- South Korea

- /

- Pharma

- /

- KOSE:A000640

Dong-A Socio Holdings (KRX:000640) Takes On Some Risk With Its Use Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Dong-A Socio Holdings Co., Ltd. (KRX:000640) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Dong-A Socio Holdings

How Much Debt Does Dong-A Socio Holdings Carry?

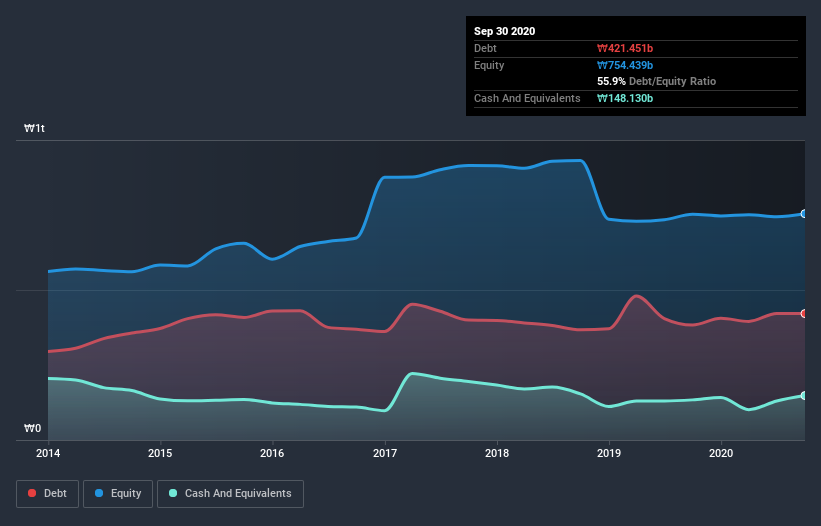

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Dong-A Socio Holdings had ₩421.5b of debt, an increase on ₩383.6b, over one year. However, it also had ₩148.1b in cash, and so its net debt is ₩273.3b.

How Healthy Is Dong-A Socio Holdings's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Dong-A Socio Holdings had liabilities of ₩322.8b due within 12 months and liabilities of ₩303.1b due beyond that. On the other hand, it had cash of ₩148.1b and ₩107.0b worth of receivables due within a year. So its liabilities total ₩370.7b more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Dong-A Socio Holdings has a market capitalization of ₩812.5b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Dong-A Socio Holdings's net debt is sitting at a very reasonable 2.4 times its EBITDA, while its EBIT covered its interest expense just 4.7 times last year. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. Importantly Dong-A Socio Holdings's EBIT was essentially flat over the last twelve months. We would prefer to see some earnings growth, because that always helps diminish debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Dong-A Socio Holdings's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Dong-A Socio Holdings recorded free cash flow worth 57% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Dong-A Socio Holdings's level of total liabilities and net debt to EBITDA definitely weigh on it, in our esteem. But we do take some comfort from its conversion of EBIT to free cash flow. Looking at all the angles mentioned above, it does seem to us that Dong-A Socio Holdings is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Dong-A Socio Holdings that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Dong-A Socio Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A000640

Dong-A Socio Holdings

Engages in the pharmaceutical business in South Korea.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026