- South Korea

- /

- Electrical

- /

- KOSE:A103590

Discovering 3 Undiscovered Gems in South Korea

Reviewed by Simply Wall St

The South Korean stock market has shown resilience, climbing over 2.6 percent in three consecutive sessions and positioning the KOSPI above the 2,580-point mark. This positive momentum is supported by optimism around interest rates and economic outlooks, mirroring gains in European and U.S. markets. In this favorable environment, discovering undervalued stocks with strong growth potential becomes crucial for investors seeking to capitalize on market opportunities. Here are three lesser-known gems in South Korea that could offer promising prospects amidst these dynamic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Snt DynamicsLtd (KOSE:A003570)

Simply Wall St Value Rating: ★★★★★★

Overview: Snt Dynamics Co., Ltd. manufactures and sells precision machinery with a market cap of ₩576.64 billion.

Operations: Snt Dynamics generates revenue primarily from its Machinery Business and Transportation Equipment Business, with the latter contributing ₩555.04 billion. The company faces a consolidated adjustment of -₩19.91 billion in its financials.

Snt Dynamics Ltd. has shown impressive earnings growth of 184.7% over the past year, significantly outpacing the Aerospace & Defense industry’s 47.9%. Trading at 68.9% below estimated fair value, it presents a compelling opportunity despite forecasted earnings declines of 19.1% annually for the next three years. The company reported net income of KRW 47 billion in Q2 2024, up from KRW 8.98 billion a year ago, with basic EPS rising to KRW 2,100 from KRW 401.

- Navigate through the intricacies of Snt DynamicsLtd with our comprehensive health report here.

Understand Snt DynamicsLtd's track record by examining our Past report.

Boryung (KOSE:A003850)

Simply Wall St Value Rating: ★★★★★★

Overview: Boryung Corporation manufactures and sells pharmaceutical products in South Korea and internationally, with a market cap of ₩809.49 billion.

Operations: Boryung Corporation generates revenue primarily from its pharmaceutical manufacturing and sales segment, which reported ₩928.72 billion. The company has a market cap of ₩809.49 billion.

Boryung's recent performance has been impressive, with second-quarter sales rising to KRW 228.62 million from KRW 80.13 million a year ago, and net income more than doubling to KRW 23,643.1 million. The company's earnings growth of 68.7% over the past year outpaced the pharmaceutical industry average of 21.6%. Additionally, Boryung trades at a significant discount to its estimated fair value and maintains a satisfactory net debt to equity ratio of 29.5%.

Iljin ElectricLtd (KOSE:A103590)

Simply Wall St Value Rating: ★★★★★★

Overview: Iljin Electric Co., Ltd operates as a heavy electric machinery company in South Korea and internationally, with a market cap of ₩1.05 trillion.

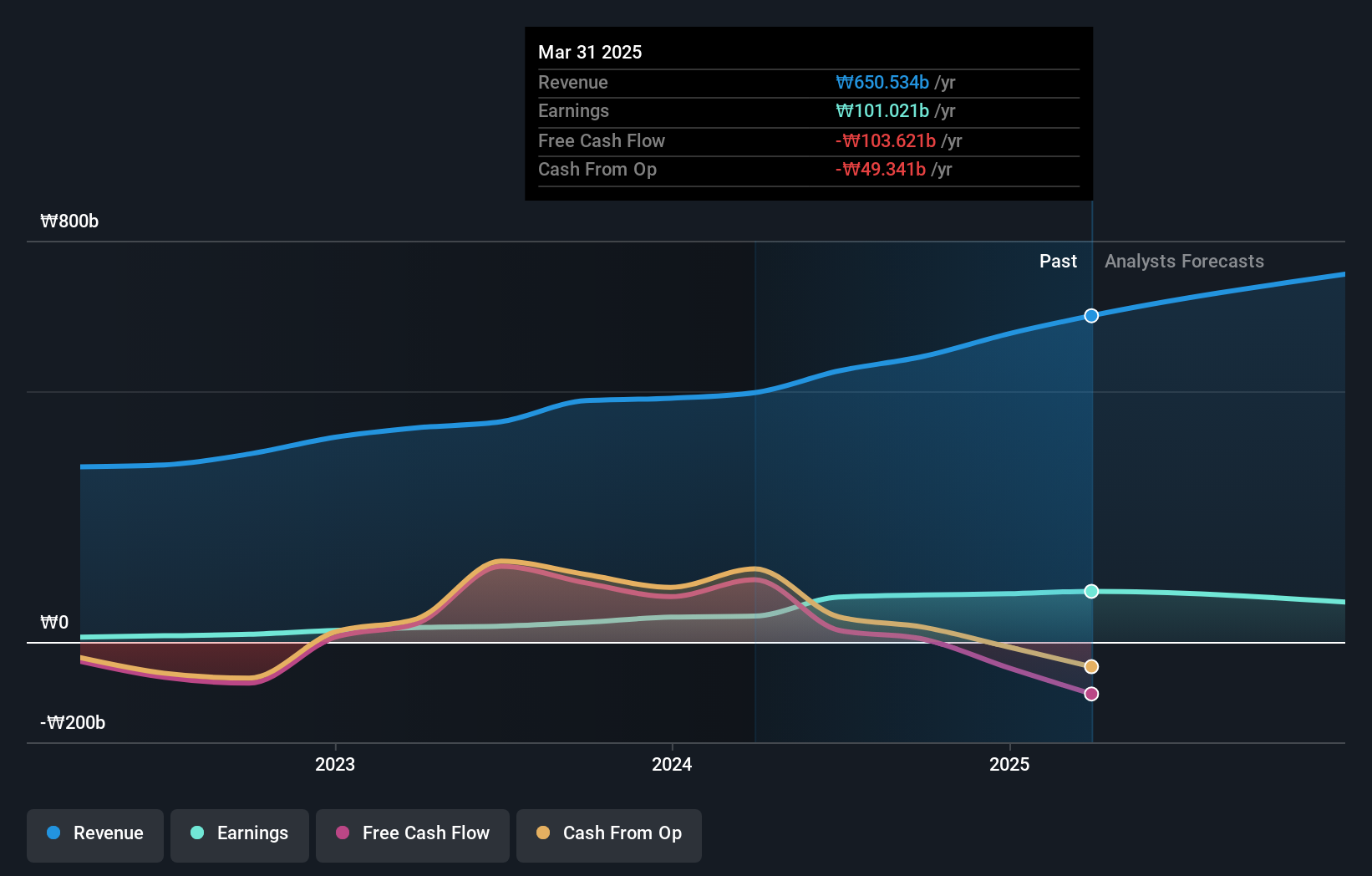

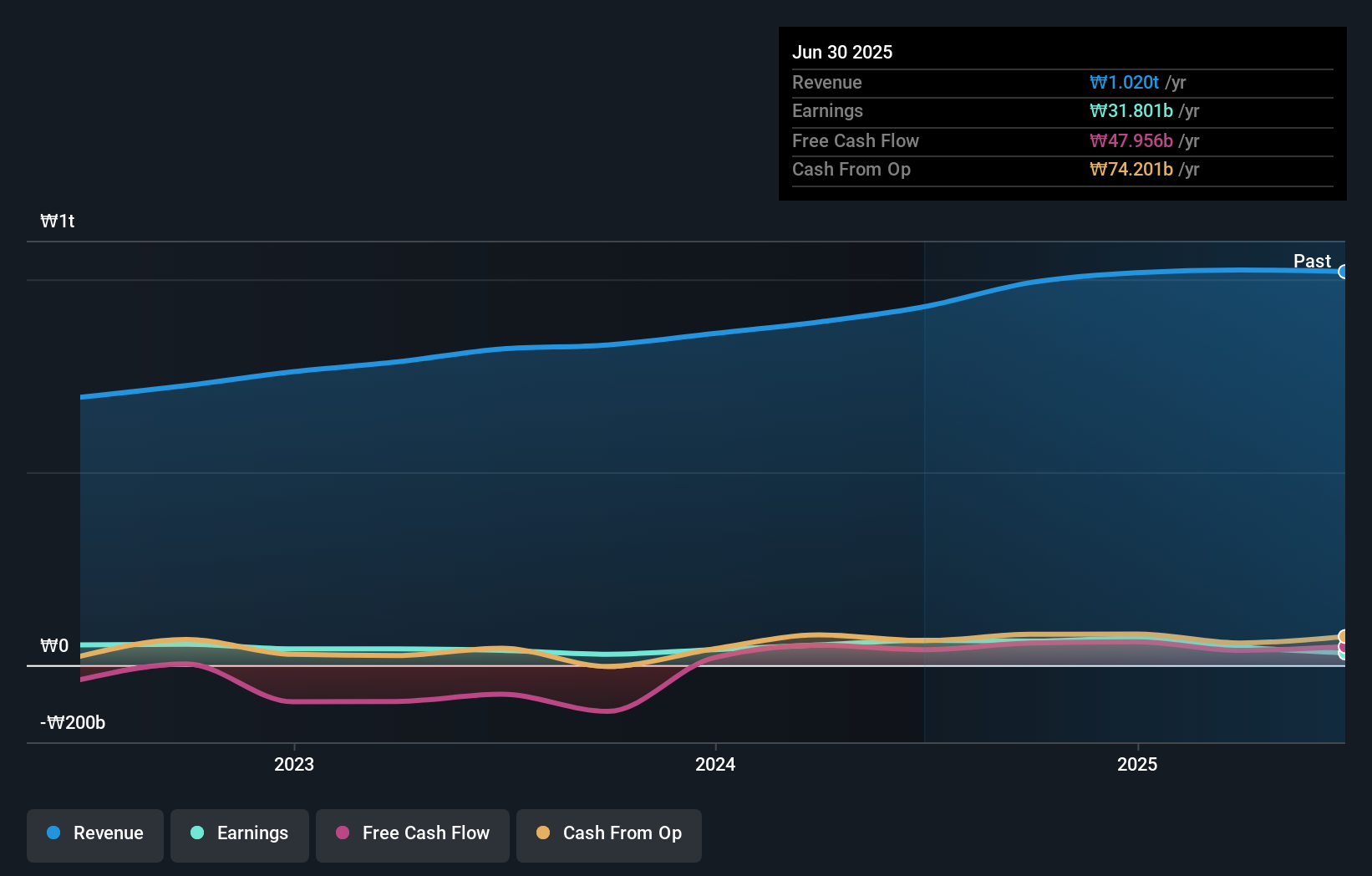

Operations: Iljin Electric Co., Ltd generates revenue primarily from its Wire segment (₩1.17 trillion) and Power System segment (₩329.01 billion).

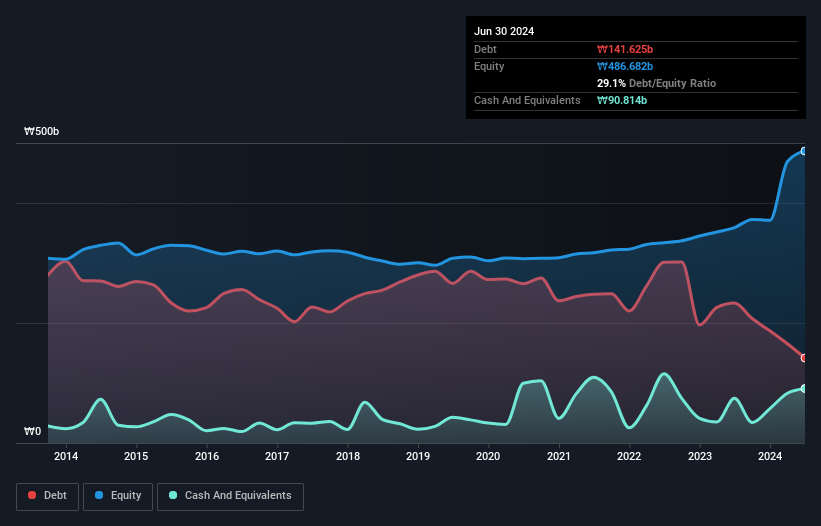

Iljin Electric Ltd. has shown impressive earnings growth of 55.6% over the past year, far outpacing the Electrical industry’s 18.5%. The company's debt to equity ratio has improved significantly from 86.4% to 29.1% in five years, indicating better financial health. Trading at a substantial discount of 83.2% below its estimated fair value, Iljin appears undervalued by market standards and offers high-quality earnings with strong EBIT coverage on interest payments (9.1x).

Next Steps

- Investigate our full lineup of 189 KRX Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A103590

Iljin ElectricLtd

Operates as a heavy electric machinery company in South Korea and internationally.

Flawless balance sheet with solid track record.