- South Korea

- /

- General Merchandise and Department Stores

- /

- KOSE:A004170

Investors Appear Satisfied With SHINSEGAE Inc.'s (KRX:004170) Prospects As Shares Rocket 27%

Despite an already strong run, SHINSEGAE Inc. (KRX:004170) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days bring the annual gain to a very sharp 68%.

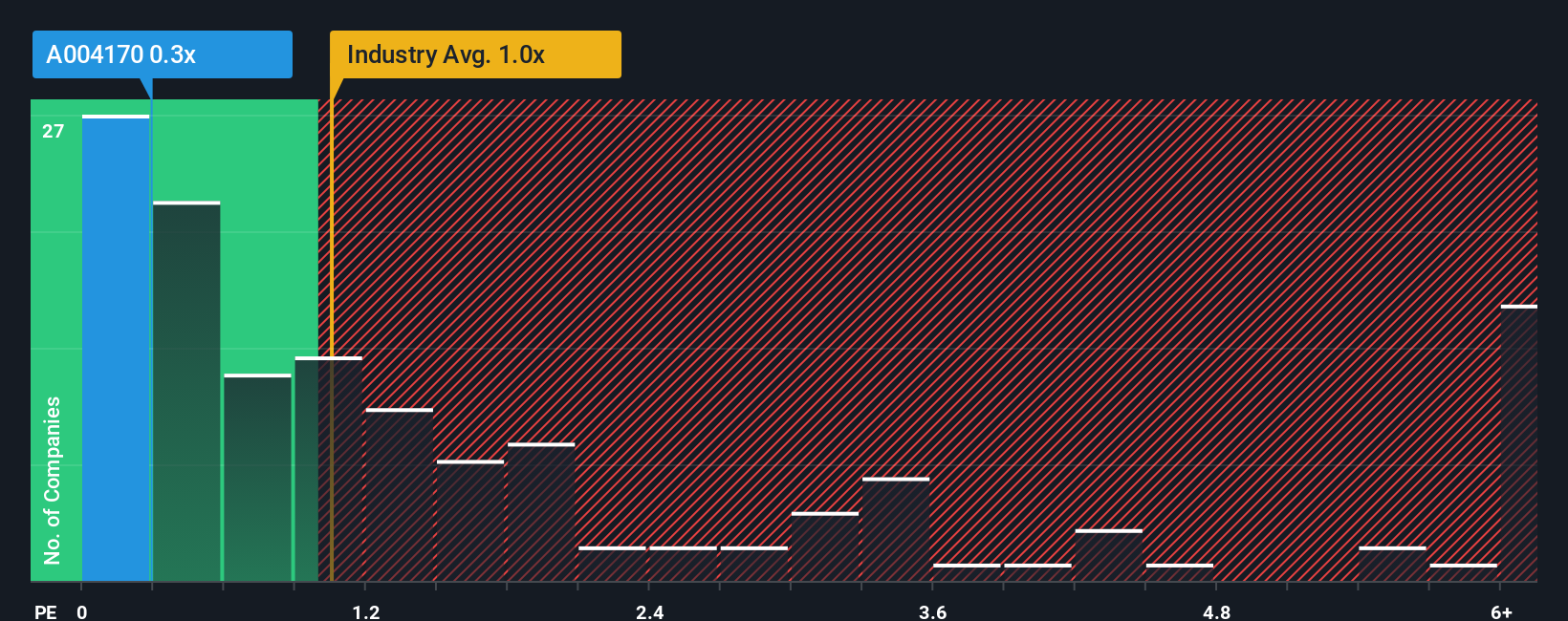

Even after such a large jump in price, you could still be forgiven for feeling indifferent about SHINSEGAE's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Multiline Retail industry in Korea is also close to 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for SHINSEGAE

What Does SHINSEGAE's P/S Mean For Shareholders?

SHINSEGAE's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on SHINSEGAE will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For SHINSEGAE?

There's an inherent assumption that a company should be matching the industry for P/S ratios like SHINSEGAE's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.6% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 7.2% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 3.7% as estimated by the analysts watching the company. With the industry predicted to deliver 2.7% growth , the company is positioned for a comparable revenue result.

With this information, we can see why SHINSEGAE is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On SHINSEGAE's P/S

SHINSEGAE appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A SHINSEGAE's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Multiline Retail industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Before you take the next step, you should know about the 4 warning signs for SHINSEGAE (2 can't be ignored!) that we have uncovered.

If these risks are making you reconsider your opinion on SHINSEGAE, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A004170

Slight risk with moderate growth potential.

Market Insights

Community Narratives