- South Korea

- /

- Biotech

- /

- KOSDAQ:A127120

JS Link, Inc.'s (KOSDAQ:127120) Shares Climb 26% But Its Business Is Yet to Catch Up

Despite an already strong run, JS Link, Inc. (KOSDAQ:127120) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days were the cherry on top of the stock's 490% gain in the last year, which is nothing short of spectacular.

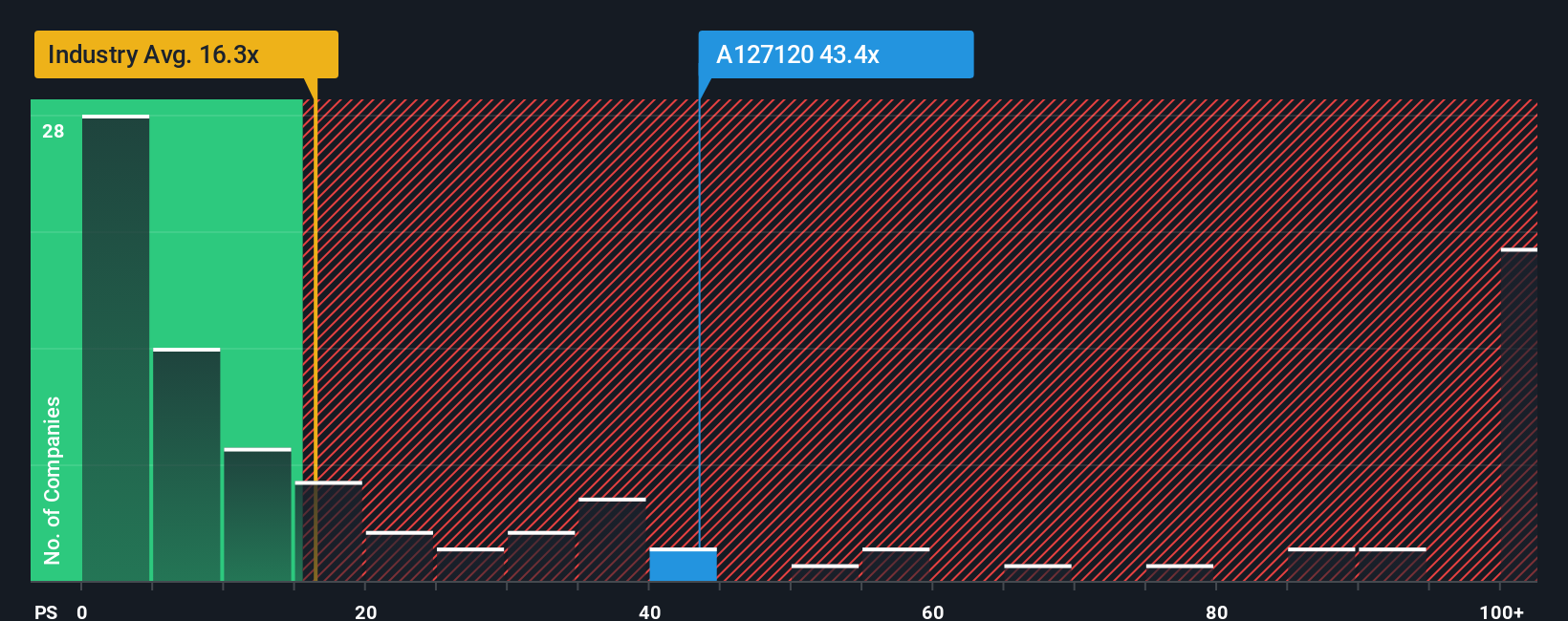

After such a large jump in price, JS Link may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 43.4x, since almost half of all companies in the Biotechs industry in Korea have P/S ratios under 16.3x and even P/S lower than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for JS Link

How Has JS Link Performed Recently?

For example, consider that JS Link's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on JS Link will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For JS Link?

JS Link's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. As a result, revenue from three years ago have also fallen 32% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 69% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that JS Link's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does JS Link's P/S Mean For Investors?

JS Link's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that JS Link currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for JS Link (of which 1 is potentially serious!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A127120

JS Link

A genome-based biotechnology company, focuses on the research and development of genome analysis services in South Korea and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026