- South Korea

- /

- Biotech

- /

- KOSDAQ:A064550

Bioneer Corporation (KOSDAQ:064550) Not Doing Enough For Some Investors As Its Shares Slump 25%

The Bioneer Corporation (KOSDAQ:064550) share price has fared very poorly over the last month, falling by a substantial 25%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 52% loss during that time.

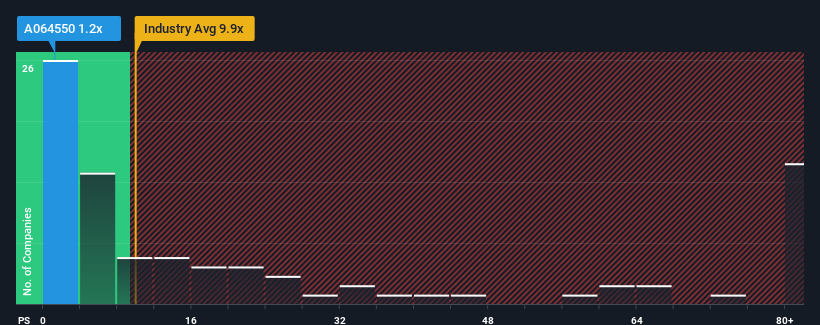

Following the heavy fall in price, Bioneer may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.2x, since almost half of all companies in the Biotechs industry in Korea have P/S ratios greater than 9.9x and even P/S higher than 42x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Bioneer

What Does Bioneer's Recent Performance Look Like?

Bioneer could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Bioneer's future stacks up against the industry? In that case, our free report is a great place to start.How Is Bioneer's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Bioneer's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. As a result, it also grew revenue by 25% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 43% during the coming year according to the only analyst following the company. With the industry predicted to deliver 51% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Bioneer's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Bioneer's P/S?

Shares in Bioneer have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Bioneer maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Bioneer with six simple checks.

If these risks are making you reconsider your opinion on Bioneer, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bioneer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A064550

Bioneer

Operates as a biotechnology company in South Korea, the Americas, Europe, Asia, Africa, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives