- South Korea

- /

- Biotech

- /

- KOSDAQ:A064550

High Growth Tech Stocks in South Korea October 2024

Reviewed by Simply Wall St

In recent sessions, the South Korean stock market has experienced a slight downturn, with the KOSPI index hovering just below the 2,610-point mark amid mixed performances across sectors such as chemicals and automobiles. Despite this volatility, global forecasts suggest mild optimism driven by decent earnings and economic news, which may provide a supportive backdrop for high-growth tech stocks in South Korea. In this environment, identifying promising tech stocks involves considering factors like innovation potential and adaptability to market shifts.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 47 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Bioneer (KOSDAQ:A064550)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bioneer Corporation is a biotechnology company with operations in South Korea and internationally, and it has a market cap of ₩662.03 billion.

Operations: Bioneer Corporation focuses on biotechnology, operating across various regions including the Americas, Europe, Asia, and Africa. The company generates revenue through its diverse biotechnology offerings in these markets.

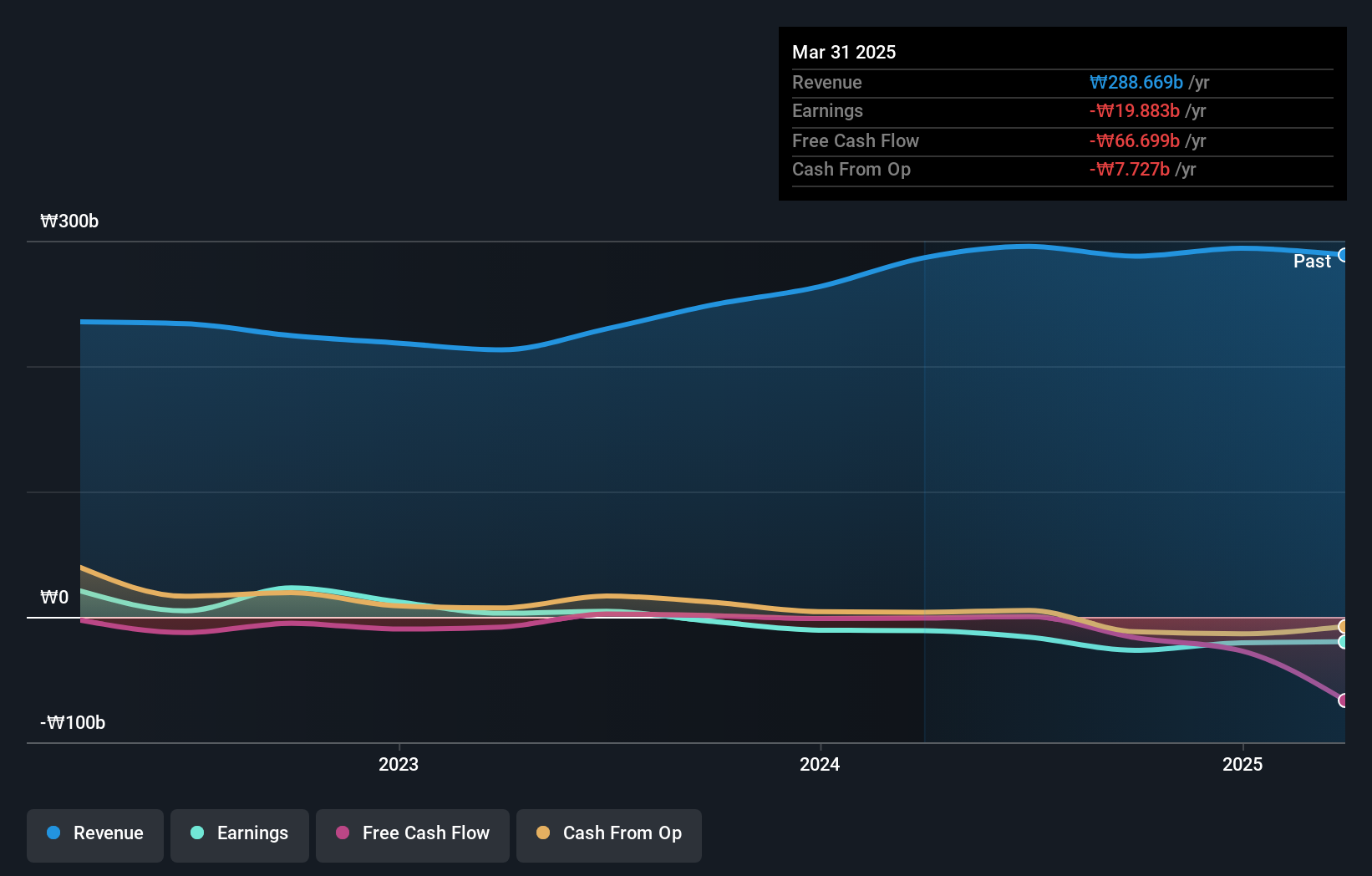

Despite recent setbacks, Bioneer shows promising growth prospects with an expected revenue increase of 23.5% annually, outpacing the Korean market's 10.2%. This surge is underpinned by significant R&D investment, aligning with a broader industry trend where tech firms intensify innovation to secure competitive edges. Furthermore, Bioneer's earnings are projected to skyrocket by 97.6% annually, positioning it for profitability within three years—a robust turnaround from its current unprofitable status. These figures reflect a strategic pivot towards high-impact areas likely to foster long-term growth in South Korea’s dynamic tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Bioneer.

Understand Bioneer's track record by examining our Past report.

EuBiologics (KOSDAQ:A206650)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EuBiologics Co., Ltd. is a South Korean biopharmaceutical company specializing in the provision of vaccines for epidemics, with a market cap of ₩446.81 billion.

Operations: EuBiologics generates revenue primarily through its pharmaceuticals segment, which includes the provision of vaccines for epidemics, amounting to ₩69.37 billion.

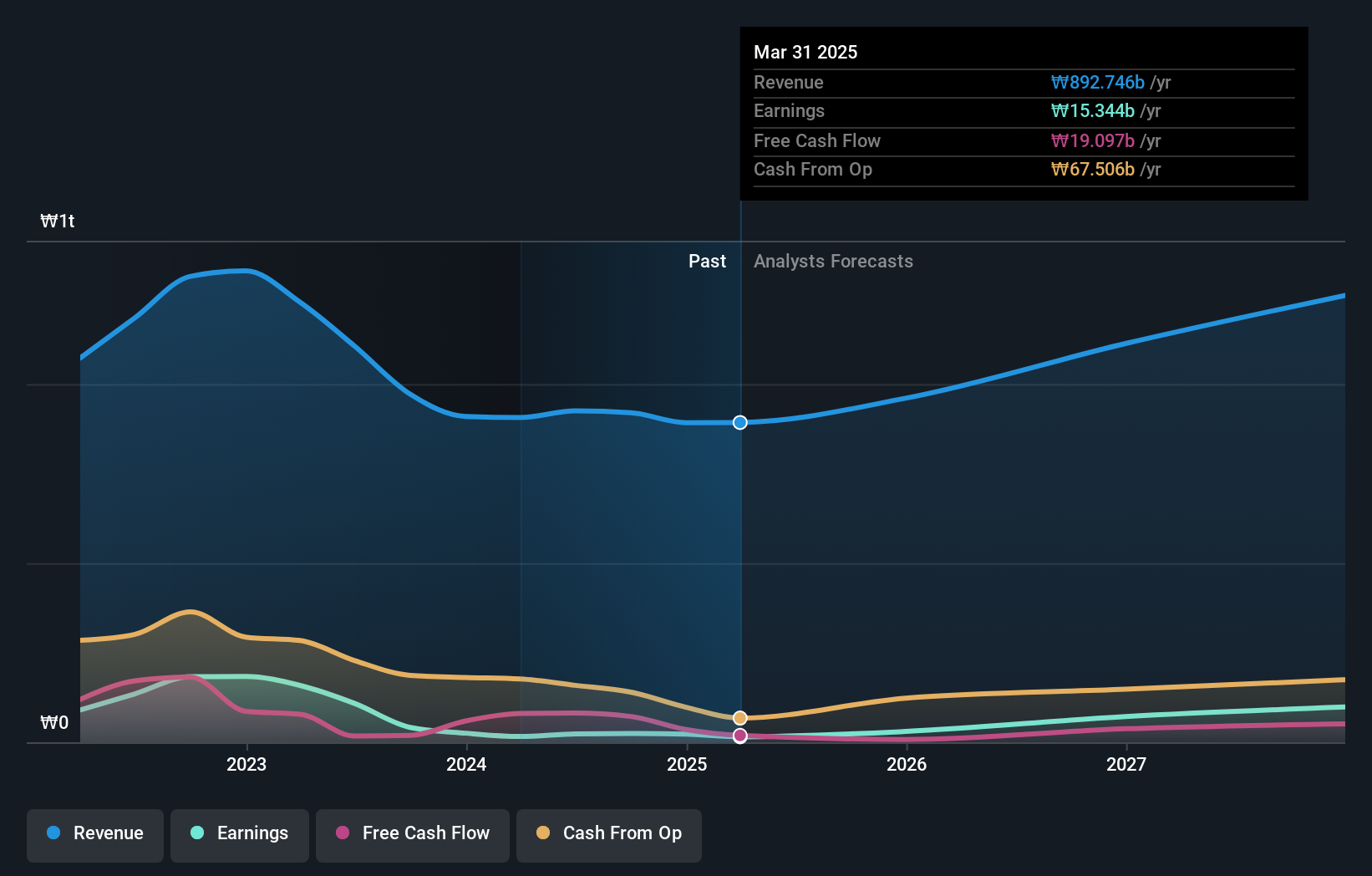

EuBiologics, a contender in South Korea's bustling biotech sector, is navigating a path toward profitability with its revenue poised to grow at 21.9% annually—double the national market average of 10.2%. This growth trajectory is bolstered by an aggressive R&D strategy, absorbing 66.3% of its earnings to fuel innovations in vaccine development and biopharmaceuticals. Such investment not only underscores its commitment to advancing healthcare solutions but also strategically positions it amidst rising global demand for medical innovations. Looking ahead, EuBiologics is expected to leverage these advancements into substantial earnings growth, projected at an impressive rate of 66.33% per year, heralding a promising horizon for this dynamic enterprise within the high-stakes realm of global health technology.

DAEDUCK ELECTRONICS (KOSE:A353200)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Daeduck Electronics Co., Ltd. specializes in the provision of various printed circuit boards (PCBs) both domestically in South Korea and internationally, with a market capitalization of approximately ₩862.17 billion.

Operations: The primary revenue stream for Daeduck Electronics comes from the manufacture and sale of printed circuit boards (PCBs), generating approximately ₩925.14 billion.

DAEDUCK ELECTRONICS has demonstrated a robust financial performance with net income soaring to KRW 12,231.29 million from KRW 4,299.72 million year-over-year for Q2 2024, reflecting a substantial increase in profitability. This growth is underpinned by a promising revenue trajectory expected to outpace the South Korean market with an annual growth rate of 13%. However, despite these gains, the company faces challenges with a profit margin reduction to 2.4% from last year's 9.8%, indicating potential cost management or pricing issues needing addressal. With earnings projected to escalate by an impressive 57% annually, DAEDUCK is positioned for significant advancements but must navigate the hurdles of shrinking margins and industry competition effectively.

Taking Advantage

- Navigate through the entire inventory of 47 KRX High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bioneer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A064550

Bioneer

Operates as a biotechnology company in South Korea, the Americas, Europe, Asia, Africa, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives