- South Korea

- /

- Specialty Stores

- /

- KOSE:A008770

Would Hotel ShillaLtd (KRX:008770) Be Better Off With Less Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Hotel Shilla Co.,Ltd (KRX:008770) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Hotel ShillaLtd

What Is Hotel ShillaLtd's Debt?

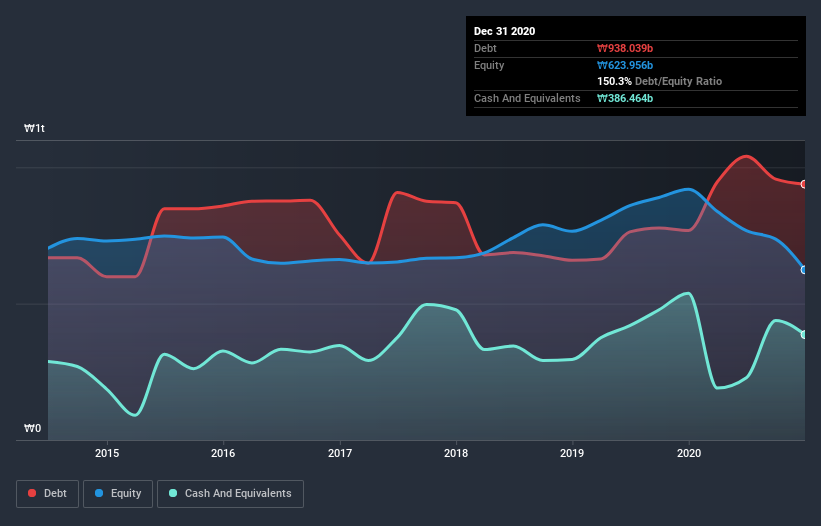

As you can see below, at the end of December 2020, Hotel ShillaLtd had ₩938.0b of debt, up from ₩768.5b a year ago. Click the image for more detail. On the flip side, it has ₩386.5b in cash leading to net debt of about ₩551.6b.

How Strong Is Hotel ShillaLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Hotel ShillaLtd had liabilities of ₩775.3b due within 12 months and liabilities of ₩1.49t due beyond that. Offsetting these obligations, it had cash of ₩386.5b as well as receivables valued at ₩137.0b due within 12 months. So its liabilities total ₩1.75t more than the combination of its cash and short-term receivables.

Hotel ShillaLtd has a market capitalization of ₩3.21t, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Hotel ShillaLtd's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Hotel ShillaLtd made a loss at the EBIT level, and saw its revenue drop to ₩3.2t, which is a fall of 44%. That makes us nervous, to say the least.

Caveat Emptor

Not only did Hotel ShillaLtd's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). To be specific the EBIT loss came in at ₩185b. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled ₩99b in negative free cash flow over the last twelve months. So suffice it to say we do consider the stock to be risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Hotel ShillaLtd that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Hotel ShillaLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hotel ShillaLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A008770

Hotel ShillaLtd

Operates as a hospitality company in South Korea and internationally.

Good value with moderate growth potential.

Market Insights

Community Narratives