Global Market Insights: 3 Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

In recent weeks, global markets have experienced mixed performances, with the U.S. Federal Reserve cutting interest rates while major stock indices showed narrow gains driven by large-cap technology stocks. Amid these fluctuations and geopolitical developments like the U.S.-China trade truce, investors might find opportunities in stocks that appear undervalued compared to their intrinsic value, offering potential for growth as market conditions evolve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥18.67 | CN¥37.00 | 49.5% |

| YIT Oyj (HLSE:YIT) | €3.024 | €6.04 | 49.9% |

| Prosegur Cash (BME:CASH) | €0.68 | €1.35 | 49.8% |

| Mobvista (SEHK:1860) | HK$18.92 | HK$37.79 | 49.9% |

| Mo-BRUK (WSE:MBR) | PLN295.50 | PLN587.42 | 49.7% |

| Lingotes Especiales (BME:LGT) | €5.55 | €11.01 | 49.6% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.04 | CN¥20.08 | 50% |

| freee K.K (TSE:4478) | ¥3355.00 | ¥6680.69 | 49.8% |

| COVER (TSE:5253) | ¥1856.00 | ¥3670.35 | 49.4% |

| Coca-Cola Içecek Anonim Sirketi (IBSE:CCOLA) | TRY52.65 | TRY105.09 | 49.9% |

Let's take a closer look at a couple of our picks from the screened companies.

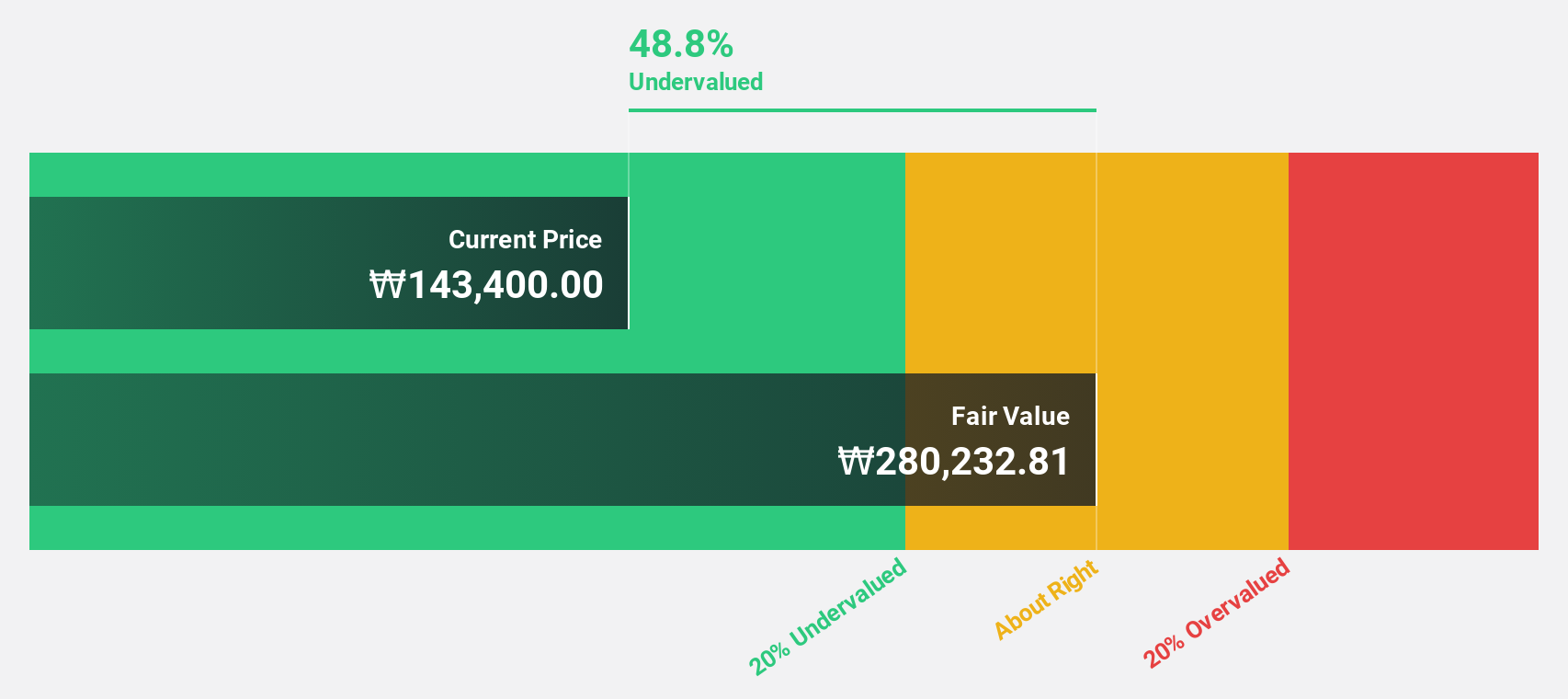

LigaChem Biosciences (KOSDAQ:A141080)

Overview: LigaChem Biosciences Inc. is a clinical stage biopharmaceutical company focused on discovering and developing medicines for unmet medical needs, with a market cap of approximately ₩5.41 billion.

Operations: The company's revenue primarily comes from its Pharmaceutical Business, contributing ₩20.81 million, and New Drug Research and Development, which accounts for ₩127.47 million.

Estimated Discount To Fair Value: 16.1%

LigaChem Biosciences is trading 16.1% below its estimated fair value of ₩187,673.82, suggesting potential undervaluation based on cash flows despite recent financial challenges. The company reported a significant net loss for the second quarter and six months ending June 2025. However, earnings are forecast to grow at an impressive rate of 95.3% annually, outpacing the Korean market's growth expectations and indicating strong future revenue prospects despite current setbacks.

- Our earnings growth report unveils the potential for significant increases in LigaChem Biosciences' future results.

- Unlock comprehensive insights into our analysis of LigaChem Biosciences stock in this financial health report.

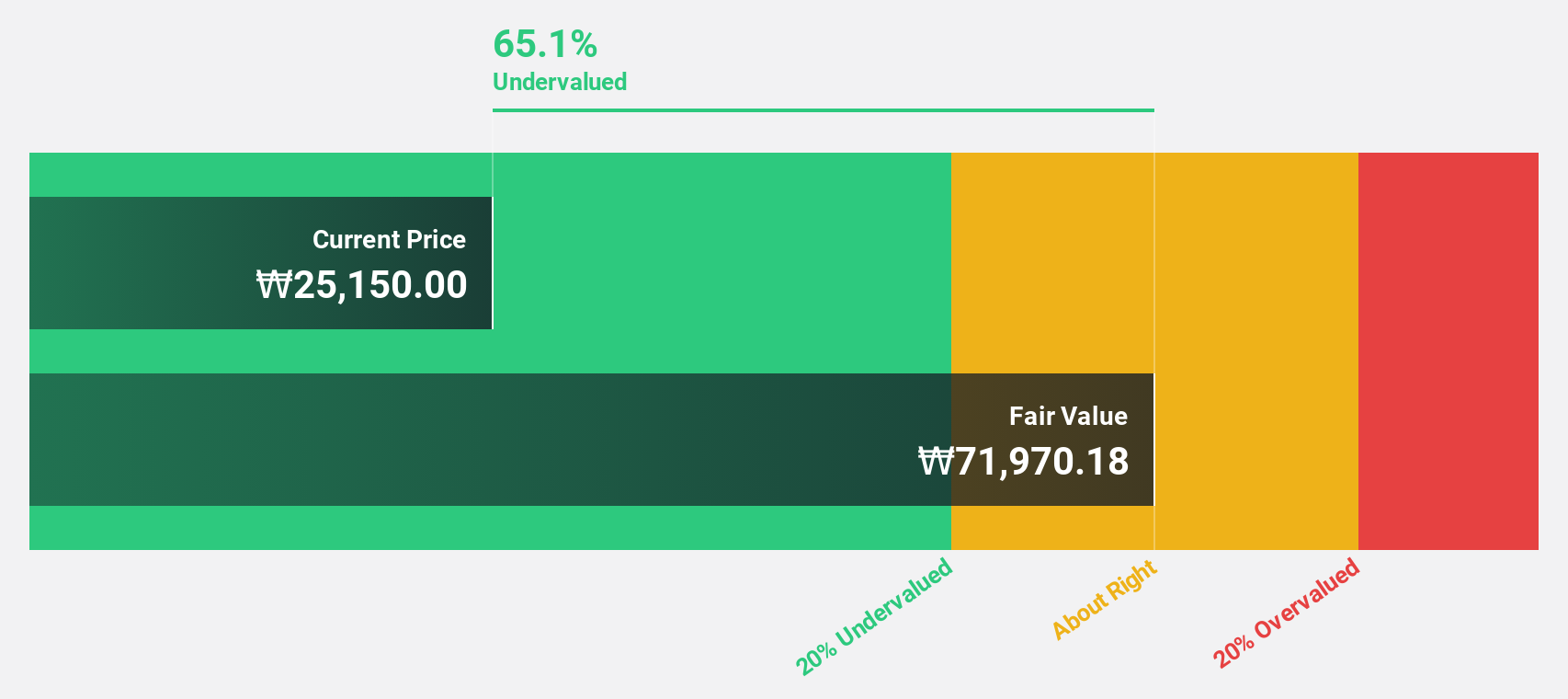

Hanall Biopharma (KOSE:A009420)

Overview: Hanall Biopharma Co., Ltd. is a pharmaceutical company that manufactures and sells pharmaceutical products both in South Korea and internationally, with a market cap of ₩1.99 trillion.

Operations: The company's revenue segment primarily comprises the manufacture and sale of pharmaceuticals, generating ₩150.09 billion.

Estimated Discount To Fair Value: 28.9%

Hanall Biopharma is trading 28.9% below its estimated fair value of ₩58,260.49, highlighting potential undervaluation based on cash flows. The company became profitable this year and is expected to see significant earnings growth of 50.82% annually over the next three years, outpacing the Korean market's average growth rate. However, its share price has been highly volatile recently, and its future return on equity is forecasted to be relatively low at 9.5%.

- Insights from our recent growth report point to a promising forecast for Hanall Biopharma's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Hanall Biopharma.

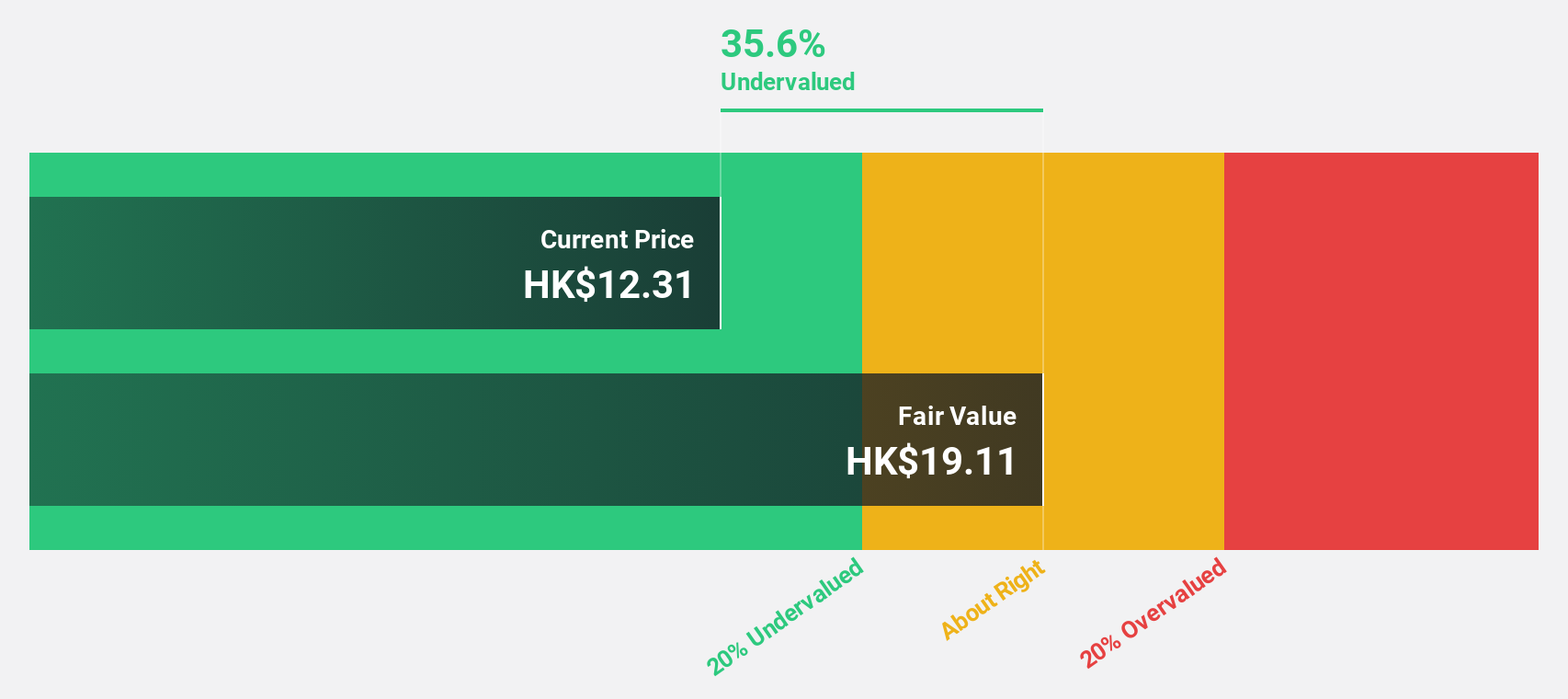

Simcere Pharmaceutical Group (SEHK:2096)

Overview: Simcere Pharmaceutical Group Limited is an investment holding company involved in the research, development, manufacture, and sale of pharmaceutical products in China with a market cap of HK$34.44 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, totaling CN¥7.11 billion.

Estimated Discount To Fair Value: 27.1%

Simcere Pharmaceutical Group is trading at HK$13.27, 27.1% below its estimated fair value of HK$18.2, suggesting potential undervaluation based on cash flows. The company recently became profitable and forecasts indicate significant earnings growth of 24.31% annually over the next three years, surpassing the Hong Kong market average growth rate. Recent developments include a follow-on equity offering raising approximately HK$1.57 billion and clinical trial approval for advanced solid tumors in China, enhancing its growth prospects further.

- Our comprehensive growth report raises the possibility that Simcere Pharmaceutical Group is poised for substantial financial growth.

- Dive into the specifics of Simcere Pharmaceutical Group here with our thorough financial health report.

Key Takeaways

- Dive into all 502 of the Undervalued Global Stocks Based On Cash Flows we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2096

Simcere Pharmaceutical Group

An investment holding company, engages in the research, development, manufacture, and sale of pharmaceutical products to distributors, pharmacy chains, and other pharmaceutical manufacturers in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives