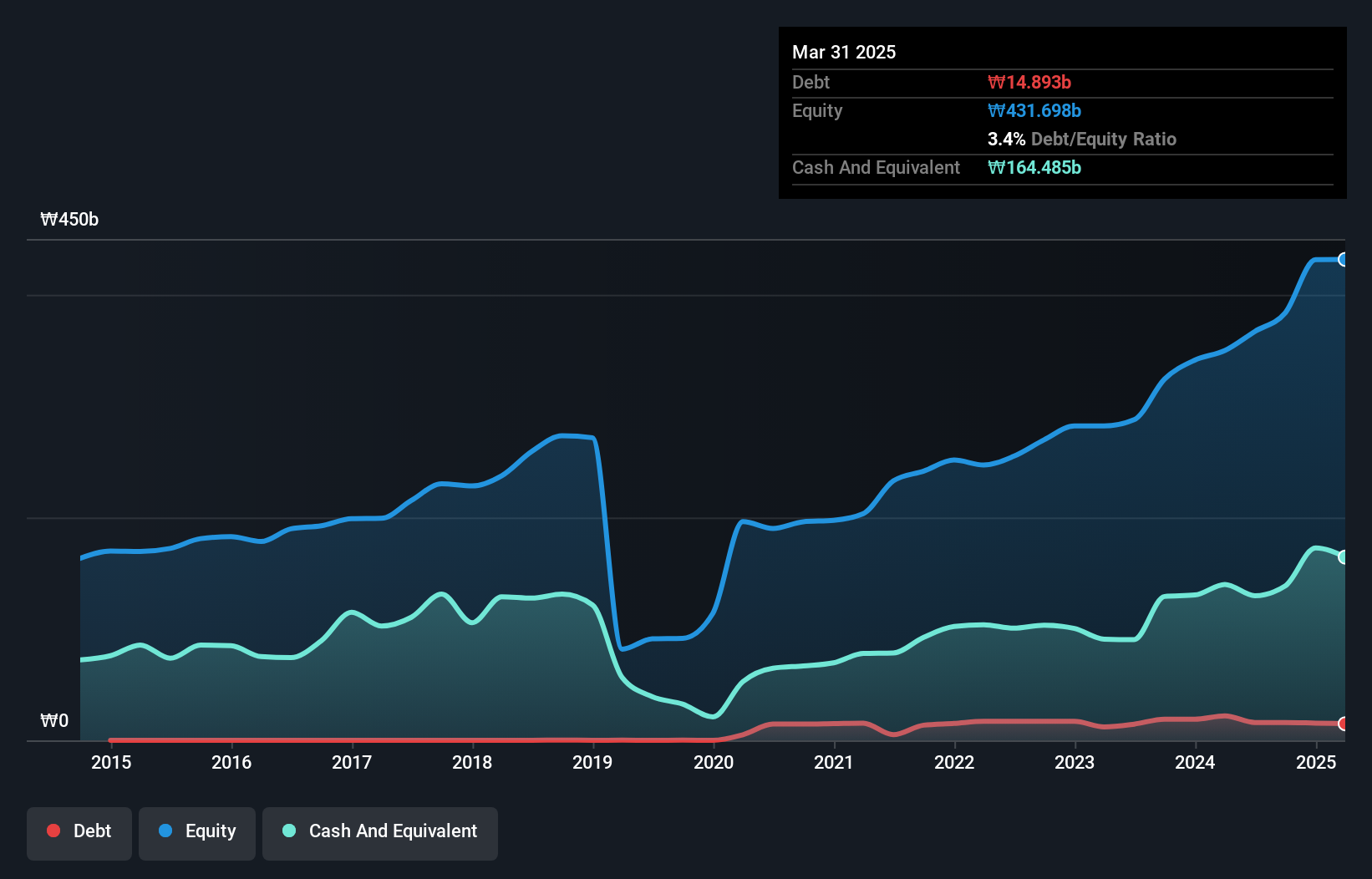

PSK Holdings, a small cap entity in South Korea, has demonstrated solid financial metrics despite recent volatility. The company's earnings grew by 16.4% over the past year, surpassing the semiconductor industry's -18.2%. A notable one-off gain of ₩18.9B impacted its last 12 months' results to March 31, 2024. Additionally, PSK's debt to equity ratio rose from 0.2% to 6.3% over five years but remains manageable with more cash than total debt on hand.

- Unlock comprehensive insights into our analysis of PSK HOLDINGS stock in this health report.

Explore historical data to track PSK HOLDINGS' performance over time in our Past section.

T&L (KOSDAQ:A340570)

Simply Wall St Value Rating: ★★★★★★

Overview: T&L Co., Ltd. manufactures and sells medical and polymer material products in South Korea, with a market cap of ₩610.24 billion.

Operations: T&L Co., Ltd. generates revenue primarily from its medical products segment, which reported ₩113.23 billion in sales. The company's market cap stands at ₩610.24 billion.

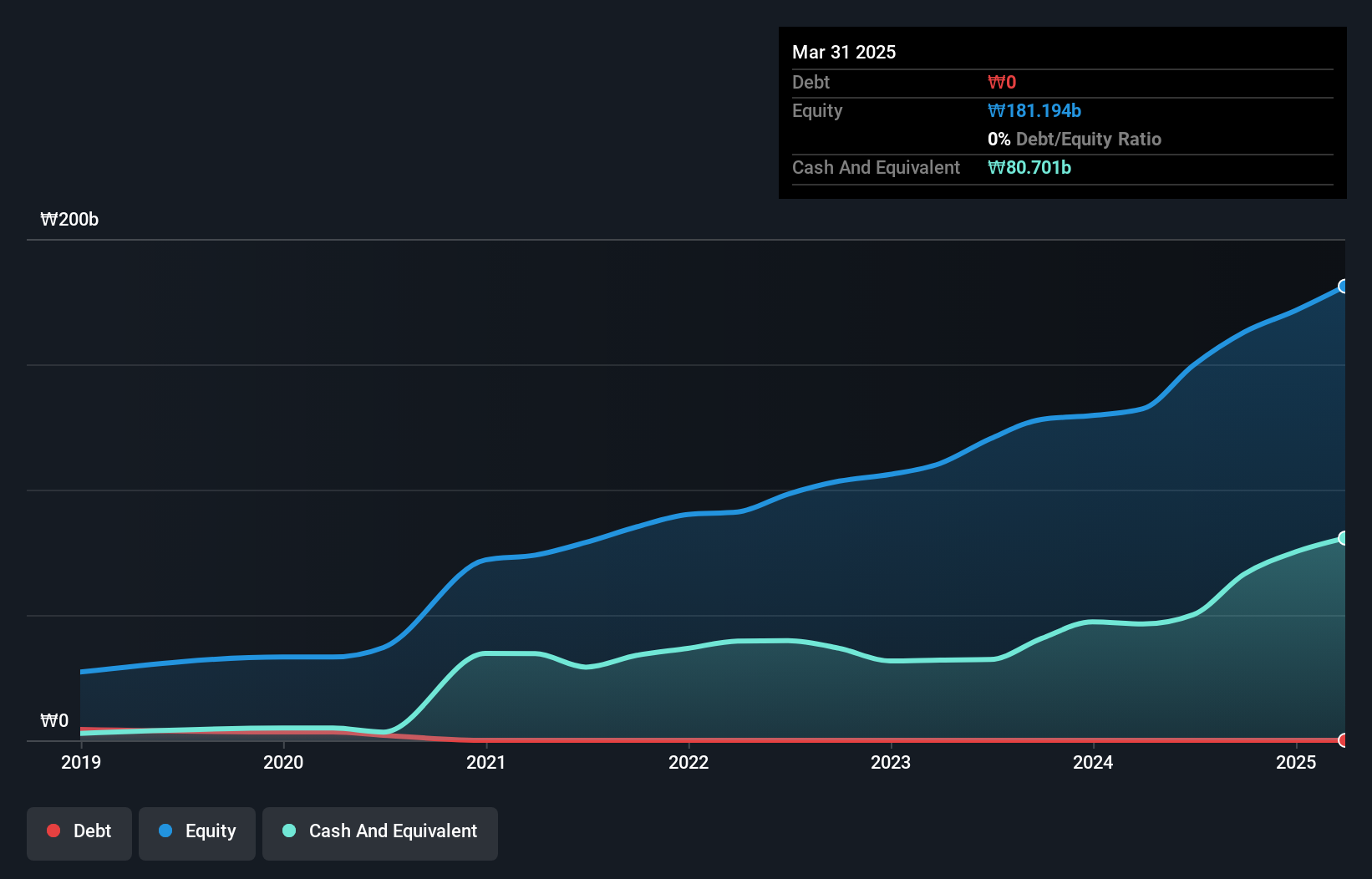

T&L has shown impressive growth, with earnings increasing by 7.7% over the past year, outpacing the Medical Equipment industry's 3.1%. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 14.2%. Additionally, T&L boasts high-quality earnings and forecasts suggest a robust annual growth rate of 34.49%. This combination of strong financial health and promising future projections makes it a noteworthy player in South Korea's market.

- Click here and access our complete health analysis report to understand the dynamics of T&L.

Gain insights into T&L's past trends and performance with our Past report.

Sebang Global Battery (KOSE:A004490)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sebang Global Battery Co., Ltd., along with its subsidiaries, manufactures and sells lead acid batteries in South Korea and internationally, with a market cap of ₩1.40 trillion.

Operations: Sebang Global Battery generates revenue primarily from the manufacture and sale of automotive and industrial storage batteries, totaling ₩1.77 billion.

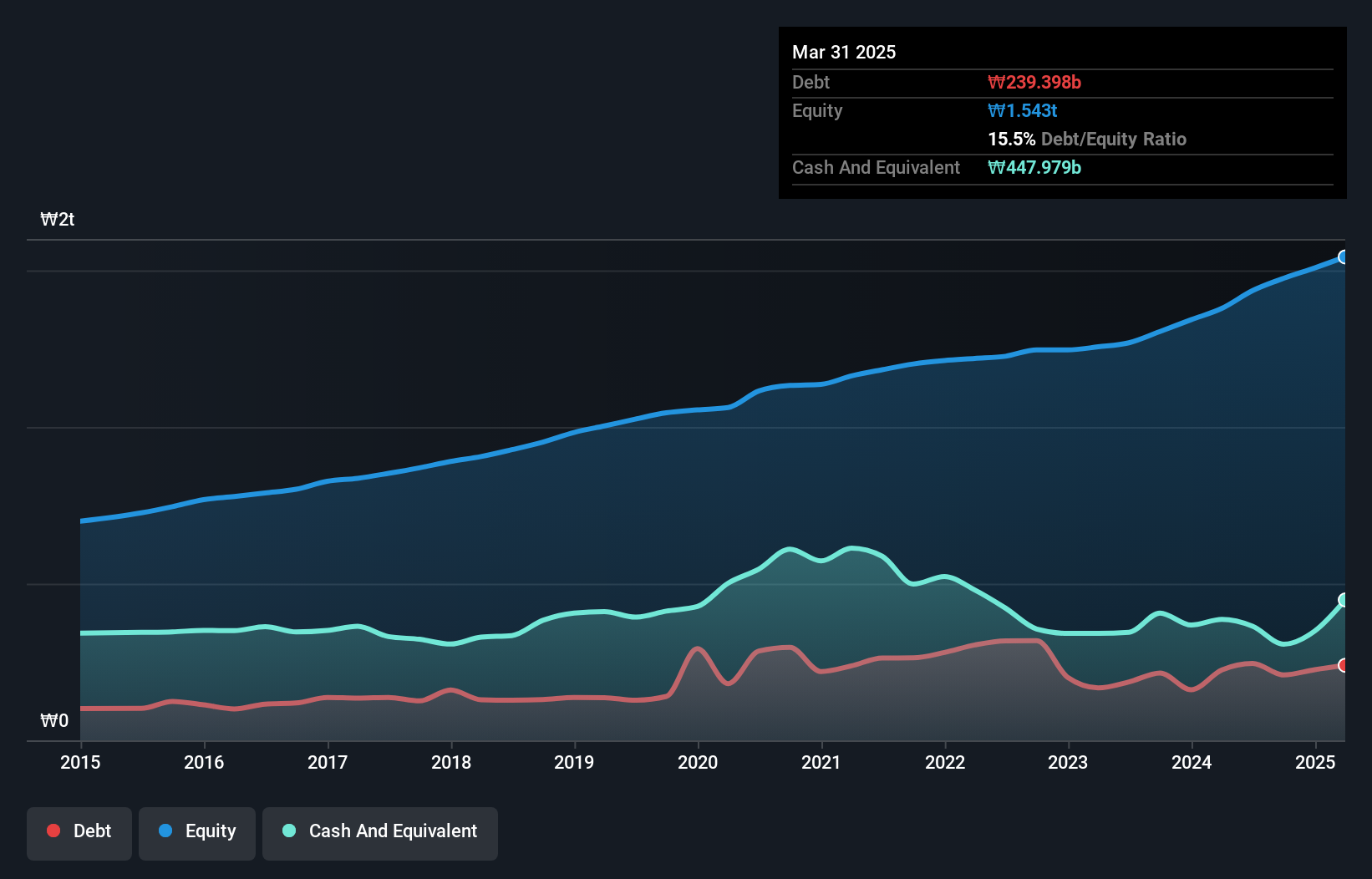

Sebang Global Battery, a small cap in South Korea, has shown impressive earnings growth of 245.4% over the past year, significantly outpacing the Auto Components industry's 15.4%. Despite a slight increase in its debt to equity ratio from 13.6% to 16.3% over five years, the company holds more cash than total debt, indicating solid financial health. Additionally, Sebang trades at 22.1% below its estimated fair value, suggesting potential for future appreciation based on current metrics and market conditions.

- Delve into the full analysis health report here for a deeper understanding of Sebang Global Battery.

Taking Advantage

- Embark on your investment journey to our 202 KRX Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A031980

PSK HOLDINGS

Manufactures and sells semiconductor manufacturing and flat panel display equipment worldwide.

Excellent balance sheet with reasonable growth potential.