- South Korea

- /

- Machinery

- /

- KOSDAQ:A036560

Undiscovered Gems In South Korea 3 Promising Small Caps To Watch

Reviewed by Simply Wall St

The South Korea stock market recently snapped a six-day winning streak, with the KOSPI index experiencing a significant dip due to losses in financial shares and industrials. Amidst this volatile environment, investors may find opportunities in small-cap stocks that demonstrate resilience and potential for growth. In the current climate, identifying promising small-cap companies involves looking for strong fundamentals, innovative business models, and the ability to navigate economic fluctuations effectively. Here are three such undiscovered gems in South Korea's small-cap sector that warrant attention.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Young Poong Precision (KOSDAQ:A036560)

Simply Wall St Value Rating: ★★★★★★

Overview: Young Poong Precision Corporation develops, manufactures, and sells chemical process pumps in South Korea and internationally, with a market cap of ₩334.69 billion.

Operations: Young Poong Precision generates revenue primarily from the sale of chemical process pumps. The company reports a market cap of ₩334.69 billion.

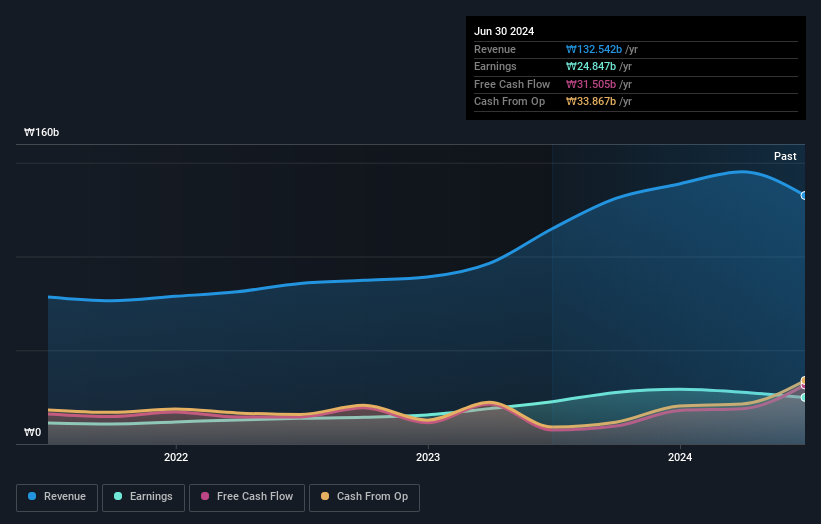

Young Poong Precision, a lesser-known entity in South Korea's machinery sector, has shown impressive earnings growth of 10.1% over the past year, outpacing the industry average of 5.4%. The company is debt-free and trades at 79.8% below its estimated fair value. Recently, Korea Corporate Investment Holdings offered approximately ₩140 billion to acquire a 43.43% stake in Young Poong Precision, with the transaction expected to complete by October 4, 2024.

- Delve into the full analysis health report here for a deeper understanding of Young Poong Precision.

FnGuide (KOSDAQ:A064850)

Simply Wall St Value Rating: ★★★★☆☆

Overview: FnGuide Inc. provides online-based financial information services and has a market cap of ₩436.41 billion.

Operations: FnGuide Inc. generates revenue primarily from its online financial information services, totaling ₩31.33 billion.

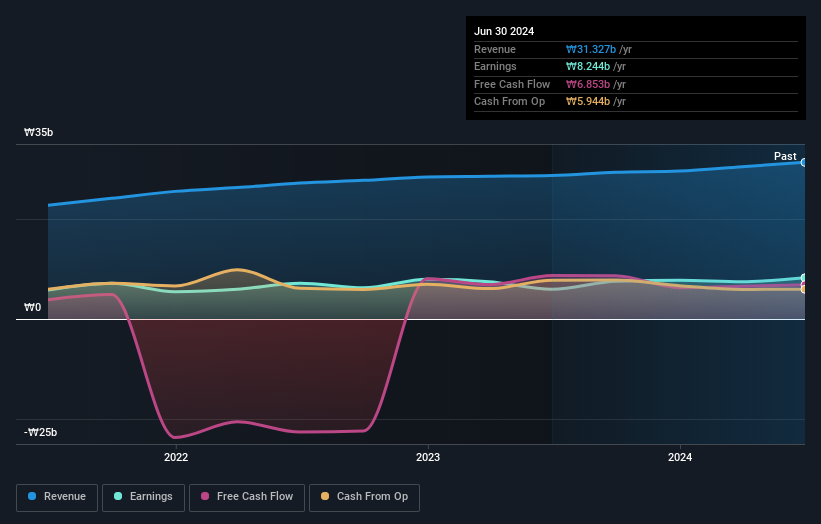

FnGuide, a small-cap player in South Korea, has shown impressive earnings growth of 38.8% over the past year, outpacing the Capital Markets industry’s 21.5%. The company's net debt to equity ratio stands at a satisfactory 10.3%, and its interest payments are well covered by EBIT with a coverage of 20.6x. However, recent financials were impacted by a large one-off gain of ₩2.5B as of June 30, 2024, which may skew performance perceptions slightly.

- Click to explore a detailed breakdown of our findings in FnGuide's health report.

Assess FnGuide's past performance with our detailed historical performance reports.

Taihan Cable & Solution (KOSE:A001440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taihan Cable & Solution Co., Ltd. manufactures, processes, and sells electric wires, cables, and related products worldwide with a market cap of ₩2.24 trillion.

Operations: The primary revenue stream for Taihan Cable & Solution comes from the wire segment, generating ₩3.42 billion. Sales between divisions account for a reduction of ₩0.38 billion.

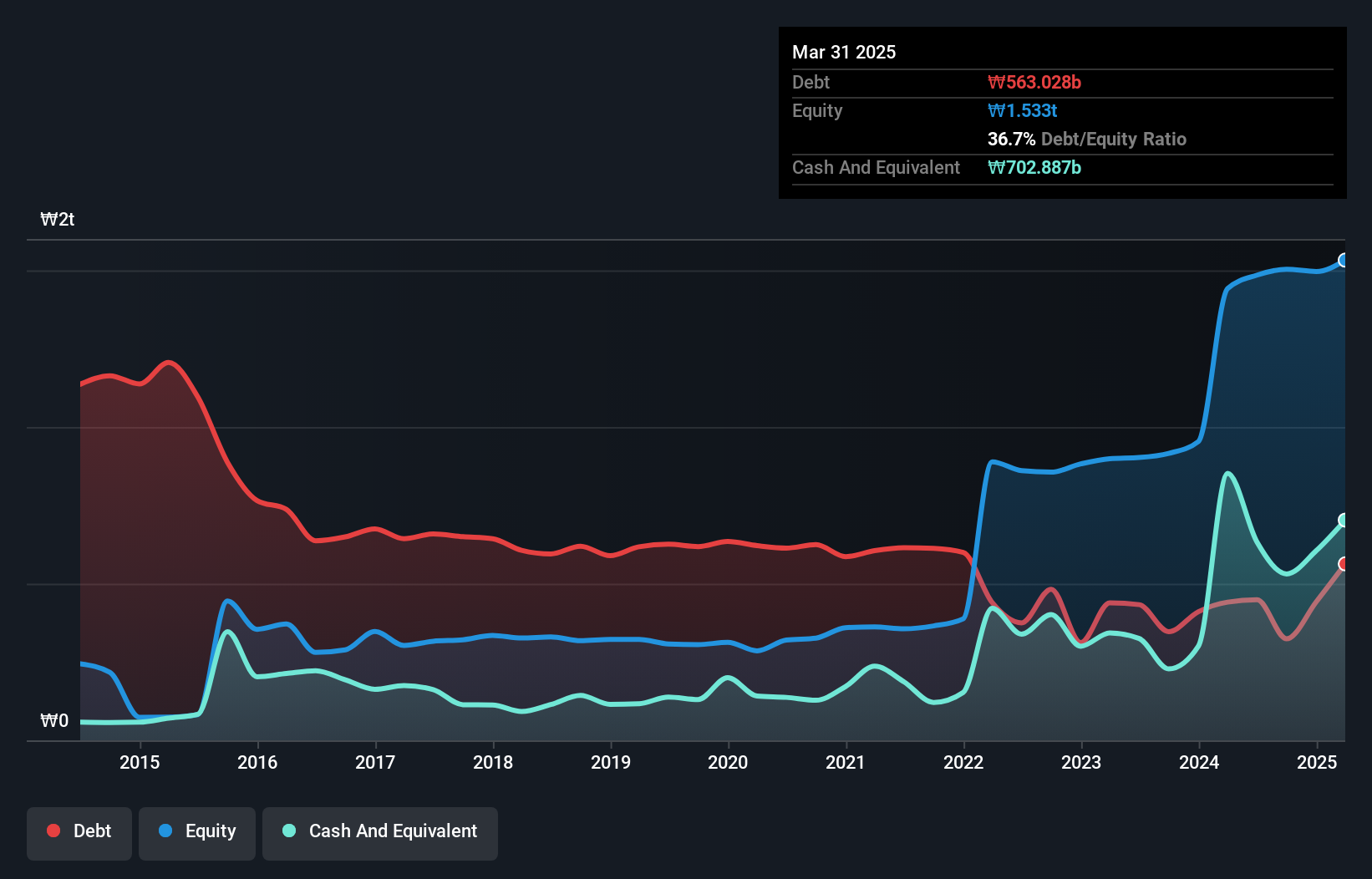

Taihan Cable & Solution has shown impressive earnings growth, with net income rising from KRW 12.82 million to KRW 24.88 million in the latest quarter. This represents a strong performance compared to the Electrical industry’s 18.5% growth rate over the past year. The company’s debt-to-equity ratio improved significantly from 203.6% to 30.2% over five years, and its interest payments are well-covered by EBIT at a ratio of 6.4x, indicating solid financial health despite substantial shareholder dilution recently.

Key Takeaways

- Navigate through the entire inventory of 186 KRX Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A036560

Young Poong Precision

Develops, manufactures, and sells chemical process pumps in South Korea and internationally.

Flawless balance sheet and good value.