Stock Analysis

- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A098460

Top KRX Stocks Estimated as Undervalued in June 2024

Reviewed by Simply Wall St

The South Korean market has shown robust growth, climbing 2.0% in the last week and achieving a 6.7% increase over the past year, with earnings expected to grow by 29% annually. In such an optimistic environment, identifying stocks that are potentially undervalued could offer interesting opportunities for investors looking to capitalize on these positive trends.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Solum (KOSE:A248070) | ₩21950.00 | ₩40062.17 | 45.2% |

| Iljin ElectricLtd (KOSE:A103590) | ₩25350.00 | ₩50653.37 | 50% |

| Grand Korea Leisure (KOSE:A114090) | ₩12760.00 | ₩24863.53 | 48.7% |

| Caregen (KOSDAQ:A214370) | ₩24500.00 | ₩43428.59 | 43.6% |

| Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49536.65 | 49.7% |

| Intellian Technologies (KOSDAQ:A189300) | ₩55800.00 | ₩107348.41 | 48% |

| IMLtd (KOSDAQ:A101390) | ₩6900.00 | ₩13535.16 | 49% |

| SK Biopharmaceuticals (KOSE:A326030) | ₩76800.00 | ₩137549.91 | 44.2% |

| Hancom Lifecare (KOSE:A372910) | ₩5690.00 | ₩10710.50 | 46.9% |

| NEXON Games (KOSDAQ:A225570) | ₩14260.00 | ₩25771.76 | 44.7% |

Let's review some notable picks from our screened stocks

Koh Young Technology (KOSDAQ:A098460)

Overview: Koh Young Technology Inc. specializes in the production and sale of automated inspection and precise measurement systems, operating both in South Korea and globally, with a market capitalization of approximately ₩843.47 billion.

Operations: The company generates its revenue from the production and sale of automated inspection and precise measurement systems, serving markets both domestically and internationally.

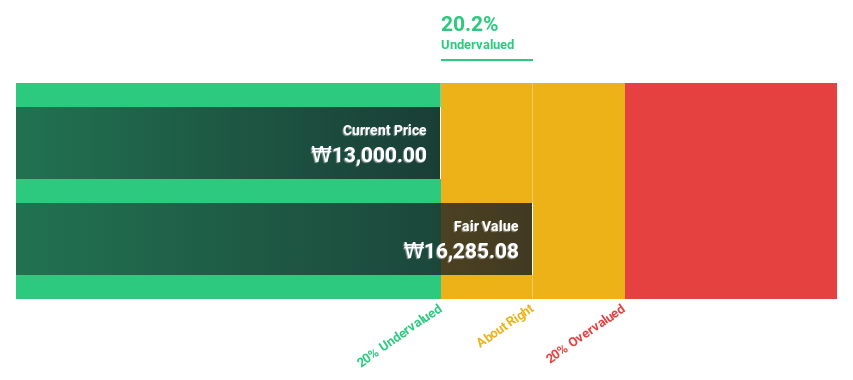

Estimated Discount To Fair Value: 14.5%

Koh Young Technology, trading at ₩12,820, is positioned below the estimated fair value of ₩15,000.32, reflecting potential undervaluation based on discounted cash flows. Despite a recent earnings dip with Q1 sales falling to KRW 53.03 billion from KRW 63.68 billion year-over-year and net income decreasing to KRW 7.28 billion, the company's aggressive share buyback strategy signals confidence in its intrinsic value. However, concerns linger due to unstable dividends and lower profit margins compared to last year (7.8% vs 15.1%). The forecast suggests robust earnings growth at an annual rate of 38.24%, outpacing the market prediction of 28.8%, but revenue growth projections are modest at 13.8% annually.

- According our earnings growth report, there's an indication that Koh Young Technology might be ready to expand.

- Unlock comprehensive insights into our analysis of Koh Young Technology stock in this financial health report.

Caregen (KOSDAQ:A214370)

Overview: Caregen Co., Ltd. is a South Korean biotechnology firm that specializes in researching, developing, and commercializing biomimetic peptides globally, with a market capitalization of approximately ₩1.20 trillion.

Operations: The company generates revenue through the development and commercialization of biomimetic peptides on a global scale.

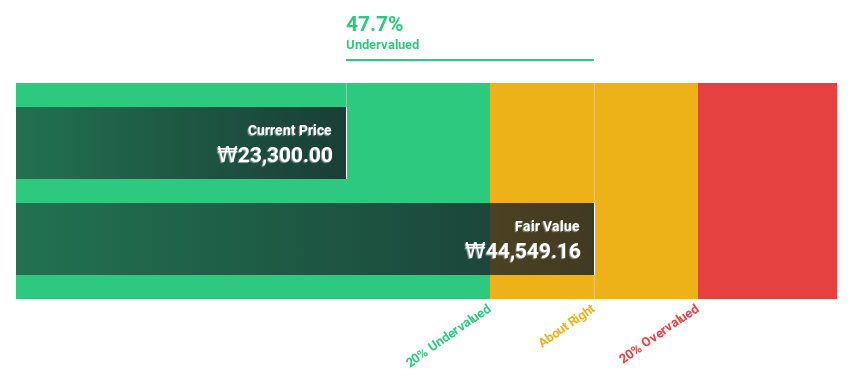

Estimated Discount To Fair Value: 43.6%

Caregen Co., Ltd., priced at ₩24,500, is significantly undervalued with our fair value estimate at ₩43,428.59. This discrepancy highlights potential based on discounted cash flow analysis. Despite a dividend of 2.61% not being well-covered by cash flows, the company has demonstrated strong growth metrics: earnings have increased by 11.9% annually over the past five years and are expected to rise by 24.28% annually going forward. Additionally, revenue growth projections outpace the South Korean market significantly at 20.9% per year compared to the market's 10.5%.

- The analysis detailed in our Caregen growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Caregen.

Iljin ElectricLtd (KOSE:A103590)

Overview: Iljin Electric Co., Ltd is a South Korean-based company specializing in heavy electric machinery, with operations both domestically and internationally, and has a market capitalization of approximately ₩1.21 billion.

Operations: The company generates revenue from its specialization in heavy electric machinery, serving both domestic and international markets.

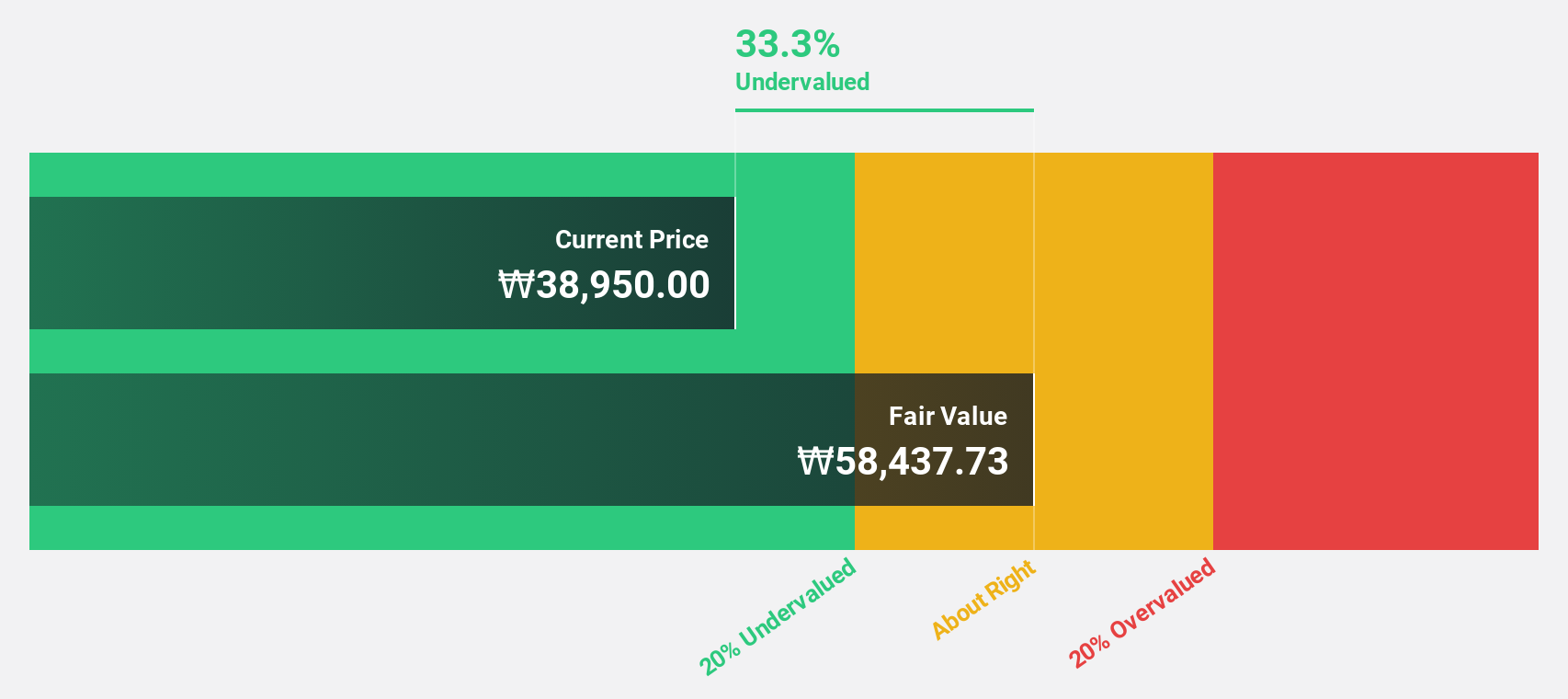

Estimated Discount To Fair Value: 50%

Iljin Electric Ltd., valued at ₩25,350, appears undervalued with a fair value estimate of ₩50,653.37 based on discounted cash flow analysis. Despite recent shareholder dilution and highly volatile share prices over the last three months, the company has shown robust performance with earnings growth of 50.8% in the past year. Forecasted annual earnings growth is 37.5%, outpacing the South Korean market's 28.8%. However, its revenue growth projection of 11% per year lags behind an aggressive market expectation of 20% annually.

- Our expertly prepared growth report on Iljin ElectricLtd implies its future financial outlook may be stronger than recent results.

- Take a closer look at Iljin ElectricLtd's balance sheet health here in our report.

Turning Ideas Into Actions

- Access the full spectrum of 34 Undervalued KRX Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Koh Young Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A098460

Koh Young Technology

Engages in the manufacturing and sale of automated inspection and precise measurement systems and equipment in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.