- South Korea

- /

- Biotech

- /

- KOSE:A068270

Exploring High Growth Tech Stocks in South Korea This September 2024

Reviewed by Simply Wall St

The South Korea stock market on Wednesday snapped a six-day winning streak in which it had rallied almost 120 points or 4.6 percent, with the KOSPI now sitting just beneath the 2,570-point plateau and potentially facing further declines. Amid this fluctuating environment, identifying high-growth tech stocks becomes crucial for investors looking to navigate these volatile conditions effectively.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.74% | 35.66% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

YG Entertainment (KOSDAQ:A122870)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: YG Entertainment Inc. is an entertainment company that operates in South Korea, Japan, and internationally, with a market cap of ₩633.38 billion.

Operations: The company generates revenue primarily from its entertainment segment, amounting to ₩493.91 billion. It operates across South Korea, Japan, and internationally.

YG Entertainment, despite a challenging year with earnings dropping significantly, is poised for a robust recovery with projected annual earnings growth of 58.7%. This forecast outpaces the broader South Korean market's expectation of 29.3%. Additionally, while recent financials reflect a substantial net loss and a decrease in sales to KRW 0.00002 million from KRW 0.00003 million year-over-year, the company's revenue growth forecast at 17.1% annually could potentially exceed the domestic market average of 10.5%. These figures suggest an aggressive turnaround strategy possibly fueled by innovative approaches in entertainment technology and content delivery which might redefine its market stance in coming years.

- Navigate through the intricacies of YG Entertainment with our comprehensive health report here.

Assess YG Entertainment's past performance with our detailed historical performance reports.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩17.56 billion.

Operations: The company primarily generates revenue from its biotechnology segment, amounting to ₩90.79 billion. It focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Alteogen's recent strides in biotechnology underscore its potential within South Korea's high-growth tech sector, particularly following the MFDS approval of Tergase®, a high-purity recombinant hyaluronidase. This approval not only transitions Alteogen into a commercial-stage company but also sets it apart with a product that exceeds existing solutions in purity and reduced immunogenicity. Financially, Alteogen’s R&D expenditure has been significant, aligning with its revenue growth forecast at an impressive 64.2% annually. Earnings are also expected to surge by 99.5% per year, heralding a promising shift towards profitability and market leadership in biotech innovations.

- Take a closer look at ALTEOGEN's potential here in our health report.

Understand ALTEOGEN's track record by examining our Past report.

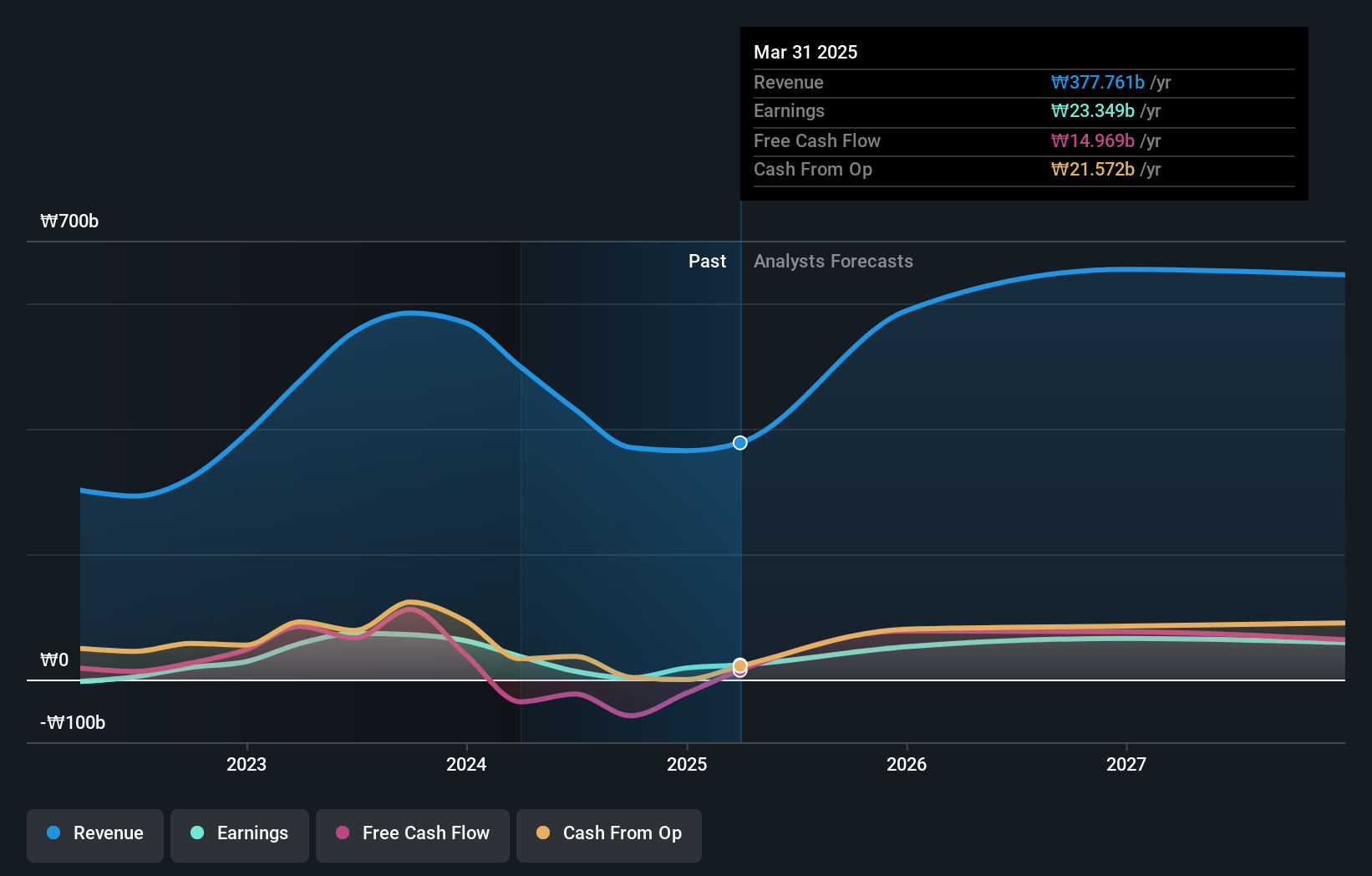

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Celltrion, Inc., along with its subsidiaries, develops and produces protein-based drugs for oncology treatment in South Korea, with a market cap of ₩41.27 billion.

Operations: The company generates revenue primarily from its Bio Medical Supply segment (₩3.54 billion) and Chemical Drugs segment (₩507.02 million). The Bio Medical Supply segment is the largest contributor to revenue.

Celltrion's recent developments highlight its robust position in the biotech industry, particularly with ZYMFENTRA's FDA approval enhancing its U.S. market presence. The company's R&D expenditure reflects a strategic focus on innovation, crucial for maintaining competitive advantage in high-growth markets; notably, R&D expenses have surged by 25.5% this year alone. Additionally, Celltrion has demonstrated significant financial agility through a share repurchase program totaling KRW 75.89 billion, underscoring confidence in its operational stability and future growth prospects amidst forecasts of revenue and earnings growth at 25.5% and 59.6% per year respectively.

- Dive into the specifics of Celltrion here with our thorough health report.

Explore historical data to track Celltrion's performance over time in our Past section.

Where To Now?

- Navigate through the entire inventory of 49 KRX High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A068270

Celltrion

Develops and produces drugs based on proteins for the treatment of oncology in South Korea.

Flawless balance sheet with high growth potential.