- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6805

Global Market's Top 3 Stocks That Could Be Undervalued In June 2025

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, with U.S. stocks climbing for the second consecutive week and European indices buoyed by easing monetary policies, investors are keenly observing the potential impacts of trade tensions and labor market shifts. Amid these developments, identifying undervalued stocks can be particularly appealing as they may offer opportunities for growth when market conditions are uncertain.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wanguo Gold Group (SEHK:3939) | HK$30.70 | HK$61.36 | 50% |

| Sparebank 68° Nord (OB:SB68) | NOK179.38 | NOK357.46 | 49.8% |

| Sahara International Petrochemical (SASE:2310) | SAR18.98 | SAR37.71 | 49.7% |

| PixArt Imaging (TPEX:3227) | NT$220.00 | NT$436.00 | 49.5% |

| Montana Aerospace (SWX:AERO) | CHF19.50 | CHF38.68 | 49.6% |

| Good Will Instrument (TWSE:2423) | NT$44.30 | NT$87.18 | 49.2% |

| Exsitec Holding (OM:EXS) | SEK128.50 | SEK254.56 | 49.5% |

| doValue (BIT:DOV) | €2.258 | €4.45 | 49.3% |

| Airbus (ENXTPA:AIR) | €163.92 | €325.62 | 49.7% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €36.70 | €72.88 | 49.6% |

Let's review some notable picks from our screened stocks.

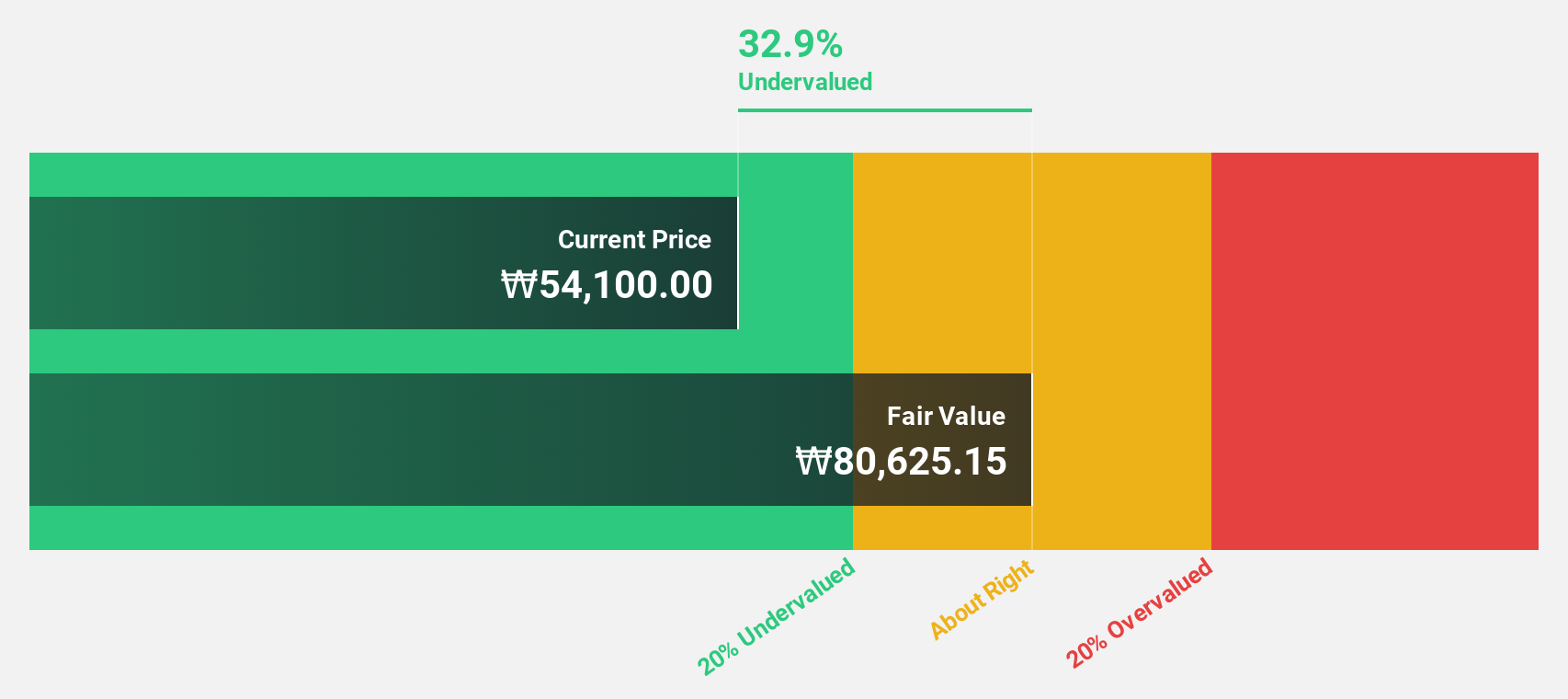

SILICON2 (KOSDAQ:A257720)

Overview: SILICON2 Co., Ltd. is involved in the global distribution of cosmetics products and has a market cap of ₩3.40 billion.

Operations: The company generates revenue primarily through its wholesale miscellaneous segment, which amounts to ₩787.27 million.

Estimated Discount To Fair Value: 41.1%

SILICON2 is trading at ₩61,800, significantly below its estimated fair value of ₩104,926.19, suggesting it may be undervalued based on cash flows. Despite high volatility in recent months, the company reported strong earnings growth of 134.2% over the past year and forecasts revenue and earnings growth above 20% annually. Recent results showed net income rising to KRW 38,785 million from KRW 25,535.55 million a year ago with improved earnings per share figures.

- The analysis detailed in our SILICON2 growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of SILICON2.

Qingdao Baheal Medical (SZSE:301015)

Overview: Qingdao Baheal Medical INC. is involved in the research, development, production, and sale of pharmaceutical products with a market cap of approximately CN¥11.10 billion.

Operations: The company's revenue is derived from its activities in research, development, production, and sale of pharmaceutical products.

Estimated Discount To Fair Value: 15.2%

Qingdao Baheal Medical is trading at CNY 23.29, below its estimated fair value of CNY 27.46, indicating potential undervaluation based on cash flows. Despite a slight decline in recent sales and net income compared to the previous year, earnings are projected to grow significantly over the next three years. The company recently affirmed a dividend distribution plan for 2024, reflecting stable shareholder returns amidst moderate revenue growth expectations above the Chinese market average.

- Our growth report here indicates Qingdao Baheal Medical may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Qingdao Baheal Medical's balance sheet health report.

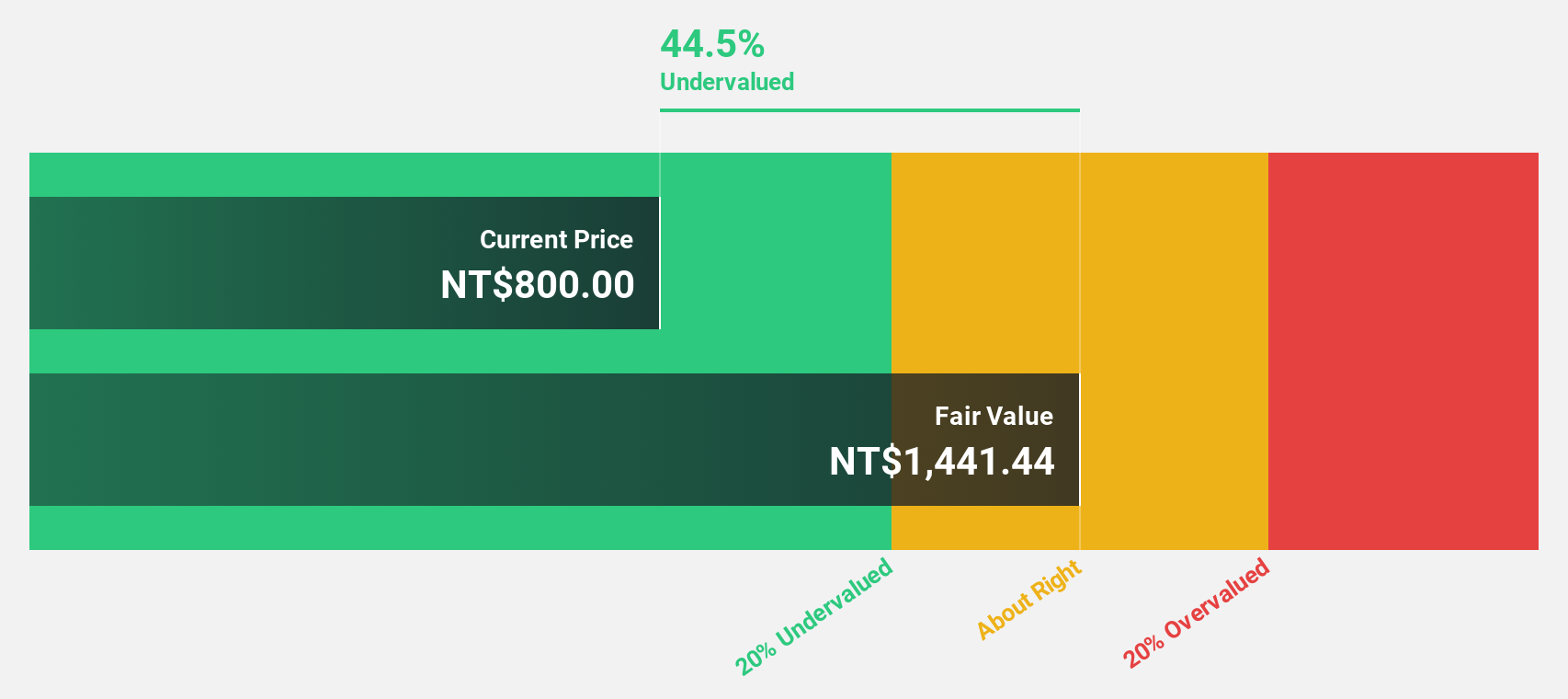

Fositek (TWSE:6805)

Overview: Fositek Corp. operates in the manufacture and wholesale of electronic materials and components, with a market cap of NT$47.58 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, generating NT$8.73 billion.

Estimated Discount To Fair Value: 47%

Fositek is trading at NT$762, significantly below its estimated fair value of NT$1,437.14, highlighting potential undervaluation based on cash flows. The company reported strong first-quarter earnings with net income rising to TWD 356.5 million from TWD 223.95 million year-over-year. Earnings are projected to grow substantially at 33.9% annually over the next three years, outpacing Taiwan's market average growth rates despite recent share price volatility and changes in company bylaws.

- The growth report we've compiled suggests that Fositek's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Fositek.

Make It Happen

- Investigate our full lineup of 495 Undervalued Global Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6805

Fositek

Engages in the manufacture and wholesale of electronic materials and components.

Exceptional growth potential with outstanding track record.

Market Insights

Community Narratives