- South Korea

- /

- Entertainment

- /

- KOSDAQ:A035760

Would Shareholders Who Purchased CJ ENM's (KOSDAQ:035760) Stock Three Years Be Happy With The Share price Today?

As an investor its worth striving to ensure your overall portfolio beats the market average. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term CJ ENM CO., Ltd. (KOSDAQ:035760) shareholders have had that experience, with the share price dropping 40% in three years, versus a market return of about 21%.

Check out our latest analysis for CJ ENM

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, CJ ENM actually saw its earnings per share (EPS) improve by 0.9% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. But it's possible a look at other metrics will be enlightening.

The modest 1.0% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 19% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching CJ ENM more closely, as sometimes stocks fall unfairly. This could present an opportunity.

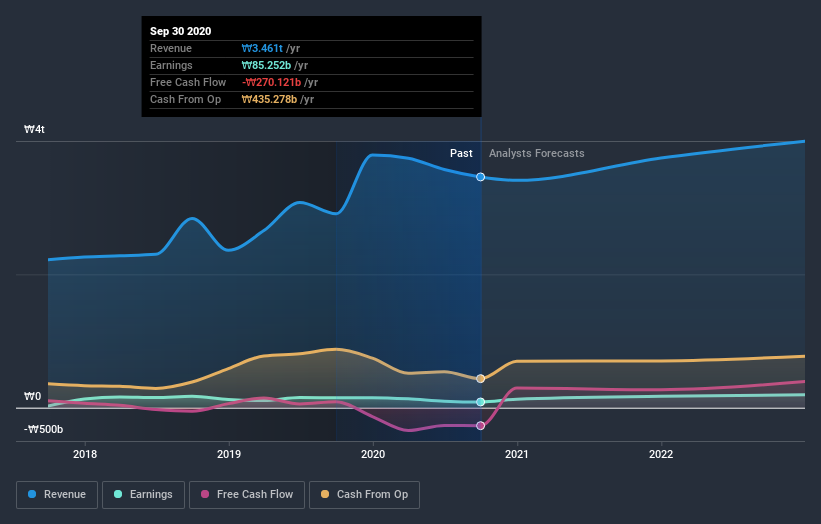

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

CJ ENM is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling CJ ENM stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Investors in CJ ENM had a tough year, with a total loss of 8.8% (including dividends), against a market gain of about 37%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for CJ ENM that you should be aware of before investing here.

We will like CJ ENM better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade CJ ENM, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A035760

CJ ENM

Engages in media platform, film/drama, music, and commerce businesses in South Korea.

Fair value with questionable track record.

Market Insights

Community Narratives