- China

- /

- Auto Components

- /

- SZSE:300680

Global Stocks That May Be Trading Below Estimated Value In November 2025

Reviewed by Simply Wall St

As global markets grapple with concerns over inflated AI valuations and mixed economic signals, investors are increasingly focused on identifying stocks that may be trading below their estimated value. In such a climate, finding undervalued stocks involves looking for companies with strong fundamentals that have been overlooked amid broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shengda ResourcesLtd (SZSE:000603) | CN¥25.16 | CN¥49.79 | 49.5% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.11 | CN¥26.02 | 49.6% |

| Nan Juen International (TPEX:6584) | NT$358.00 | NT$709.20 | 49.5% |

| Nanjing COSMOS Chemical (SZSE:300856) | CN¥16.15 | CN¥29.38 | 45% |

| HMS Bergbau (XTRA:HMU) | €52.00 | €103.59 | 49.8% |

| EcoUp Oyj (HLSE:ECOUP) | €1.34 | €2.64 | 49.3% |

| China Ruyi Holdings (SEHK:136) | HK$2.44 | HK$4.82 | 49.4% |

| B&S Group (ENXTAM:BSGR) | €5.95 | €11.85 | 49.8% |

| Allcore (BIT:CORE) | €1.325 | €2.65 | 49.9% |

| ALEC Holdings PJSC (DFM:ALEC) | AED1.41 | AED2.80 | 49.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

ST PharmLtd (KOSDAQ:A237690)

Overview: ST Pharm Co., Ltd. offers manufacturing services for active pharmaceutical ingredients and intermediates, with a market cap of ₩2.14 trillion.

Operations: The company's revenue segments include Raw Material Manufacturing, generating ₩270.88 billion, and Clinical Trial Contract Research, contributing ₩31.30 billion.

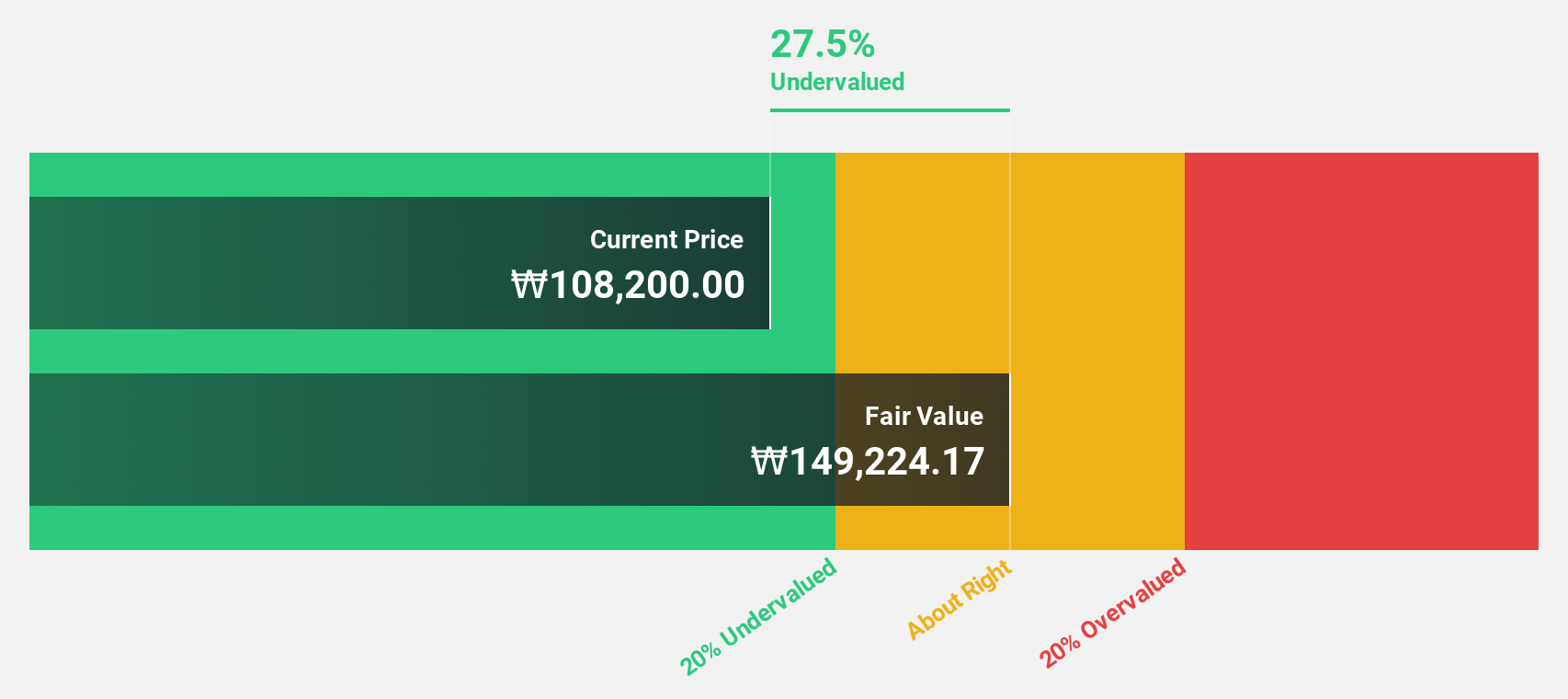

Estimated Discount To Fair Value: 27.5%

ST Pharm Ltd. is currently trading at ₩108,200, significantly below its estimated fair value of ₩149,224.17. The company's earnings are forecast to grow 33.91% annually over the next three years, outpacing the Korean market's growth rate of 28.5%. Despite a low expected return on equity of 12.1%, ST Pharm's revenue is projected to increase by 20.3% per year, surpassing market expectations and highlighting its potential as an undervalued stock based on cash flows.

- Our growth report here indicates ST PharmLtd may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of ST PharmLtd stock in this financial health report.

Wuxi Longsheng TechnologyLtd (SZSE:300680)

Overview: Wuxi Longsheng Technology Co., Ltd specializes in the research, development, production, sales, and service of automotive parts both in China and internationally with a market capitalization of CN¥10.49 billion.

Operations: Wuxi Longsheng Technology Co., Ltd generates its revenue through the research, development, production, sales, and service of automotive parts within China and on an international scale.

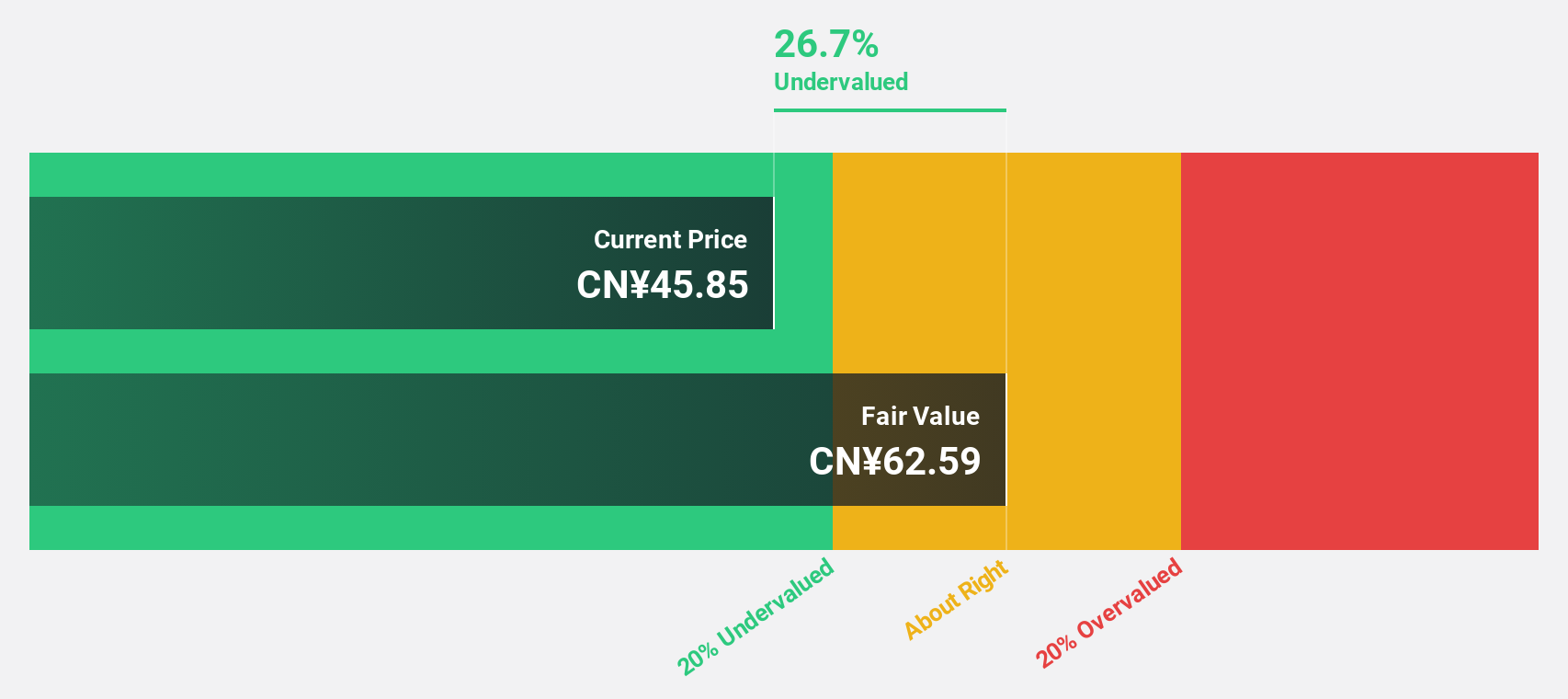

Estimated Discount To Fair Value: 26.8%

Wuxi Longsheng Technology Ltd. is trading at CN¥45.85, well below its estimated fair value of CN¥62.64, suggesting it may be undervalued based on cash flows. The company's earnings and revenue are forecast to grow significantly at 28.9% and 28.7% annually, respectively, outpacing the Chinese market's growth rates. Despite recent volatility in share price and large one-off items impacting financial results, its inclusion in the S&P Global BMI Index underscores potential investor interest.

- Our expertly prepared growth report on Wuxi Longsheng TechnologyLtd implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Wuxi Longsheng TechnologyLtd's balance sheet health report.

Taiwan Speciality Chemicals (TPEX:4772)

Overview: Taiwan Speciality Chemicals Corporation manufactures and sells specialty electronic-grade gases and chemicals in Taiwan, with a market cap of NT$44.45 billion.

Operations: Revenue Segments (in millions of NT$): Specialty electronic-grade gases and chemicals.

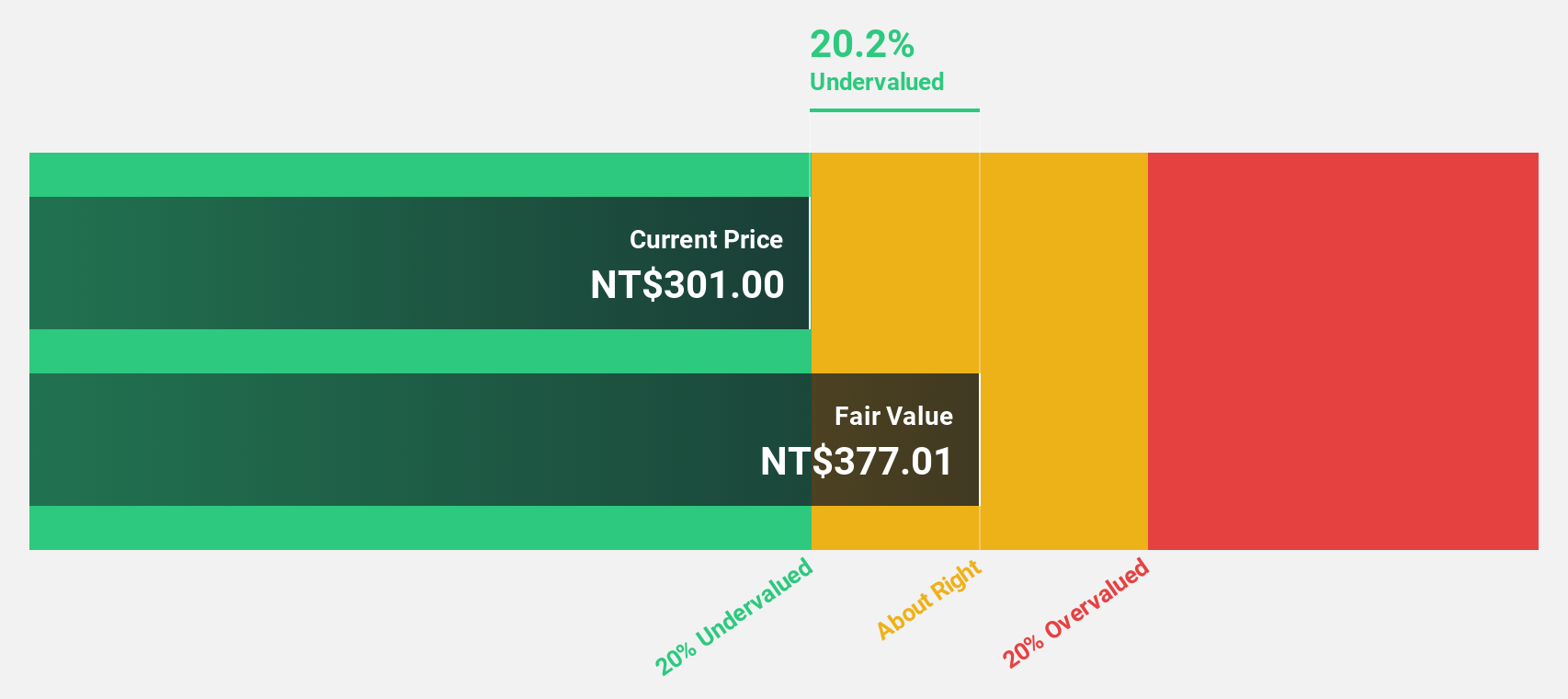

Estimated Discount To Fair Value: 20.3%

Taiwan Speciality Chemicals, trading at NT$301, is valued below its estimated fair value of NT$377.43, highlighting potential undervaluation based on cash flows. The company's earnings and revenue are expected to grow significantly at 47.6% and 56.8% annually, surpassing the Taiwan market's growth rates. Despite recent share price volatility, third-quarter results showed robust financial health with sales reaching TWD 639.51 million and net income rising to TWD 178.23 million from the previous year.

- The growth report we've compiled suggests that Taiwan Speciality Chemicals' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Taiwan Speciality Chemicals.

Make It Happen

- Take a closer look at our Undervalued Global Stocks Based On Cash Flows list of 509 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Longsheng TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300680

Wuxi Longsheng TechnologyLtd

Engages in the research and development, production, sales, and service of automotive parts products in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success