- South Korea

- /

- Biotech

- /

- KOSE:A006280

High Growth Tech Stocks in Asia for July 2025

Reviewed by Simply Wall St

As of July 2025, Asian markets have been navigating a complex landscape marked by China's stronger-than-expected GDP growth and Japan's modest stock market gains, despite global inflationary pressures and ongoing trade negotiations. In this dynamic environment, identifying high-growth tech stocks requires an understanding of how these companies can leverage regional economic trends and technological advancements to sustain their momentum.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gold Circuit Electronics | 20.76% | 25.89% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 27.03% | 30.47% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

GC Biopharma (KOSE:A006280)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GC Biopharma Corp. is a biopharmaceutical company that develops and sells pharmaceutical drugs both domestically in South Korea and internationally, with a market cap of ₩1.78 trillion.

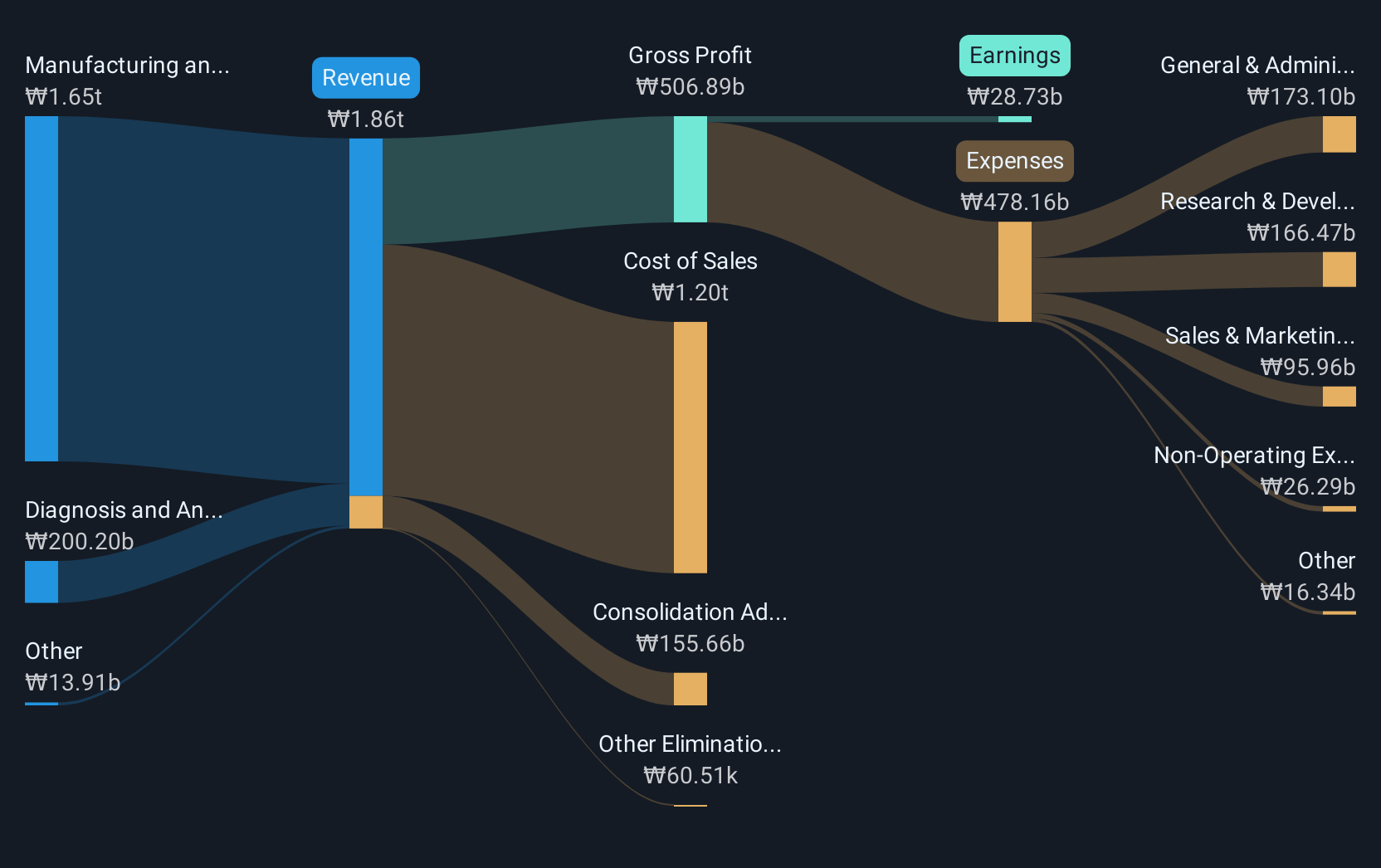

Operations: GC Biopharma Corp. generates revenue primarily from the manufacturing and sales of pharmaceuticals, contributing ₩1.65 trillion to its revenue stream. The company also engages in diagnosis and analysis of samples, adding another ₩200.20 billion to its earnings.

GC Biopharma is making significant strides in the high-growth tech sector in Asia, particularly through its recent advances in vaccine development and regulatory approvals. The company's varicella vaccine, BARYCELA, has been granted marketing authorization by Vietnam's Drug Administration, a key milestone following WHO Pre-Qualification. This approval not only underscores GC Biopharma’s capability to meet stringent global standards but also enhances its position in Vietnam’s burgeoning private vaccine market, which grew at a CAGR of 32% from 2018 to 2021. Furthermore, the company's focus on R&D is evident as it allocates substantial resources towards innovation—evidenced by an R&D expenditure increase to ₩200 billion this year from ₩150 billion last year. This investment supports their dual-track strategy of expanding global access while penetrating individual markets directly, promising sustained growth and stability in revenue streams.

- Click here to discover the nuances of GC Biopharma with our detailed analytical health report.

Assess GC Biopharma's past performance with our detailed historical performance reports.

Ascentage Pharma Group International (SEHK:6855)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ascentage Pharma Group International is a clinical-stage biotechnology company focused on developing therapies for cancers, chronic hepatitis B virus (HBV), and age-related diseases in Mainland China, with a market cap of HK$26.61 billion.

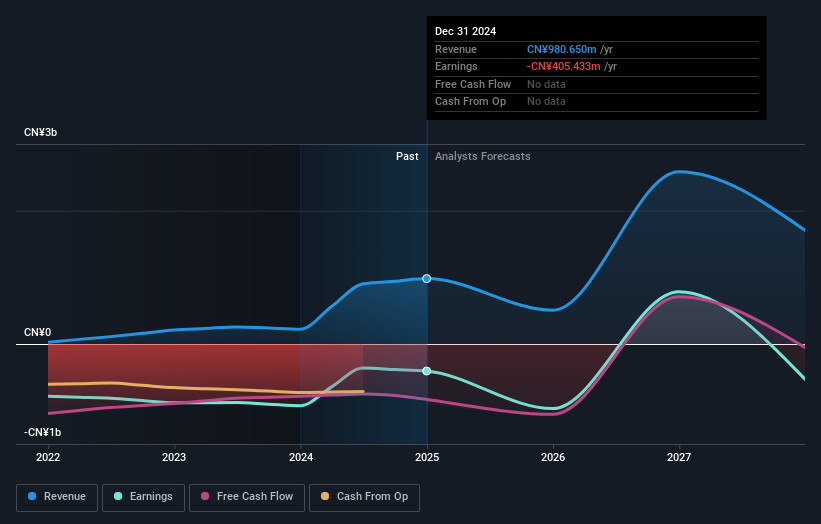

Operations: The company's primary revenue stream is the development and sale of novel small-scale therapies, generating CN¥980.65 million.

Ascentage Pharma Group International, a trailblazer in apoptosis-targeted therapies, recently marked significant progress with its Bcl-2 inhibitor lisaftoclax receiving NMPA approval for CLL/SLL treatment—making it the first of its kind approved in China. This milestone underscores Ascentage's robust R&D framework, which consistently channels substantial investments into innovation; notably, their R&D expenses have surged by 15.1% annually over the past five years. Additionally, the company completed a HKD 1.509 billion equity offering, bolstering its financial position to further fuel these pioneering research endeavors and potentially accelerate revenue growth forecasted at an impressive annual rate of 23.2%. This strategic blend of groundbreaking clinical achievements and solid financial strategies positions Ascentage Pharma well within Asia's competitive high-growth tech landscape.

Shanghai BOCHU Electronic Technology (SHSE:688188)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shanghai BOCHU Electronic Technology Corporation Limited operates in the electronic technology sector and has a market capitalization of CN¥39.42 billion.

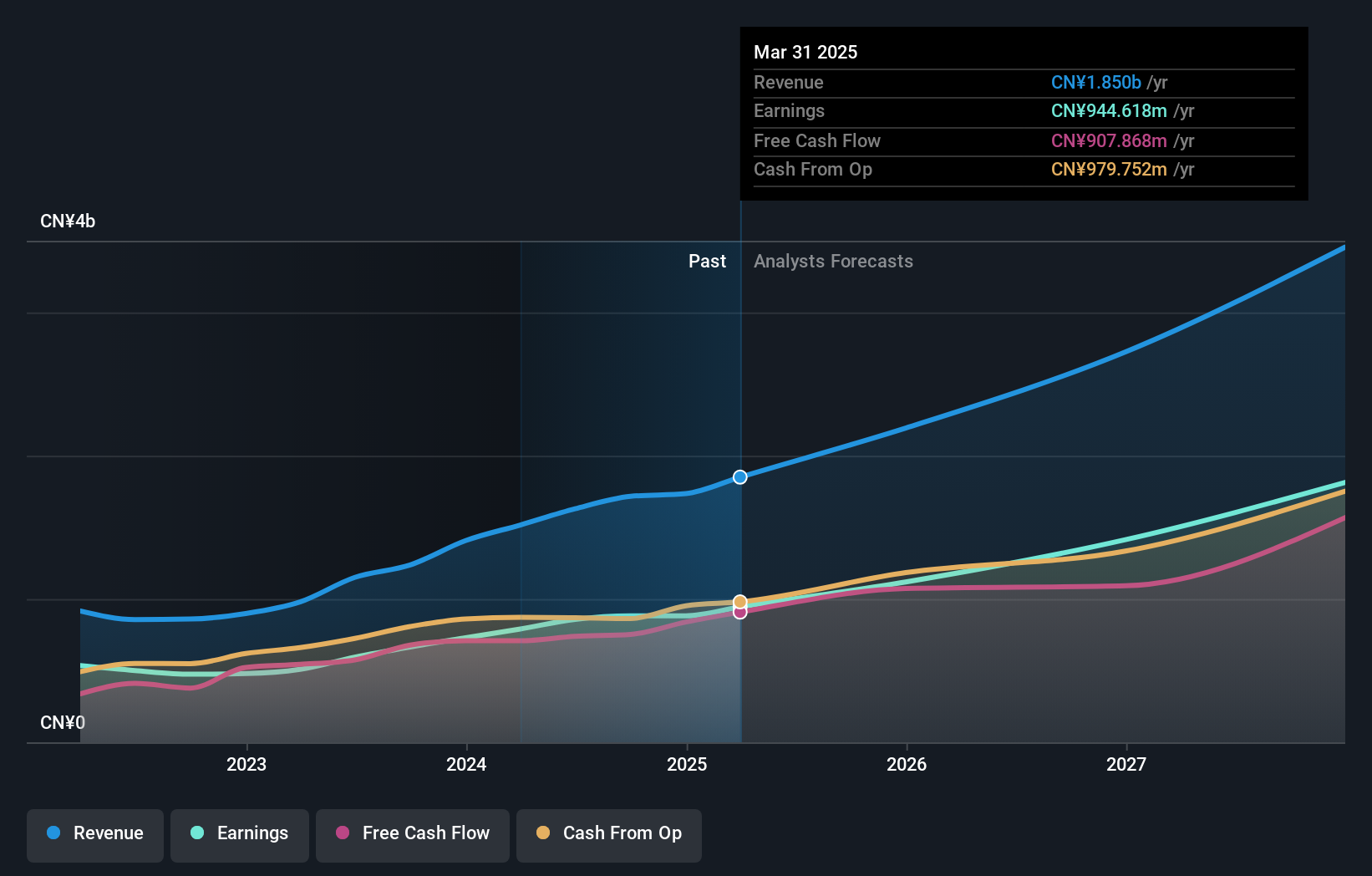

Operations: Shanghai BOCHU Electronic Technology primarily generates revenue through its operations in the electronic technology sector. The company has a market capitalization of CN¥39.42 billion, indicating a significant presence in its industry.

Shanghai BOCHU Electronic Technology has demonstrated robust growth dynamics, with earnings expected to surge by 23.5% annually. This performance is notably superior to the broader Chinese market's 23.4%, highlighting its competitive edge in the electronics sector. Moreover, the company's commitment to innovation is evident from its strategic R&D investments, which are crucial for sustaining long-term growth in a rapidly evolving industry landscape. With revenue also projected to expand at an impressive rate of 22.6% per year—outpacing the market average of 12.5%—BOCHU is well-positioned to capitalize on emerging technological trends and maintain its upward trajectory in Asia's high-growth tech scene.

Turning Ideas Into Actions

- Explore the 479 names from our Asian High Growth Tech and AI Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A006280

GC Biopharma

A biopharmaceutical company, develops and sells pharmaceutical drugs in South Korea and internationally.

Good value with questionable track record.

Similar Companies

Market Insights

Community Narratives