- South Korea

- /

- Pharma

- /

- KOSDAQ:A082800

Some Vivozon Pharmaceutical Co., Ltd. (KOSDAQ:082800) Shareholders Look For Exit As Shares Take 35% Pounding

The Vivozon Pharmaceutical Co., Ltd. (KOSDAQ:082800) share price has fared very poorly over the last month, falling by a substantial 35%. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 20%.

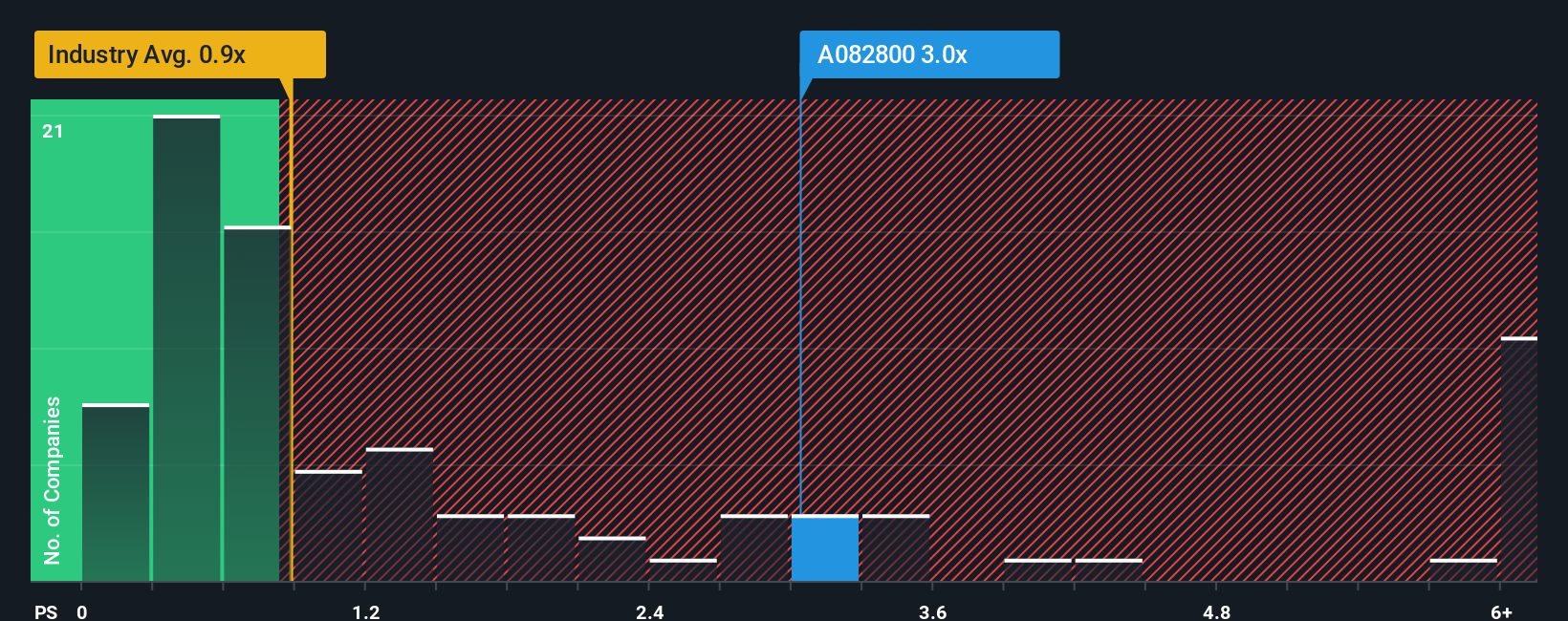

Even after such a large drop in price, when almost half of the companies in Korea's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Vivozon Pharmaceutical as a stock not worth researching with its 3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Vivozon Pharmaceutical

What Does Vivozon Pharmaceutical's P/S Mean For Shareholders?

We'd have to say that with no tangible growth over the last year, Vivozon Pharmaceutical's revenue has been unimpressive. Perhaps the market believes that revenue growth will improve markedly over current levels, inflating the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Vivozon Pharmaceutical will help you shine a light on its historical performance.How Is Vivozon Pharmaceutical's Revenue Growth Trending?

In order to justify its P/S ratio, Vivozon Pharmaceutical would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 58% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

It's interesting to note that the rest of the industry is similarly expected to grow by 18% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's curious that Vivozon Pharmaceutical's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Bottom Line On Vivozon Pharmaceutical's P/S

Even after such a strong price drop, Vivozon Pharmaceutical's P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Vivozon Pharmaceutical has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Vivozon Pharmaceutical that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A082800

Vivozon Pharmaceutical

Researches, develops, produces, and sells LED products primarily in South Korea.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives