- South Korea

- /

- Biotech

- /

- KOSDAQ:A096530

Can You Imagine How Elated Seegene's (KOSDAQ:096530) Shareholders Feel About Its 656% Share Price Gain?

Seegene, Inc. (KOSDAQ:096530) shareholders have seen the share price descend 25% over the month. But that doesn't change the fact that the returns over the last year have been spectacular. In that time, shareholders have had the pleasure of a 656% boost to the share price. So the recent fall isn't enough to negate the good performance. The real question is whether the fundamental business performance can justify the strong increase over the long term.

It really delights us to see such great share price performance for investors.

View our latest analysis for Seegene

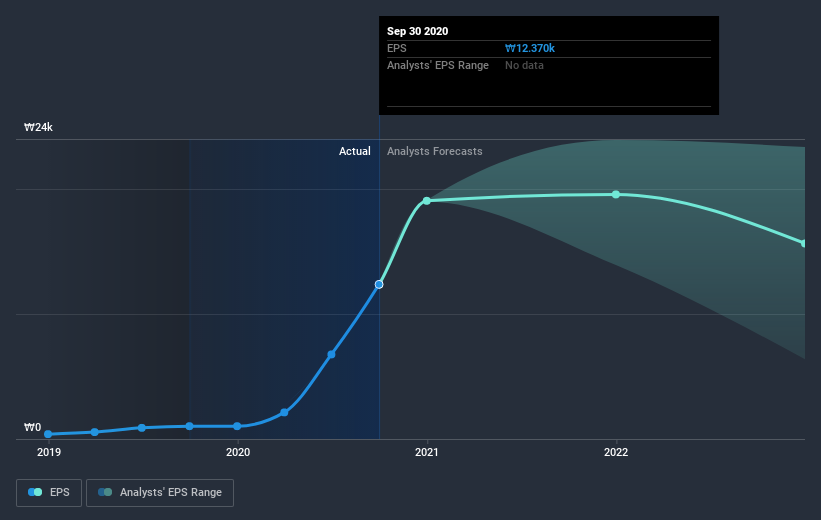

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Seegene boasted truly magnificent EPS growth in the last year. While that particular rate of growth is unlikely to be sustained for long, it is still remarkable. We are not surprised the share price is up. We're real advocates of letting inflection points like this guide our research as stock pickers.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Seegene has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Seegene's financial health with this free report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Seegene's TSR for the last year was 659%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Seegene has rewarded shareholders with a total shareholder return of 659% in the last twelve months. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 43% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Seegene you should be aware of, and 2 of them are a bit unpleasant.

Of course Seegene may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Seegene, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A096530

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives