- South Korea

- /

- Biotech

- /

- KOSDAQ:A144510

Can You Imagine How Jubilant Green Cross Lab Cell's (KOSDAQ:144510) Shareholders Feel About Its 139% Share Price Gain?

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. For example, the Green Cross Lab Cell Corporation (KOSDAQ:144510) share price has soared 139% in the last year. Most would be very happy with that, especially in just one year! And in the last month, the share price has gained -1.4%. Looking back further, the stock price is 100% higher than it was three years ago.

See our latest analysis for Green Cross Lab Cell

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Green Cross Lab Cell grew its earnings per share, moving from a loss to a profit.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

We doubt the modest 0.03% dividend yield is doing much to support the share price. We think that the revenue growth of 34% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

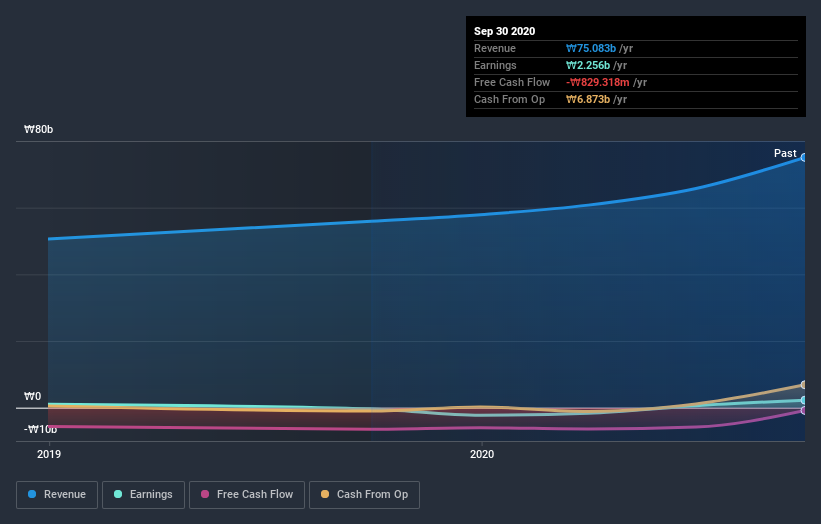

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Green Cross Lab Cell's financial health with this free report on its balance sheet.

A Different Perspective

Pleasingly, Green Cross Lab Cell's total shareholder return last year was 139%. And yes, that does include the dividend. That's better than the annualized TSR of 26% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting Green Cross Lab Cell on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Green Cross Lab Cell .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Green Cross Lab Cell or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A144510

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026