- South Korea

- /

- Pharma

- /

- KOSDAQ:A237690

3 KRX Stocks That May Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

The South Korean market is up 1.4% over the last week but has experienced a 3.9% decline over the past 12 months, with earnings forecasted to grow by 29% annually. In this context, identifying stocks that may be trading below their intrinsic value can offer potential opportunities for investors looking to capitalize on future growth.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| APR (KOSE:A278470) | ₩294500.00 | ₩519577.56 | 43.3% |

| T'Way Air (KOSE:A091810) | ₩2985.00 | ₩5723.97 | 47.9% |

| Cosmecca Korea (KOSDAQ:A241710) | ₩87500.00 | ₩152265.82 | 42.5% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Oscotec (KOSDAQ:A039200) | ₩35700.00 | ₩65583.14 | 45.6% |

| Intellian Technologies (KOSDAQ:A189300) | ₩49600.00 | ₩90834.54 | 45.4% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1640.00 | ₩2972.85 | 44.8% |

| Global Tax Free (KOSDAQ:A204620) | ₩3630.00 | ₩6407.29 | 43.3% |

| Hotel ShillaLtd (KOSE:A008770) | ₩45500.00 | ₩81710.08 | 44.3% |

| Kakao Games (KOSDAQ:A293490) | ₩17220.00 | ₩29763.62 | 42.1% |

Underneath we present a selection of stocks filtered out by our screen.

ST PharmLtd (KOSDAQ:A237690)

Overview: ST Pharm Co., Ltd. provides custom manufacturing services for active pharmaceutical ingredients and intermediates in South Korea and internationally, with a market cap of ₩2.04 trillion.

Operations: The company's revenue segments include Raw Material Manufacturing, which generated ₩236.78 billion, and the Clinical Trial Site Consignment Research Institute, which brought in ₩36.38 billion.

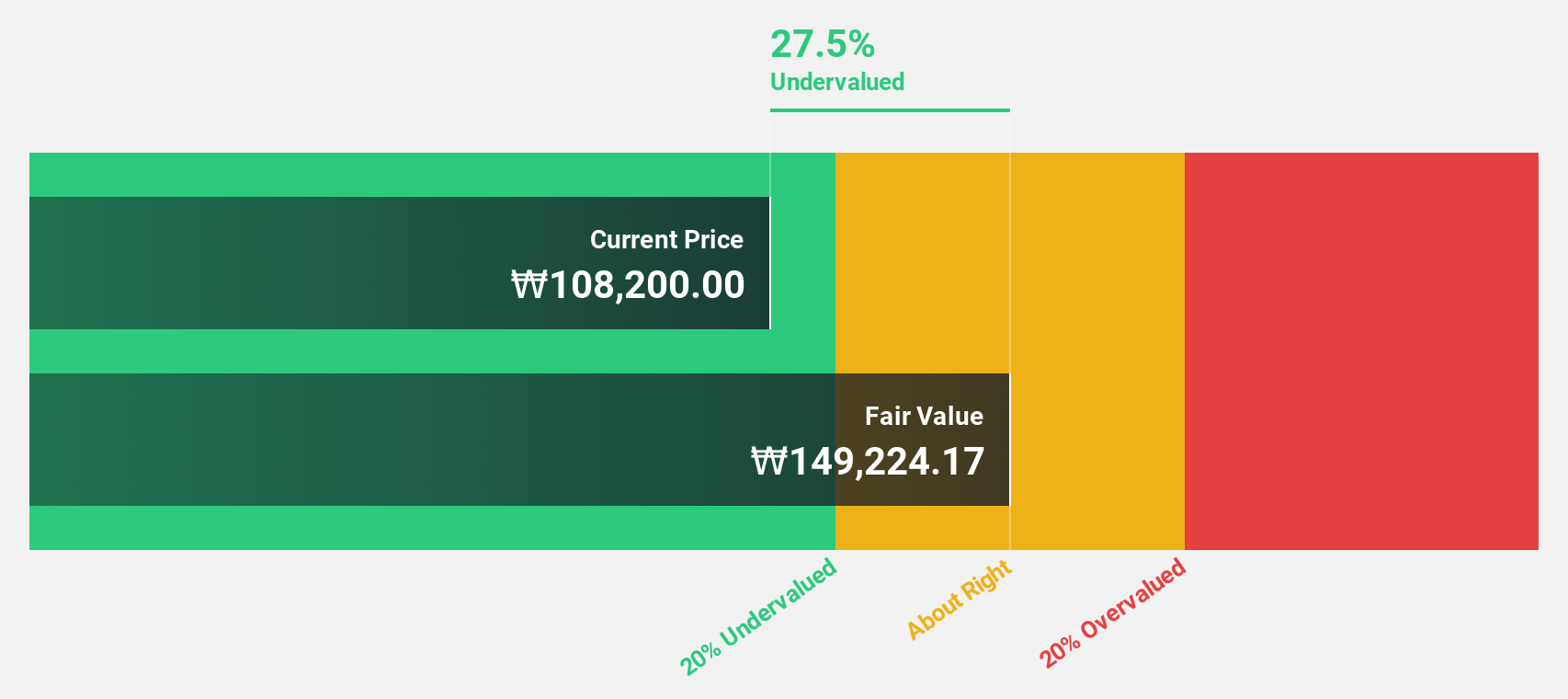

Estimated Discount To Fair Value: 32%

ST Pharm Ltd. is trading at ₩101,800, significantly below its estimated fair value of ₩149,811.92. Despite recent shareholder dilution and low forecasted return on equity (13.1% in three years), the company’s earnings grew 21.9% last year and are expected to grow 37.36% annually over the next three years, outpacing the Korean market's growth rate of 29.1%. Revenue is projected to increase by 19.2% per year, higher than the market average of 10.4%.

- Insights from our recent growth report point to a promising forecast for ST PharmLtd's business outlook.

- Dive into the specifics of ST PharmLtd here with our thorough financial health report.

Cosmecca Korea (KOSDAQ:A241710)

Overview: Cosmecca Korea Co., Ltd. engages in the research, development, manufacture, and sale of skincare products both domestically and internationally, with a market cap of ₩934.50 billion.

Operations: Cosmecca Korea's revenue primarily comes from its cosmetics segment, which generated ₩558.96 billion, and technology fees amounting to ₩3.17 billion.

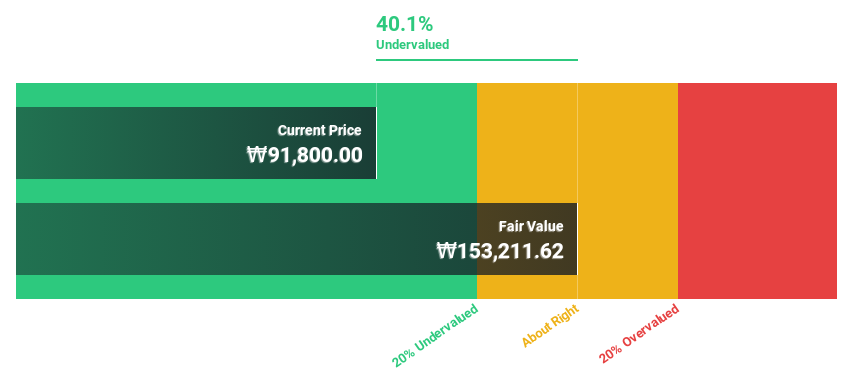

Estimated Discount To Fair Value: 42.5%

Cosmecca Korea is trading at ₩87,500, significantly below its estimated fair value of ₩152,265.82. Despite earnings forecasted to grow slower than the Korean market at 21.57% annually over the next three years, revenue is expected to increase by 14.6% per year, outpacing the market average of 10.4%. The company's earnings grew by a very large amount last year and it remains highly undervalued based on discounted cash flow analysis.

- The growth report we've compiled suggests that Cosmecca Korea's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Cosmecca Korea's balance sheet health report.

T'Way Air (KOSE:A091810)

Overview: T'Way Air Co., Ltd. provides air transportation services within South Korea and internationally, with a market cap of ₩642.29 billion.

Operations: The company's revenue primarily comes from its aviation business, amounting to ₩1.45 billion.

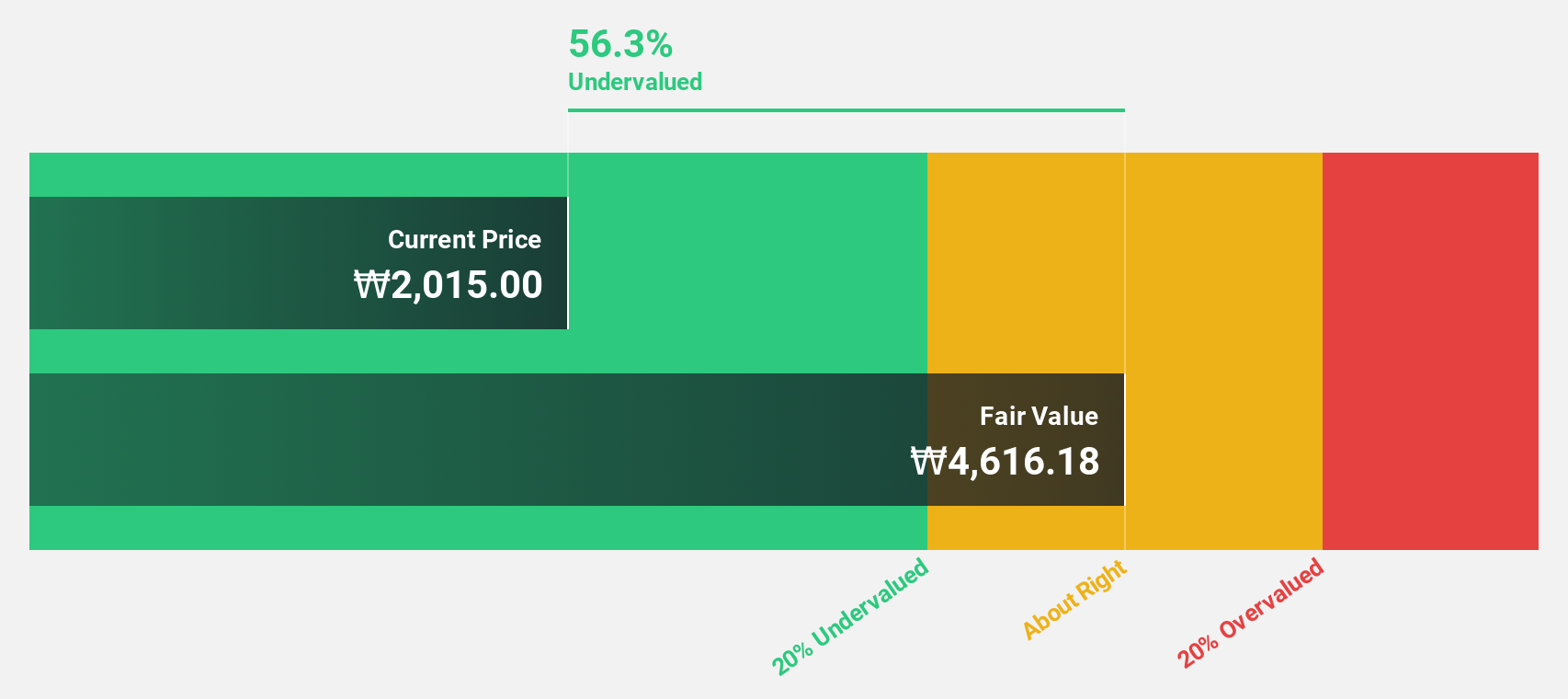

Estimated Discount To Fair Value: 47.9%

T'Way Air is trading at ₩2985, substantially below its estimated fair value of ₩5723.97, making it highly undervalued based on discounted cash flow analysis. Despite past shareholder dilution, earnings are projected to grow significantly at 23.39% annually over the next three years, though slightly slower than the Korean market average. Recent M&A transactions totaling KRW 176.44 billion further underscore investor confidence in T'Way Air's long-term prospects and potential for revenue growth above market rates.

- Our earnings growth report unveils the potential for significant increases in T'Way Air's future results.

- Unlock comprehensive insights into our analysis of T'Way Air stock in this financial health report.

Make It Happen

- Unlock more gems! Our Undervalued KRX Stocks Based On Cash Flows screener has unearthed 32 more companies for you to explore.Click here to unveil our expertly curated list of 35 Undervalued KRX Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A237690

ST PharmLtd

Provides custom manufacturing services for active pharmaceutical ingredient and intermediates in South Korea and internationally.

Reasonable growth potential with adequate balance sheet.